I wanna buy cooking hood from China (taobao online).

Shipping using sea freight.

Anyone know how much i will be taxed?

Thanx

![]() Malaysia Import Duties

Malaysia Import Duties

| Bump Topic Add Reply RSS Feed New Topic New Poll |

![]() Malaysia Import Duties

Malaysia Import Duties

|

|

Dec 26 2016, 01:12 PM Dec 26 2016, 01:12 PM

|

Junior Member

191 posts Joined: Jan 2003 |

I wanna buy cooking hood from China (taobao online).

Shipping using sea freight. Anyone know how much i will be taxed? Thanx |

|

|

|

|

|

Dec 26 2016, 01:29 PM Dec 26 2016, 01:29 PM

Show posts by this member only | IPv6 | Post

#1122

|

Newbie

5 posts Joined: Nov 2016 |

Hello.

I'm thinking of importing a PS2 Network adapter, Memory card and a HDD from Ebay or Amazon. How much will i get taxed ? |

|

|

Dec 28 2016, 10:52 PM Dec 28 2016, 10:52 PM

|

Junior Member

29 posts Joined: May 2013 From: Cave of Caerbannog |

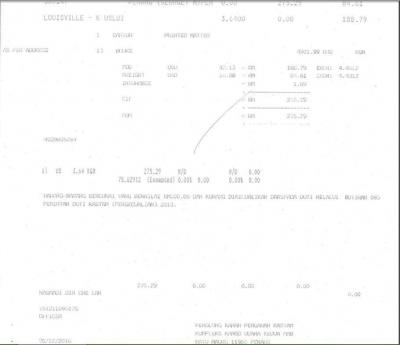

QUOTE(kherel77 @ Dec 22 2016, 03:42 PM) Welcome at anytime bro...that's what i do in this 7 years. With correct knowledge about this import & export regulations, you can easily beat some crap & lazy Customs officers...hahaha. Thanks kherel77 and mastering for your replies. Very informative. I actually bought two graphic novels from Barnes & Noble and they were sent out in separate parcels. The taxed parcel we're talking about was the first one to arrive. The second one arrived two days later also via UPS. Although the item and shipping cost are the same, no K1 freight charges were added to this parcel and therefore no tax was charged. kherel77, if you're correct in saying that my first parcel should definitely have K1 freight charges applied to it, does this mean that customs was being lenient and closed one eye when they did not apply the K1 freight charges for the second parcel? I'd also like to add that I received a DHL parcel worth CIF USD95 (~RM400) a few months back and despite customs opening my box for inspection, they did not apply any K1 freight charges or tax as well. Were they being lenient as well? I've attached below both customs slips. Sorry for the poor quality but the print was already pretty faded when I received it. I did notice that they used different tariff codes for both (4205.00.900 and 4901.99.000) but that should be irrelevant as it has no impact on the K1 freight charges. Oh, and just to confirm. Does this Kos Tambang Dagangan apply to EMS/Poslaju as well?

|

|

|

Dec 29 2016, 09:27 AM Dec 29 2016, 09:27 AM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(rabbit.dynamite @ Dec 28 2016, 10:52 PM) Thanks kherel77 and mastering for your replies. Very informative. First, for printed books/brochures/leaflets or similar, Tariff Codes should be from 4901.xx xxx which carry 0% import duties & 6% GST. If both of your shipment have same value & weight, from my calculation...both should be 6% taxed. I actually bought two graphic novels from Barnes & Noble and they were sent out in separate parcels. The taxed parcel we're talking about was the first one to arrive. The second one arrived two days later also via UPS. Although the item and shipping cost are the same, no K1 freight charges were added to this parcel and therefore no tax was charged. kherel77, if you're correct in saying that my first parcel should definitely have K1 freight charges applied to it, does this mean that customs was being lenient and closed one eye when they did not apply the K1 freight charges for the second parcel? I'd also like to add that I received a DHL parcel worth CIF USD95 (~RM400) a few months back and despite customs opening my box for inspection, they did not apply any K1 freight charges or tax as well. Were they being lenient as well? I've attached below both customs slips. Sorry for the poor quality but the print was already pretty faded when I received it. I did notice that they used different tariff codes for both (4205.00.900 and 4901.99.000) but that should be irrelevant as it has no impact on the K1 freight charges. Oh, and just to confirm. Does this Kos Tambang Dagangan apply to EMS/Poslaju as well? From the K1 attached, i should say it's Customs mistake about the second shipment's calculation & you should be grateful as Customs also human, sometimes newbies/rookies, and made mistake. I'd face this many times before but as working for strictly-audit-able company...I have to rectify what they missed out or mistake...and pay as it should. For the DHL case you'd mention, maybe the items is fall under non-taxable items or it go through some smuggling checking inspection...something like that. And yes, Kos Tambang Dagangan is applied to every shipment inbound...air/land/sea, although the rate is different between this three. |

|

|

Dec 30 2016, 01:21 AM Dec 30 2016, 01:21 AM

|

Junior Member

29 posts Joined: May 2013 From: Cave of Caerbannog |

QUOTE(kherel77 @ Dec 29 2016, 09:27 AM) First, for printed books/brochures/leaflets or similar, Tariff Codes should be from 4901.xx xxx which carry 0% import duties & 6% GST. If both of your shipment have same value & weight, from my calculation...both should be 6% taxed. Thank you very much for the info! From the K1 attached, i should say it's Customs mistake about the second shipment's calculation & you should be grateful as Customs also human, sometimes newbies/rookies, and made mistake. I'd face this many times before but as working for strictly-audit-able company...I have to rectify what they missed out or mistake...and pay as it should. For the DHL case you'd mention, maybe the items is fall under non-taxable items or it go through some smuggling checking inspection...something like that. And yes, Kos Tambang Dagangan is applied to every shipment inbound...air/land/sea, although the rate is different between this three. I guess I won't be pursuing clarification from UPS now then, as my first parcel seems to be correctly taxed and I'm lucky that my second parcel wasn't. Every shipment coming in? I was led to believe that Kos Tambang Dagangan only applies to express couriers like Fedex/UPS/DHL/Poslaju, and normal mail services from Pos Malaysia are not subjected to it. If really for all shipment, I'm guessing Customs is not that strict with Pos Malaysia and Poslaju, as I've received multiple shipments from them without any tax. This post has been edited by rabbit.dynamite: Dec 30 2016, 01:28 AM |

|

|

Dec 30 2016, 12:00 PM Dec 30 2016, 12:00 PM

|

Senior Member

6,955 posts Joined: Apr 2008 |

What if the merchant is declaring more than what I paid? Apparently just clarified with my merchant that he has declared on the declaration form outside the parcel based on RRP and not the discounted price...

|

|

|

Dec 30 2016, 04:30 PM Dec 30 2016, 04:30 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(rabbit.dynamite @ Dec 30 2016, 01:21 AM) Thank you very much for the info! Yes, you're right about Pos Malaysia & Pos Laju. My assuming is both is gorv. body so they just close one eyes to the others. But not all, as few shipment thru POS Malaysia/Laju also got taxed.I guess I won't be pursuing clarification from UPS now then, as my first parcel seems to be correctly taxed and I'm lucky that my second parcel wasn't. Every shipment coming in? I was led to believe that Kos Tambang Dagangan only applies to express couriers like Fedex/UPS/DHL/Poslaju, and normal mail services from Pos Malaysia are not subjected to it. If really for all shipment, I'm guessing Customs is not that strict with Pos Malaysia and Poslaju, as I've received multiple shipments from them without any tax. QUOTE(janson_kaniaz @ Dec 30 2016, 12:00 PM) What if the merchant is declaring more than what I paid? Apparently just clarified with my merchant that he has declared on the declaration form outside the parcel based on RRP and not the discounted price... Declaration value take from what stated in shipping invoice or Air Way Bill / Consignment Note. I think your seller put the pre-discount price. |

|

|

Jan 1 2017, 03:39 PM Jan 1 2017, 03:39 PM

|

Newbie

0 posts Joined: Jan 2017 |

I want to buy a backpack, field pockets, zip oil and zipper pull replacement system(paracord and heat shrink tubing) from GORUCK. Any import duties or tax?[QUOTE] It cost USD $577. About RM 2500.

This post has been edited by gail_arth: Jan 1 2017, 03:42 PM |

|

|

Jan 3 2017, 08:12 PM Jan 3 2017, 08:12 PM

|

Senior Member

6,955 posts Joined: Apr 2008 |

QUOTE(kherel77 @ Dec 30 2016, 04:30 PM) Yes, you're right about Pos Malaysia & Pos Laju. My assuming is both is gorv. body so they just close one eyes to the others. But not all, as few shipment thru POS Malaysia/Laju also got taxed. Also, since typically things below RM500 will not be taxed, is this based on custom own exchange rate or based on what is being reflected on our credit card statement?Declaration value take from what stated in shipping invoice or Air Way Bill / Consignment Note. I think your seller put the pre-discount price. |

|

|

Jan 4 2017, 12:09 AM Jan 4 2017, 12:09 AM

Show posts by this member only | IPv6 | Post

#1130

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

|

|

|

|

|

|

Jan 5 2017, 02:13 PM Jan 5 2017, 02:13 PM

|

Junior Member

42 posts Joined: Dec 2007 |

QUOTE(janson_kaniaz @ Jan 3 2017, 08:12 PM) Also, since typically things below RM500 will not be taxed, is this based on custom own exchange rate or based on what is being reflected on our credit card statement? Customs maintain their own exchange rates which is updated weekly (although I somewhat remember it was fortnightly many years back, but I guess due to current erratic movement of MYR they have updated it more frequently). You can check it at the link below:http://customsgc.gov.my/cgi-bin/exchange.cgi Exchange rate to be used is based on K1 date as mentioned by bro @kherel77 |

|

|

Jan 6 2017, 07:54 PM Jan 6 2017, 07:54 PM

|

Newbie

0 posts Joined: Aug 2013 |

Today I got notified that I kena customs charge for my parcel.

The total value for the items + shipping is below RM500 This is the third time I ordered stuff from taobao. Previous 2 parcels no issue I have some questions (refer to the attached pics). 1) What is EDI charges and why is it so expensive ? 2) Does this mean that every time my package get held by customs, I confirm must pay these extra charges ?   |

|

|

Jan 6 2017, 11:10 PM Jan 6 2017, 11:10 PM

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

QUOTE(lucius9989 @ Jan 6 2017, 07:54 PM) Today I got notified that I kena customs charge for my parcel. Seems your CIF value only RM298.31 which can be exempted from duty/tax (less than RM500 CIF value). The total value for the items + shipping is below RM500 This is the third time I ordered stuff from taobao. Previous 2 parcels no issue I have some questions (refer to the attached pics). 1) What is EDI charges and why is it so expensive ? 2) Does this mean that every time my package get held by customs, I confirm must pay these extra charges ?   "Customs Duties Exemption Order 1988 Item#172: Any goods below RM500 CIF value using air courier services thru KLIA, Subang, Bayan Lepas, Senai, KK & Kuching airport will be duties/taxes exempted except cigarettes, liquors & tobaccos." EDI & handling charges is charged by your courier/forwarder company as they do the declaration for you on-behalf. |

|

|

Jan 7 2017, 12:29 PM Jan 7 2017, 12:29 PM

|

Newbie

0 posts Joined: Aug 2013 |

QUOTE(kherel77 @ Jan 6 2017, 11:10 PM) Seems your CIF value only RM298.31 which can be exempted from duty/tax (less than RM500 CIF value). Hi kherel77, thanks for your reply."Customs Duties Exemption Order 1988 Item#172: Any goods below RM500 CIF value using air courier services thru KLIA, Subang, Bayan Lepas, Senai, KK & Kuching airport will be duties/taxes exempted except cigarettes, liquors & tobaccos." EDI & handling charges is charged by your courier/forwarder company as they do the declaration for you on-behalf. I guess its time to switch forwarders. totally not worth it anymore to buy stuff from taobao with all these extra charges. |

|

|

Jan 10 2017, 09:56 PM Jan 10 2017, 09:56 PM

|

Senior Member

692 posts Joined: Oct 2011 From: pay_fild04 |

May i know how much % of import tax for books if the total CIF value above RM500? Izit only subject to 6% gst from total CIF value?

Did a little googling on this, and it shows that it vary from country to country, starting from 0 - 55% . This post has been edited by LalaluSan: Jan 10 2017, 10:18 PM |

|

|

Jan 13 2017, 02:07 PM Jan 13 2017, 02:07 PM

|

Junior Member

23 posts Joined: Jun 2010 |

Bought used projector in Singapore. Still kena tax if used item? I bought only Sgd 50 at carousel..

|

|

|

Jan 18 2017, 03:09 PM Jan 18 2017, 03:09 PM

|

Newbie

0 posts Joined: Sep 2016 From: Shah Alam |

|

|

|

Jan 20 2017, 04:44 PM Jan 20 2017, 04:44 PM

|

Senior Member

6,955 posts Joined: Apr 2008 |

|

|

|

Jan 20 2017, 10:58 PM Jan 20 2017, 10:58 PM

Show posts by this member only | IPv6 | Post

#1139

|

Senior Member

1,435 posts Joined: Apr 2011 From: Blank Space |

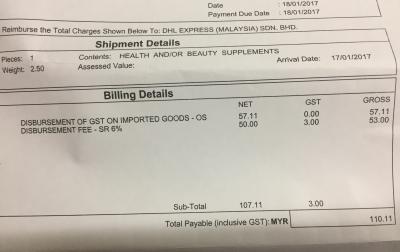

QUOTE(janson_kaniaz @ Jan 20 2017, 04:44 PM) I just paid RM110 to DHL Express with GST being half of it. Got K1 Form copy? The calculation is there...My total purchase item is less than RM500. If 6% GST is charged on my items, my total purchase must be >RM900 but that's not the case. Am I missing something here?

|

|

|

Jan 20 2017, 11:08 PM Jan 20 2017, 11:08 PM

|

Senior Member

6,955 posts Joined: Apr 2008 |

|

| Change to: |  0.0417sec 0.0417sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 03:32 AM |