QUOTE(guy3288 @ Mar 17 2024, 08:16 PM)

How how so many? What price did you buy at?Bond kaki lai, DRB HICOM bond coming

Bond kaki lai, DRB HICOM bond coming

|

|

Mar 20 2024, 04:25 PM Mar 20 2024, 04:25 PM

|

Senior Member

5,576 posts Joined: Aug 2011 |

|

|

|

|

|

|

Mar 20 2024, 04:55 PM Mar 20 2024, 04:55 PM

|

Senior Member

3,681 posts Joined: Apr 2019 |

QUOTE(BWassup @ Mar 20 2024, 04:22 PM) have to read the transaction list properly... there are 2 transactions in the morning... just minutes apart... suspect a intermediary basically had a client standby to offload the bond from another client. |

|

|

Mar 20 2024, 05:01 PM Mar 20 2024, 05:01 PM

Show posts by this member only | IPv6 | Post

#223

|

Junior Member

845 posts Joined: Sep 2022 |

QUOTE(Wedchar2912 @ Mar 20 2024, 04:55 PM) have to read the transaction list properly... there are 2 transactions in the morning... just minutes apart... Noted. But the buy at 9.68% not too bad either.suspect a intermediary basically had a client standby to offload the bond from another client. In any case someone was willing to pay 100.08 This post has been edited by BWassup: Mar 20 2024, 05:02 PM Wedchar2912 liked this post

|

|

|

Mar 20 2024, 10:45 PM Mar 20 2024, 10:45 PM

Show posts by this member only | IPv6 | Post

#224

|

Senior Member

5,919 posts Joined: Sep 2009 |

QUOTE(contestchris @ Mar 20 2024, 04:25 PM) Nett yield when called back lah is 17.37%unless the chart is wrong lets see ah.. my cost RM48227.40 x2 =96454.80 bought 31.1.24 dividends RM1750 x2 on 26.3.24 RM1750 x 2 on 25.9.24 Call back on 25.9.24, i get back capital RM100k Dividend sudah RM7000 , so Total RM107000 Gain RM10545/96454 =10.93% in 238D convert to 1 year =16.8 % pa. ok lah after 0.5% fees in. Attached thumbnail(s)

|

|

|

Mar 21 2024, 06:43 AM Mar 21 2024, 06:43 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Mar 20 2024, 10:45 PM) Nett yield when called back lah is 17.37% Sounds like an excellent return bro. Well done.unless the chart is wrong lets see ah.. my cost RM48227.40 x2 =96454.80 bought 31.1.24 dividends RM1750 x2 on 26.3.24 RM1750 x 2 on 25.9.24 Call back on 25.9.24, i get back capital RM100k Dividend sudah RM7000 , so Total RM107000 Gain RM10545/96454 =10.93% in 238D convert to 1 year =16.8 % pa. ok lah after 0.5% fees in. |

|

|

Mar 21 2024, 01:34 PM Mar 21 2024, 01:34 PM

Show posts by this member only | IPv6 | Post

#226

|

Senior Member

5,919 posts Joined: Sep 2009 |

|

|

|

|

|

|

Mar 21 2024, 01:49 PM Mar 21 2024, 01:49 PM

|

Senior Member

5,576 posts Joined: Aug 2011 |

|

|

|

Mar 21 2024, 02:12 PM Mar 21 2024, 02:12 PM

Show posts by this member only | IPv6 | Post

#228

|

Senior Member

5,919 posts Joined: Sep 2009 |

|

|

|

Mar 21 2024, 06:19 PM Mar 21 2024, 06:19 PM

Show posts by this member only | IPv6 | Post

#229

|

Senior Member

5,919 posts Joined: Sep 2009 |

|

|

|

Mar 21 2024, 06:54 PM Mar 21 2024, 06:54 PM

Show posts by this member only | IPv6 | Post

#230

|

Junior Member

845 posts Joined: Sep 2022 |

QUOTE(guy3288 @ Mar 21 2024, 06:19 PM) The person in your chat seems certain that Tropicana will redeem the bond on 25 September. Can ask who is he?Today Swiss surprised with a rate cut, UK looks likely as well. Think Fed could cut in June as well. How about Malaysia? Makes sense for Tropicana to redeem/refinance in this environment. Bond Express indicative asking price upped to 96.00 This post has been edited by BWassup: Mar 21 2024, 06:57 PM |

|

|

Mar 21 2024, 10:19 PM Mar 21 2024, 10:19 PM

Show posts by this member only | IPv6 | Post

#231

|

Senior Member

5,919 posts Joined: Sep 2009 |

QUOTE(BWassup @ Mar 21 2024, 06:54 PM) The person in your chat seems certain that Tropicana will redeem the bond on 25 September. Can ask who is he? my FSM contact past many yearsToday Swiss surprised with a rate cut, UK looks likely as well. Think Fed could cut in June as well. How about Malaysia? Makes sense for Tropicana to redeem/refinance in this environment. Bond Express indicative asking price upped to 96.00 should be senior by now i dont know his position |

|

|

Mar 22 2024, 02:08 PM Mar 22 2024, 02:08 PM

|

Senior Member

5,576 posts Joined: Aug 2011 |

|

|

|

Mar 22 2024, 02:12 PM Mar 22 2024, 02:12 PM

|

Senior Member

5,576 posts Joined: Aug 2011 |

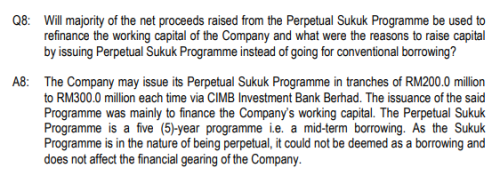

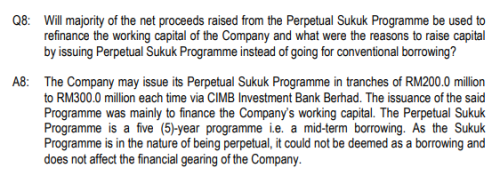

QUOTE(guy3288 @ Mar 21 2024, 06:19 PM) I mean they only know as best as the next person.Company has been clear that the perpetual sukuk is a 5 year program. The step-up interest from Y6 onwards is a hefty penalty for non-redemption.  https://www.tropicanacorp.com.my/files/TCB%...th%20AGM%20.pdf But of course, Tropicana retains the flexibility to not call, or even then defer the coupon payment. But these will only happen because "shit hits the fan". |

|

|

|

|

|

Mar 22 2024, 11:18 PM Mar 22 2024, 11:18 PM

Show posts by this member only | IPv6 | Post

#234

|

Senior Member

5,919 posts Joined: Sep 2009 |

QUOTE(contestchris @ Mar 22 2024, 02:12 PM) I mean they only know as best as the next person. yes no one can confirm call back or notCompany has been clear that the perpetual sukuk is a 5 year program. The step-up interest from Y6 onwards is a hefty penalty for non-redemption.  https://www.tropicanacorp.com.my/files/TCB%...th%20AGM%20.pdf But of course, Tropicana retains the flexibility to not call, or even then defer the coupon payment. But these will only happen because "shit hits the fan". consensus belief is yes, will call back either way i think we cant lose dont call back takpa pay us 9% lo. if tropicana defer us dividend then it also cannot pay all other bonds so many queuing behind us like that Tropicana got to close man.. |

|

|

Mar 25 2024, 03:36 PM Mar 25 2024, 03:36 PM

Show posts by this member only | IPv6 | Post

#235

|

Senior Member

5,576 posts Joined: Aug 2011 |

How long does it take to receive bond coupon payments?

|

|

|

Mar 25 2024, 05:51 PM Mar 25 2024, 05:51 PM

Show posts by this member only | IPv6 | Post

#236

|

Senior Member

5,919 posts Joined: Sep 2009 |

|

|

|

Mar 26 2024, 09:19 AM Mar 26 2024, 09:19 AM

Show posts by this member only | IPv6 | Post

#237

|

Senior Member

5,919 posts Joined: Sep 2009 |

Tropicana dividend in CIMB not received so far.

first time like this some problem is going on. |

|

|

Mar 26 2024, 03:53 PM Mar 26 2024, 03:53 PM

Show posts by this member only | IPv6 | Post

#238

|

Senior Member

5,576 posts Joined: Aug 2011 |

|

|

|

Mar 26 2024, 04:55 PM Mar 26 2024, 04:55 PM

Show posts by this member only | IPv6 | Post

#239

|

Senior Member

4,500 posts Joined: Mar 2014 |

Default? 🤔 |

|

|

Mar 26 2024, 05:49 PM Mar 26 2024, 05:49 PM

|

Senior Member

3,681 posts Joined: Apr 2019 |

|

| Change to: |  0.0281sec 0.0281sec

0.77 0.77

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 11:18 AM |