QUOTE(Garysydney @ Dec 24 2022, 11:33 AM)

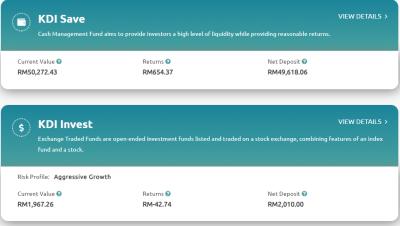

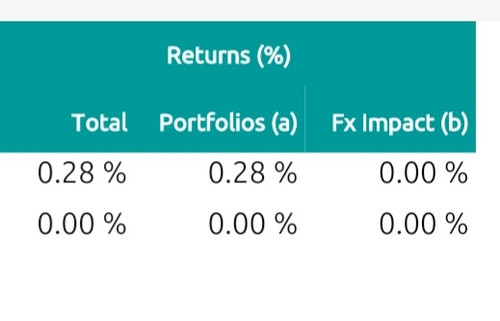

Actually i am quite happy with kdi with 3.5%. I just want some place to park some 'lazy' money - for me my lazy money is about 50k which is for emergencies like hospital fees or unforeseeable expenditure. Have credit card to cover emergencies but also nice to have some cash in hand. I used to leave about 20k in my main MBB savings acct but now i only keep about 8k or 9k in my main MBB savings acct (actually i keep in total more like 12k or 13k because i got so many accts with just 1k dormannt in it).

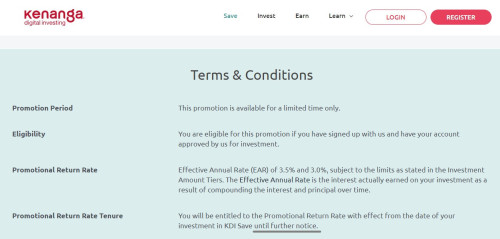

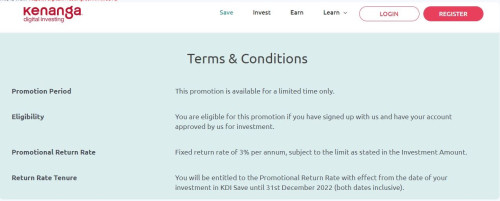

have to keep in mind this is promotional rate effective until 31st of this month only.. come 1st jan which is just 1 more week, will go back down to 3%. and 1 more week only still no news from them whether got any revised promo or not.. if really nothing, i doubt that time you will be happy with the 3%..dont get me wrong. kdi still good place to park money because they have higher limit of 50k for people like you and me, compared to go+ 9.5k only which is not sufficient for us.

but for people who have 10k only or lower, now go+ seems like the better choice. and go+ is better at liquidity cause can use for payments directly.

in fact if go+ keeps going up i myself will remove 9.5k from kdi save and put back into go+. i recently did the reverse of this and all-in kdi save cause decided didnt wantto use the money anytime soon, so keep into kdi better because its more secure and also can act as a forced savings. sometimes if left in go+ and hand itchy make impulse purchases.

anyway just wishful thinking, hope kdi will do another round of promotion and give better revised rates than current to keep up with competitors. because i really dont want to put back into go+ for reasons mentioned above

This post has been edited by Optizorb: Dec 24 2022, 12:26 PM

Dec 24 2022, 12:19 PM

Dec 24 2022, 12:19 PM

Quote

Quote

0.0169sec

0.0169sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled