HQ said Tropicana at RM93.50 no more stocks...that should say something

Bond kaki lai, DRB HICOM bond coming

Bond kaki lai, DRB HICOM bond coming

|

|

Feb 18 2024, 02:19 PM Feb 18 2024, 02:19 PM

Show posts by this member only | IPv6 | Post

#181

|

Senior Member

5,926 posts Joined: Sep 2009 |

HQ said Tropicana at RM93.50 no more stocks...that should say something BWassup liked this post

|

|

|

|

|

|

Feb 18 2024, 08:11 PM Feb 18 2024, 08:11 PM

Show posts by this member only | IPv6 | Post

#182

|

Junior Member

850 posts Joined: Sep 2022 |

QUOTE(contestchris @ Feb 14 2024, 12:20 AM) There is NO WAY for you to buy at 93.50 at the moment. FSM is not selling at that price. deletedYou can however sell at 92.00. Up to RM50k nominal. At the moment, FSM is only buying at 92.00 and that's why I say, there is some level of manipulation here. This post has been edited by BWassup: Feb 18 2024, 10:07 PM |

|

|

Feb 18 2024, 08:42 PM Feb 18 2024, 08:42 PM

Show posts by this member only | IPv6 | Post

#183

|

Junior Member

850 posts Joined: Sep 2022 |

|

|

|

Feb 20 2024, 01:58 PM Feb 20 2024, 01:58 PM

|

Senior Member

5,582 posts Joined: Aug 2011 |

BWassup liked this post

|

|

|

Mar 2 2024, 11:09 PM Mar 2 2024, 11:09 PM

Show posts by this member only | IPv6 | Post

#185

|

Senior Member

5,926 posts Joined: Sep 2009 |

|

|

|

Mar 3 2024, 12:10 AM Mar 3 2024, 12:10 AM

Show posts by this member only | IPv6 | Post

#186

|

Senior Member

5,582 posts Joined: Aug 2011 |

QUOTE(guy3288 @ Mar 2 2024, 11:09 PM) Bank Islam Vice President Wealth guy Ivan said he thinks call back unlikely. I find that hard to believe. Tropicana is buying new land with bank financing at 6%. They'd be dumb to not exercise the call option as the interest will br 9%. It will scare existing bond investors and unlikely to be able to issue bonds anytime soon. Will cause a rating downgrade too maybe. I've spoken to MARC and they think it'd be to Tropicana's detriment to not call back.never mind lah as long as next coupon 9% can be paid. |

|

|

|

|

|

Mar 3 2024, 10:54 AM Mar 3 2024, 10:54 AM

Show posts by this member only | IPv6 | Post

#187

|

Junior Member

850 posts Joined: Sep 2022 |

QUOTE(guy3288 @ Mar 2 2024, 11:09 PM) Bank Islam Vice President Wealth guy Ivan said he thinks call back unlikely. If that does happen, wouldn't that lead to a cross-default of their banking facilities? They just announced buying more land in Tropicana for RM224m.never mind lah as long as next coupon 9% can be paid. They will not be able to pay any dividends as well. |

|

|

Mar 3 2024, 02:53 PM Mar 3 2024, 02:53 PM

|

Senior Member

3,687 posts Joined: Apr 2019 |

QUOTE(BWassup @ Mar 3 2024, 10:54 AM) If that does happen, wouldn't that lead to a cross-default of their banking facilities? They just announced buying more land in Tropicana for RM224m. no lar... like the name suggested, it is a perp, with a callable feature. The call sits with the issuer. They will not be able to pay any dividends as well. issuer not calling it is not a bankruptcy event, as it is specifically allowed in the mandate. This bond have dividend covenant? if got, then maybe not so bad. |

|

|

Mar 3 2024, 03:06 PM Mar 3 2024, 03:06 PM

Show posts by this member only | IPv6 | Post

#189

|

Senior Member

5,582 posts Joined: Aug 2011 |

QUOTE(Wedchar2912 @ Mar 3 2024, 02:53 PM) no lar... like the name suggested, it is a perp, with a callable feature. The call sits with the issuer. Yes it's part of the feature but it doesn't inspire confidence in the credit capacity of the company, who in their right mind will pay 9% coupon on a perp when they can get long term credit from banks at 6%?issuer not calling it is not a bankruptcy event, as it is specifically allowed in the mandate. This bond have dividend covenant? if got, then maybe not so bad. So much bullshit from some people. Like I said, I spoke with the guys doing the rating of Trooicana sukuk at MARC, they confirmed that not redeeming the bond at the call date is going to be viewed as credit negative. It's specifically the step up nature of the perp that makes it credit negative to not exercise the redemption. This post has been edited by contestchris: Mar 3 2024, 03:07 PM |

|

|

Mar 3 2024, 03:21 PM Mar 3 2024, 03:21 PM

|

Senior Member

3,687 posts Joined: Apr 2019 |

QUOTE(contestchris @ Mar 3 2024, 03:06 PM) Yes it's part of the feature but it doesn't inspire confidence in the credit capacity of the company, who in their right mind will pay 9% coupon on a perp when they can get long term credit from banks at 6%? Not calling can be viewed as credit negative, but it is not a bankruptcy event. So much bullshit from some people. Like I said, I spoke with the guys doing the rating of Trooicana sukuk at MARC, they confirmed that not redeeming the bond at the call date is going to be viewed as credit negative. It's specifically the step up nature of the perp that makes it credit negative to not exercise the redemption. the credit rating is only a concern to the issuer if they wish to tap the credit market again... the main shareholders usually would want to receive div, so usually they will inform the management to do the right thing. But in Malaysia, sometimes the main shareholders have ulterior motives. (plus sneaky... for FY2023, tropicana posted loss... so they already don't plan to give dividend rite? last div was 2020) I suspect the bank's credit at 6% is arrived due to some collaterals posted or some other surety. the collateral could be that land purchased itself. This post has been edited by Wedchar2912: Mar 3 2024, 03:26 PM |

|

|

Mar 3 2024, 04:51 PM Mar 3 2024, 04:51 PM

|

Senior Member

5,582 posts Joined: Aug 2011 |

I read that Tropicana Gardens Mall is going to be sold to IOI for over RM700mil, so could be from there. They've already sold W Hotel KL and Mariott Penang

|

|

|

Mar 3 2024, 05:54 PM Mar 3 2024, 05:54 PM

Show posts by this member only | IPv6 | Post

#192

|

Junior Member

850 posts Joined: Sep 2022 |

QUOTE(contestchris @ Mar 3 2024, 03:06 PM) Yes it's part of the feature but it doesn't inspire confidence in the credit capacity of the company, who in their right mind will pay 9% coupon on a perp when they can get long term credit from banks at 6%? What about Tropicana issuing another sukuk to refinance the one callable in September 2024? If there is demand, wouldn't they be able to do that at below 9% (+ 1% each subsequent year it is not called) on secured basis?So much bullshit from some people. Like I said, I spoke with the guys doing the rating of Trooicana sukuk at MARC, they confirmed that not redeeming the bond at the call date is going to be viewed as credit negative. It's specifically the step up nature of the perp that makes it credit negative to not exercise the redemption. On the possibility of Tropicana deferring future expected distributions, are they allowed to defer them indefinitely, in which case, it could become a rolling snowball which may never be paid? Weird. Their credit standing would plummet. This post has been edited by BWassup: Mar 3 2024, 05:59 PM |

|

|

Mar 3 2024, 06:00 PM Mar 3 2024, 06:00 PM

Show posts by this member only | IPv6 | Post

#193

|

Senior Member

5,582 posts Joined: Aug 2011 |

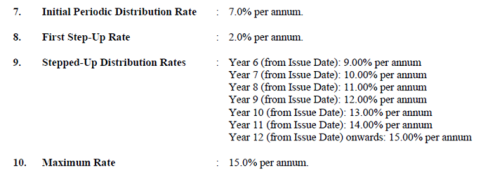

QUOTE(BWassup @ Mar 3 2024, 05:54 PM) What about Tropicana issuing another sukuk to refinance the one callable in September 2024? If there is demand, wouldn't they be able to do that at below 9% (+ 1% each subsequent year it is not called)? The dividend and capital stopper clause for the perpetual sukuk prohibits any dividends, distributions or other payments to shareholders or junior debt obligations. This enforces the higher ranking of obligations for debt and perpetual sukuk holders above the common shareholders. As such, if the Issuer wishes to declare any dividends, they would have to first satisfy any outstanding deferred periodic payments.On the possibility of Tropicana deferring future expected distributions, are they allowed to defer them indefinitely, in which case, it could become a rolling snowball which may never be paid? Weird. Their credit standing would plummet. Secondly, another repercussion would be the poorer reputation of the issuer in the market. To elaborate on the implications of this, a large corporation like Tropicana deferring on periodic payments may send an unfavourable message to the market. Being a property developer requiring consistent funding for upcoming developments, deferring on payments may result in banks withdrawing their credit facilities, imposing stricter lending requirements or higher borrowing rates. Furthermore, it will be harder for them to tap into the bond market for financing, and even if they manage to do so, they will most likely have to offer a much higher interest to investors. Given the implications, deferring on payments is often the last resort for issuers, as it may snowball into a bigger problem for them down the road. Additionally, in the event of a non-call the first coupon step-up of 2% per annum and an additional 1% per annum for the year following that will make servicing the debt more expensive for the issuer and will be an incentive for them to call the perpetual sukuk on the first call date as shown below.  This post has been edited by contestchris: Mar 3 2024, 06:02 PM |

|

|

|

|

|

Mar 3 2024, 06:03 PM Mar 3 2024, 06:03 PM

Show posts by this member only | IPv6 | Post

#194

|

Senior Member

5,582 posts Joined: Aug 2011 |

QUOTE(BWassup @ Mar 3 2024, 05:54 PM) What about Tropicana issuing another sukuk to refinance the one callable in September 2024? If there is demand, wouldn't they be able to do that at below 9% (+ 1% each subsequent year it is not called) on secured basis? I think no more demand, look at the yields on the secondary market. Tropicana can forget about tapping into the bond market in the next few years if they fail to redeem the 7.00% perp in Sep 2024.On the possibility of Tropicana deferring future expected distributions, are they allowed to defer them indefinitely, in which case, it could become a rolling snowball which may never be paid? Weird. Their credit standing would plummet. |

|

|

Mar 3 2024, 06:24 PM Mar 3 2024, 06:24 PM

|

Senior Member

3,687 posts Joined: Apr 2019 |

QUOTE(BWassup @ Mar 3 2024, 05:54 PM) What about Tropicana issuing another sukuk to refinance the one callable in September 2024? If there is demand, wouldn't they be able to do that at below 9% (+ 1% each subsequent year it is not called) on secured basis? this is what firms usually do... so called rolling their debts... it is everyone's guess why IB didn't tell them to do so? On the possibility of Tropicana deferring future expected distributions, are they allowed to defer them indefinitely, in which case, it could become a rolling snowball which may never be paid? Weird. Their credit standing would plummet. also, i did mention previously... don't know if this perp has cumulative deferral feature... need the bond holders to check the mandate. (I don't have bonds in my portfolio, so just discussing for discussion sake) This post has been edited by Wedchar2912: Mar 3 2024, 06:33 PM |

|

|

Mar 4 2024, 12:41 AM Mar 4 2024, 12:41 AM

Show posts by this member only | IPv6 | Post

#196

|

Senior Member

5,926 posts Joined: Sep 2009 |

i hope Tropicana would call it back.their bank loan is not cheap. not 6% pay us 9% might still be easier

ours perpetual.no call back still no default unlike the last one in Oct mati mati also must go get money.Total RM 2 billions lining up.. can Tropicana spare 248M for us? coupons would still be paid lah methinks.. Ini first tranche if koyak imagine what the many more tranches behind would react. |

|

|

Mar 4 2024, 11:45 AM Mar 4 2024, 11:45 AM

Show posts by this member only | IPv6 | Post

#197

|

Junior Member

850 posts Joined: Sep 2022 |

QUOTE(guy3288 @ Mar 4 2024, 12:41 AM) i hope Tropicana would call it back.their bank loan is not cheap. not 6% pay us 9% might still be easier I trust they will call back or refinance. The ramifications on all their credit facilities and biz would be quite damaging otherwise. And they have other sukuk from 2025 onwards where 1st call is due. It would just compound matters and spike their sukuk coupon rates.ours perpetual.no call back still no default unlike the last one in Oct mati mati also must go get money.Total RM 2 billions lining up.. can Tropicana spare 248M for us? coupons would still be paid lah methinks.. Ini first tranche if koyak imagine what the many more tranches behind would react. |

|

|

Mar 6 2024, 01:11 AM Mar 6 2024, 01:11 AM

Show posts by this member only | IPv6 | Post

#198

|

Senior Member

5,926 posts Joined: Sep 2009 |

QUOTE(BWassup @ Mar 4 2024, 11:45 AM) I trust they will call back or refinance. The ramifications on all their credit facilities and biz would be quite damaging otherwise. And they have other sukuk from 2025 onwards where 1st call is due. It would just compound matters and spike their sukuk coupon rates. No call back also nice get 9% later on when Tropicana got more cash then only call back boleh? hksgmy liked this post

|

|

|

Mar 6 2024, 07:59 AM Mar 6 2024, 07:59 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

|

|

|

Mar 6 2024, 10:25 AM Mar 6 2024, 10:25 AM

Show posts by this member only | IPv6 | Post

#200

|

Junior Member

850 posts Joined: Sep 2022 |

QUOTE(guy3288 @ Mar 6 2024, 01:11 AM) I also like higher coupon, provided they pay.Unfortunately, it seems that under the terms, if they don't pay the coupons, they will just accumulate, and we cannot do anything about it. That would not be a good situation. |

| Change to: |  0.0298sec 0.0298sec

1.09 1.09

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 02:19 PM |