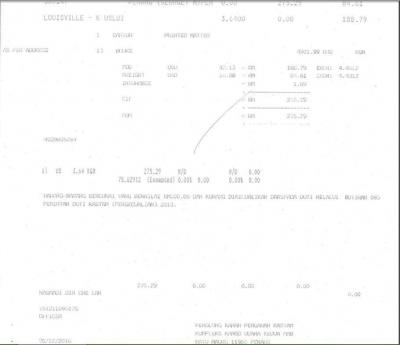

I ordered a graphic novel from Barnes & Noble in the US, delivery via UPS. Item cost RM193, shipping RM80. However, it seems Customs used the Jadual to calculate my shipping fee and set it as RM480, despite the invoice clearly stating my shipping as RM80. The funny thing is, as you can see below, someone used a pencil/pen to cancel out the shipping fee of RM80 and replaced it with RM480. Same with the total CIF (RM274 to RM675) and the GST (RM16.50 to RM40.50).

Is Customs correct to add on the RM400 to my shipping fee? Or are they being sneaky and trying to charge me higher/unnecessarily? Seems funny to me that the system printed out the correct amount as per the invoice, and someone manually changed it by hand. I was issued an official Customs receipt for the RM40.50 GST, and I was also charged RM25 by UPS for brokerage fee.

Another thing is that my original CIF was RM274, below the RM500 taxable threshold. This exempts me from import duty, as stated in the document. Does this exempt me from GST as well? This seems to be the case as the final line at the bottom shows everything as 0.00, before someone manually changed it to the jacked up RM40.50 GST. Or do items below RM500 also get charged GST?

I'm thinking of going to UPS first to inquire about this, and maybe Customs too if necessary. But what I'd like to know before going is should the Jadual Kos Tambang Dagangan be used even when the shipping fee is declared properly? I'm afraid UPS/Customs will try to pull a fast one on me and insist that that is the case, when it should not be.

Sorry for the long post, and thanks for reading.

Attached thumbnail(s)

Dec 21 2016, 01:58 AM

Dec 21 2016, 01:58 AM

Quote

Quote

0.0174sec

0.0174sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled