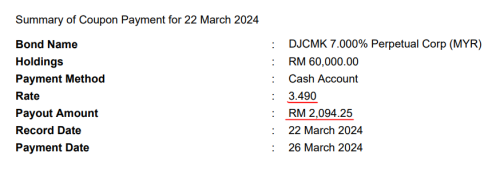

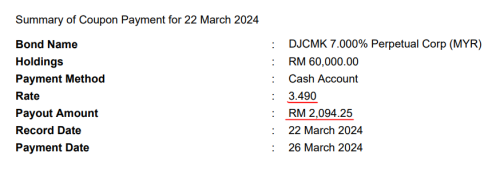

Received the money on FSM.

But why is the rate 3.49% instead of 3.50%? And why is the payout RM2,094.25 instead of RM2,100.00?

Bond kaki lai, DRB HICOM bond coming

|

|

Mar 26 2024, 06:07 PM Mar 26 2024, 06:07 PM

|

Senior Member

5,564 posts Joined: Aug 2011 |

|

|

|

|

|

|

Mar 26 2024, 09:13 PM Mar 26 2024, 09:13 PM

Show posts by this member only | IPv6 | Post

#242

|

Senior Member

5,903 posts Joined: Sep 2009 |

QUOTE(contestchris @ Mar 26 2024, 03:53 PM) technical hiccup onlyQUOTE(contestchris @ Mar 26 2024, 06:07 PM)  Received the money on FSM. But why is the rate 3.49% instead of 3.50%? And why is the payout RM2,094.25 instead of RM2,100.00? did you withdraw from FSM cash Account to bank? My last withdrawal money almost instantly received This time need wait 1 day?? soemthing is wrong again Attached image(s)  |

|

|

Mar 26 2024, 09:28 PM Mar 26 2024, 09:28 PM

Show posts by this member only | IPv6 | Post

#243

|

Junior Member

840 posts Joined: Sep 2022 |

|

|

|

Mar 26 2024, 09:43 PM Mar 26 2024, 09:43 PM

Show posts by this member only | IPv6 | Post

#244

|

Senior Member

5,564 posts Joined: Aug 2011 |

QUOTE(guy3288 @ Mar 26 2024, 09:13 PM) technical hiccup only Oh wait, so you're saying 7.00% semi-annual doesn't simply mean 3.50% every 6 months? They actually count the actual number of days between Sep 26 to March 25, then again from March 26 to Sep 25? Meaning which, the next coupon will be 7% * 184/365? In which case, the total amount will actually be slightly above 7.00% as it is a leap year?Rm60k x7% x182/365 did you withdraw from FSM cash Account to bank? My last withdrawal money almost instantly received This time need wait 1 day?? soemthing is wrong again This post has been edited by contestchris: Mar 26 2024, 09:44 PM |

|

|

Mar 27 2024, 10:55 AM Mar 27 2024, 10:55 AM

Show posts by this member only | IPv6 | Post

#245

|

Senior Member

5,903 posts Joined: Sep 2009 |

QUOTE(BWassup @ Mar 26 2024, 09:28 PM) Tu cilakak mbb offline ngam ngam that minuteFailed ibft became normal ibg, no return QUOTE(contestchris @ Mar 26 2024, 09:43 PM) Oh wait, so you're saying 7.00% semi-annual doesn't simply mean 3.50% every 6 months? They actually count the actual number of days between Sep 26 to March 25, then again from March 26 to Sep 25? Meaning which, the next coupon will be 7% * 184/365? In which case, the total amount will actually be slightly above 7.00% as it is a leap year? Bro bonds are like that lah, exact calculation by dayDivide by 365 we untung lo Overseas even divide by 360days! |

|

|

Apr 16 2024, 09:09 PM Apr 16 2024, 09:09 PM

Show posts by this member only | IPv6 | Post

#246

|

Senior Member

5,903 posts Joined: Sep 2009 |

Hextar Global Bond any one?

Hextar Global Bhd 7Y MYR New Issuance - 5.100 - 5.300% area HEXTAR BOND Attached thumbnail(s)

|

|

|

|

|

|

Apr 17 2024, 08:58 PM Apr 17 2024, 08:58 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Apr 16 2024, 09:09 PM) Bro, you seem to be on a bond buying spree.... Over here in Singapore, my bond acquisition has dried to a trickle... not many good investment grade bonds to choose from, sadly. |

|

|

Apr 17 2024, 09:47 PM Apr 17 2024, 09:47 PM

Show posts by this member only | IPv6 | Post

#248

|

Senior Member

5,564 posts Joined: Aug 2011 |

QUOTE(guy3288 @ Apr 16 2024, 09:09 PM) Yield is too low. |

|

|

Apr 17 2024, 10:44 PM Apr 17 2024, 10:44 PM

|

Senior Member

4,499 posts Joined: Mar 2014 |

guy3288 liked this post

|

|

|

Apr 18 2024, 09:37 PM Apr 18 2024, 09:37 PM

Show posts by this member only | IPv6 | Post

#250

|

Senior Member

5,903 posts Joined: Sep 2009 |

QUOTE(hksgmy @ Apr 17 2024, 08:58 PM) Bro, you seem to be on a bond buying spree.... justaskingonly bro.Over here in Singapore, my bond acquisition has dried to a trickle... not many good investment grade bonds to choose from, sadly. QUOTE(contestchris @ Apr 17 2024, 09:47 PM) yeah abit low for long 7 years... |

|

|

Apr 28 2024, 11:28 AM Apr 28 2024, 11:28 AM

Show posts by this member only | IPv6 | Post

#251

|

Junior Member

840 posts Joined: Sep 2022 |

Tropicana 7% Bond

Trade Date Amount Price Yield 23-Apr-2024 0.7 100.23 6.42 |

|

|

Apr 28 2024, 09:12 PM Apr 28 2024, 09:12 PM

Show posts by this member only | IPv6 | Post

#252

|

Senior Member

5,903 posts Joined: Sep 2009 |

|

|

|

Apr 29 2024, 12:21 AM Apr 29 2024, 12:21 AM

Show posts by this member only | IPv6 | Post

#253

|

Junior Member

840 posts Joined: Sep 2022 |

|

|

|

|

|

|

Apr 29 2024, 01:02 AM Apr 29 2024, 01:02 AM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

QUOTE(BWassup @ Apr 29 2024, 12:21 AM) Tropicana share price also surged this week. I'm not sure what announcements have been made, but I guess the bond price is moving in tandem. Tropicano Share definitely impact bond price la..when their share not performing so does their company. They are in -EPS, not many ppl would believe they could service their bond. Thats y the low price. I too have been checking out on them, too much red flag to me, as a beginner...lol |

|

|

Apr 29 2024, 03:32 PM Apr 29 2024, 03:32 PM

Show posts by this member only | IPv6 | Post

#255

|

Junior Member

395 posts Joined: Dec 2017 |

Looking at AUD bonds on FSM. Some with quite good YTM/YTC. Only hesitation is currency risk, i.e., how AUD will fare against MYR in long run.

|

|

|

May 29 2024, 12:54 AM May 29 2024, 12:54 AM

Show posts by this member only | IPv6 | Post

#256

|

Senior Member

5,564 posts Joined: Aug 2011 |

|

|

|

May 29 2024, 06:29 PM May 29 2024, 06:29 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Mattrock @ Apr 29 2024, 03:32 PM) Looking at AUD bonds on FSM. Some with quite good YTM/YTC. Only hesitation is currency risk, i.e., how AUD will fare against MYR in long run. Well, most of us here are probably of the opinion that MYR will trend within the lower ranges for the foreseeable future due to a variety of factors both within and beyond our country’s control…. |

|

|

May 30 2024, 01:17 PM May 30 2024, 01:17 PM

Show posts by this member only | IPv6 | Post

#258

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

May 30 2024, 03:14 PM May 30 2024, 03:14 PM

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(zebras @ May 30 2024, 01:17 PM) In their briefing right now!As indicated by the poster, please indicate your interest. If the Company is confident they are able to raise the amount, they will launch it. There was feedback that the coupon rates are not attractive. Best, Jiansheng This post has been edited by Holocene: May 30 2024, 03:29 PM |

|

|

Jun 1 2024, 04:32 AM Jun 1 2024, 04:32 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Holocene @ May 30 2024, 03:14 PM) In their briefing right now! 4.5% yield in this present high interest rate environment may not seem like a lot, but if you take into account that most analysts are expecting a return to lower rates soon, then it’s quite decent.As indicated by the poster, please indicate your interest. If the Company is confident they are able to raise the amount, they will launch it. There was feedback that the coupon rates are not attractive. Best, Jiansheng |

| Change to: |  0.0172sec 0.0172sec

0.67 0.67

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 09:18 AM |