QUOTE(guy3288 @ Jul 30 2023, 09:17 PM)

You sounded like you have knowledge in internal running of bonds

you worked in banking bonds before?

but still i cannot fathom how...

1)once the bond is issued there is daily price movements that

customers can view before buy or sell.

And the spread is rather fixed

not much different from Bursa also

except it wont change every few minute lah.

2) i doubt they can suka suka pushing up selling price additional RM5 without also

pushing up the equivalent amount for buying price.

3) So in an attempt to profit from buyers sell at extra RM5.00,

the bank would inadvertently put itself at risk of overpaying

seller also for same extra RM5.00

4) If they play dirty, imagine buyer found out later

as many bonds we can buy sell from other bankers also.

i doubt the banker willing to take that kind of risk of getting a bad name.

The spread is not considered fee

ok.

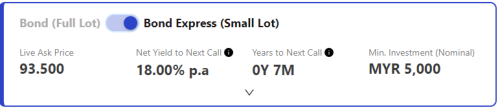

How about the buying price eg new launch PAR value RM100

i have to pay RM102 for it

Isnt the extra Rm2.00 the 2% buying fee as they said to me.

so when i sell it is only fair that they go charge the new buyer

Malaysia bond market is considered very illiquid, with exception of govies.

So the spread you noticed is basically made up by the bank that is servicing you. And usually, not always, the other side of transaction is the bank itself (represented by the trader). And because of this, it is possible for bank A and bank B to quote you different price.

(except for buying, this different price is useless when you want to sell because your bond is being custodized with the bank you purchased at start).

Bursa is a stock exchange, and by right, all publicly listed equities in Malaysia must trade via the exchange, with certain exceptions. This price is transparent for all to see.

Btw, I doubt it is written anywhere by the bank that the bid-offer spread must be 2? Just like fx, which is a lot more liquid, at times of market uncertainty, the spread for FX widens like mad.

2 and 3 imply spread is fixed. It is not. and neither is real fair value of the bond needs to be within the bid-offer prices.

4 is the most interesting part. How often do clients really shop around? (even changing physical foreign currency also people don't really get the best price) Once you purchased a bond from a particular bank, you have to sell that bond back to them. Unless you transfer said bond out. Plus, its not that easy for a client to shop around unless they are premier clients of a few banks.

Btw, you have also answered your own question about why the price is 102 for a IPO. The convention is that all bonds are issued at PAR (ie only the coupon is varied for each issuance), so by right you should be subscibing to the bond at 100 bucks.

Occam's razor: the bank slapped extra 2 bucks on top of the real offer price, which is 100.

edit: forgot to mention. If the extra 2rm is "buying fee", then in your statement it should spell out fee. Its like you purchase Maybank shares at 9.00, but got small items called this and that fee.

This post has been edited by Wedchar2912: Jul 30 2023, 10:49 PM

Jul 27 2023, 08:25 PM

Jul 27 2023, 08:25 PM

Quote

Quote

0.0289sec

0.0289sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled