This is what illiquidity means, and that bonds are traded in the OTC market. As much as Bond Express is trying to make itself like a exchange, it is not. It is just a platform. The other "platform" the retail banks and buy via your fav RM.

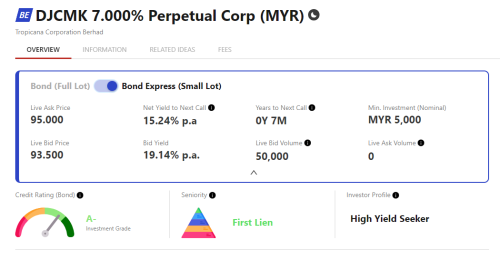

Prices presented as 92.0/93.5 is the bid/offer price on the platform. No transactions at these levels indicate illiquidity, and in some sense, is the market price on this platform. If a investor feel it is good value, then he should just hit the 93.5 price and get his bond. In fact, if this investor have enough money and risk appetite, he can keep on buying the bonds until FSM platform runs out or until the price shifts higher.

Conversely, if a existing investor is desperate and willing to sell his bonds at 92, he should just throw.

The other part is a market structure issue, which maybe you would know.

Similar to Brk-A convertible to Brk-B (and then to -C) but in reverse, would you know if the small lot size can be grouped together to form the standard lot size of 250K rm? I suspect it is not possible and hence this creates a weird dual pricing.

(like you said, there were transaction of 250K rm at 91, which suggested someone can break the standard lot to small lot and try to earn the 2 bucks. It is just a guess and no way to find out except to ask some insider in FSM).

Nonetheless, looking the transactions, even the full lots are traded below par, with 6 months away for the callability. Investors are not fully convinced that the issuer will call back the bonds. I also think this bond don't have cumulative deferral feature. Just my guess.

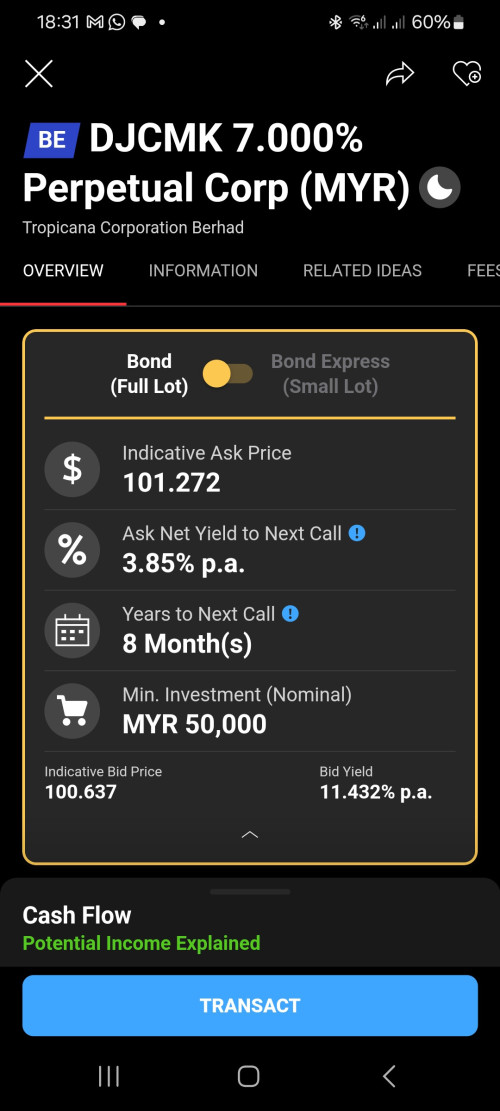

There is NO WAY for you to buy at 93.50 at the moment. FSM is not selling at that price.

You can however sell at 92.00. Up to RM50k nominal.

At the moment, FSM is only buying at 92.00 and that's why I say, there is some level of manipulation here.

Nov 20 2023, 11:33 PM

Nov 20 2023, 11:33 PM

Quote

Quote

0.0266sec

0.0266sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled