how long it takes for money to reflect in kdi save after deposit? forgot already..

deposited around 11pm ytd, till now no update.

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Dec 15 2022, 03:28 PM Dec 15 2022, 03:28 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,260 posts Joined: Sep 2021 |

how long it takes for money to reflect in kdi save after deposit? forgot already..

deposited around 11pm ytd, till now no update. |

|

|

|

|

|

Dec 20 2022, 06:20 AM Dec 20 2022, 06:20 AM

Return to original view | Post

#2

|

Senior Member

1,260 posts Joined: Sep 2021 |

got this email from them.

need to reply ka? QUOTE Kenanga Digital Investing: Requesting further details for Enhance Due Diligence Greetings from Kenanga Digital Investing (KDI). Firstly, thank you very much for choosing us as one of your investment alternatives. As part of the enhance due diligence requirements, we seek your kind reply to furnish us with the information to these three (3) questions as per below. 1. Where will the main source of funds for investment in KDI be from? Please state Applicable or Not Applicable for the categories below: a) Business: b) Investment: c) Employment* (*this shall include directorship fees) - d) Inheritance: e) Savings: f) EPF: 2. Please indicate other sources of wealth (if applicable) and their "estimated" values thereof: a) Savings: Estimated value RM b) Fixed Deposit: Estimated value RM c) Real Estate investment: Estimated value RM d) Securities: Estimated value RM e) Others: Estimated value RM This post has been edited by Optizorb: Dec 20 2022, 06:20 AM |

|

|

Dec 20 2022, 11:13 AM Dec 20 2022, 11:13 AM

Return to original view | Post

#3

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(guy3288 @ Dec 20 2022, 08:44 AM) QUOTE(Ramjade @ Dec 20 2022, 09:20 AM) Of course need to reply. Part of their KYC if they think you are transacting huge amount. thanks for the info, will proceed to give basic answers.If you don't reply, cannot use their service. guy3288 liked this post

|

|

|

Dec 21 2022, 03:29 PM Dec 21 2022, 03:29 PM

Return to original view | Post

#4

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(download88 @ Dec 21 2022, 03:17 PM) they have to, else all just run back to fd.fd now almost all 4%+ ady.. in fact i think 3.5% getting low already, meaning they should bump it up. even go+ these past week hovering at 3.3% Garysydney liked this post

|

|

|

Dec 21 2022, 04:52 PM Dec 21 2022, 04:52 PM

Return to original view | Post

#5

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(xander2k8 @ Dec 21 2022, 04:35 PM) Indefinite for now some fd accrue the interest daily/monthly, and can withdraw the fd without burning the full interest right.. so can just withdraw the fd if allowed..Wait until BNM next policy meeting in mid Feb next year 3.5% is still within the range you can’t ask for more with liquidity FD can give you higher but if term limits but not liquidity 🤦♀️ anyway my point was, even go+ already giving 3% to 3.3% the past month.. if kdi dont continue this so called "promo" rate of 3.5% and return back to normal rate of 3%. then who want to continue put in kdi.. |

|

|

Dec 23 2022, 11:33 AM Dec 23 2022, 11:33 AM

Return to original view | Post

#6

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

|

|

|

Dec 24 2022, 11:17 AM Dec 24 2022, 11:17 AM

Return to original view | Post

#7

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(gooroojee @ Dec 24 2022, 10:33 AM) I checked my November statement for KDI. Return as per KDI statement and calculation is 0.278% for the month, which when multiplied by 12 is only 3.336%. instead of 3.5% EAR... On a separate note, Touch N Go's Go+ daily return was 3.45% yesterday... Btw, it is perfectly fine to discuss and reply comments without using derogatory or demeaning words on other forumers. Putting people down doesn't make anybody smarter, it just reflects that you have nothing intellectual to offer any more. This forum is to share info and also find help. QUOTE(Garysydney @ Dec 24 2022, 10:54 AM) I got 86c interest from TnGo and my balance is about 9,380 yesterday. Works out around 3.334%. so go+ on par with kdi now..Didn't check my wife's phone today. Her balance also about the same balance as myself. Last few days her interest also around 83 or 84c. but go+ got potential to go even higher. i can see it going to 3.5 to 3.6 in the following weeks. which just proves my point earlier. kdi save is already "low" and that is promotional rate even.. if they dont at least continue it but return back to normal rate of 3% can say goodbye. hope kdi will revise their rates soon. |

|

|

Dec 24 2022, 12:19 PM Dec 24 2022, 12:19 PM

Return to original view | Post

#8

|

Senior Member

1,260 posts Joined: Sep 2021 |

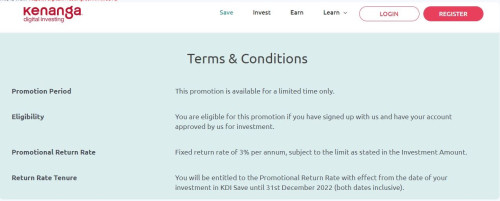

QUOTE(Garysydney @ Dec 24 2022, 11:33 AM) Actually i am quite happy with kdi with 3.5%. I just want some place to park some 'lazy' money - for me my lazy money is about 50k which is for emergencies like hospital fees or unforeseeable expenditure. Have credit card to cover emergencies but also nice to have some cash in hand. I used to leave about 20k in my main MBB savings acct but now i only keep about 8k or 9k in my main MBB savings acct (actually i keep in total more like 12k or 13k because i got so many accts with just 1k dormannt in it). have to keep in mind this is promotional rate effective until 31st of this month only.. come 1st jan which is just 1 more week, will go back down to 3%. and 1 more week only still no news from them whether got any revised promo or not.. if really nothing, i doubt that time you will be happy with the 3%..dont get me wrong. kdi still good place to park money because they have higher limit of 50k for people like you and me, compared to go+ 9.5k only which is not sufficient for us. but for people who have 10k only or lower, now go+ seems like the better choice. and go+ is better at liquidity cause can use for payments directly. in fact if go+ keeps going up i myself will remove 9.5k from kdi save and put back into go+. i recently did the reverse of this and all-in kdi save cause decided didnt wantto use the money anytime soon, so keep into kdi better because its more secure and also can act as a forced savings. sometimes if left in go+ and hand itchy make impulse purchases. anyway just wishful thinking, hope kdi will do another round of promotion and give better revised rates than current to keep up with competitors. because i really dont want to put back into go+ for reasons mentioned above This post has been edited by Optizorb: Dec 24 2022, 12:26 PM |

|

|

Dec 25 2022, 08:40 AM Dec 25 2022, 08:40 AM

Return to original view | Post

#9

|

Senior Member

1,260 posts Joined: Sep 2021 |

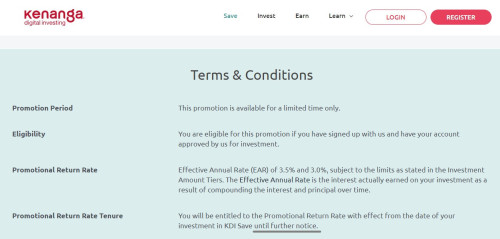

QUOTE(1mr3tard3d @ Dec 25 2022, 03:28 AM) there is no specific deadline to this 3.5% EAR  the 31 December 2022 was last time promotion, luckily someone screenshot the TNC  so the reversion to 3% beginning 1st Jan does not make sense either since the promotion will end on 31 December 2022 looks like they just changed it then to "until further notice" iirc, as recent as last week it was still showing until 31st dec when i was putting in money and the tnc pop up. |

|

|

Dec 28 2022, 01:09 PM Dec 28 2022, 01:09 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Dec 29 2022, 02:22 PM Dec 29 2022, 02:22 PM

Return to original view | Post

#11

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(adele123 @ Dec 29 2022, 02:14 PM) Well, with the campaign coming to an end, just want to give thumbs up to KDI for fast withdrawal. read 1 page back. it didnt end.Submit request before 11am on tuesday, money received on end of tuesday. But didnt check my acct though till the next day. extended "till further notice" This post has been edited by Optizorb: Dec 29 2022, 02:23 PM |

|

|

Jan 3 2023, 05:34 PM Jan 3 2023, 05:34 PM

Return to original view | Post

#12

|

Senior Member

1,260 posts Joined: Sep 2021 |

btw is it possible to see daily earnings like in go+ where they tell you how much got credited daily?

and also, is the returns compounding with net deposit? like e.g if net deposit was 50k initially, then after 1 month gained rm141 returns. so have 50,141 in kdi save. is the interest still calculated on 50k or 50,141 ? This post has been edited by Optizorb: Jan 3 2023, 05:38 PM |

|

|

Jan 5 2023, 05:10 PM Jan 5 2023, 05:10 PM

Return to original view | Post

#13

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(lovelyuser @ Jan 5 2023, 03:08 PM) If you have 30k, the interest difference on daily is about RM 0.41, RM 15k is RM 0.21, and bear in mind the withdrawal processing of Versa is not as fast as KDI, you lose out few days in and few days out… yeah thats the only thing stopping me from moving to versa. heard of the long in and out time..how many days versa take? heard can take up to 7 days to withdraw? |

|

|

|

|

|

Jan 6 2023, 02:13 PM Jan 6 2023, 02:13 PM

Return to original view | Post

#14

|

Senior Member

1,260 posts Joined: Sep 2021 |

considering to move my funds from kdi to hlb eFD 3 months @ 3.93% or maybe ambank 2 months @ 4.1% (not yet read TNC)

This post has been edited by Optizorb: Jan 6 2023, 02:37 PM |

|

|

Jan 31 2023, 02:08 PM Jan 31 2023, 02:08 PM

Return to original view | Post

#15

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(nike89 @ Jan 31 2023, 02:05 PM) i submit withdrawal request on 27/12 and got the fund in my bank on 28/12. before 11am/12pm you get back same day at night around 9pmto me it's very fast, I expected the fund to be credited in T+3 days though. nike89 liked this post

|

|

|

Jan 31 2023, 04:58 PM Jan 31 2023, 04:58 PM

Return to original view | Post

#16

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(cybpsych @ Jan 31 2023, 04:37 PM) you tested >11am but <12pm, and can get same day around 9pm? no, never withdraw out before. was just giving the guy rough estimate. only heard before people said 11/12. but guess it is before 11am to be precise.yeah, new app update push before can use biometric login |

|

|

Feb 13 2023, 12:20 PM Feb 13 2023, 12:20 PM

Return to original view | Post

#17

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Apr 13 2023, 11:53 PM Apr 13 2023, 11:53 PM

Return to original view | Post

#18

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(yayai @ Apr 13 2023, 10:22 PM) Don't think Kenanga will do this, better email/call them for clarification, and maybe share the phone number so we can all judge +1 to calling kenanga up to verify it..As a conspiracy theorist LOL, either some internal Kenanga people misuse your data to promote other product, or KDI investors details kena leaked, which is even worse at the very least you will find out its true or not and if it is not true, you can let kenanga know someone impersonating them to scam.. and also they will be aware one of their internal sold customer data too. |

|

|

May 18 2023, 10:35 PM May 18 2023, 10:35 PM

Return to original view | Post

#19

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Sitting Duck @ May 18 2023, 09:58 PM) Hi Sifu, hmm?I noticed that the interests is no longer compounded and the interests is given only on the "Net Deposit". I remembered when KDi save started, the interests are compounded (interests is calculated based on the balance from yesterday after interests credited). Is that the case now? im still getting compounded interest. cause for every 10k, im getting 0.957 ringgit now.. checked exactly 1 month back, every 10k i was getting 0.953 then.. 2 months back, every 10k i was getting 0.950.. for comparison at the beginning for every 10k, i got 0.943 only.. This post has been edited by Optizorb: May 18 2023, 10:38 PM |

|

|

Jun 7 2023, 10:58 AM Jun 7 2023, 10:58 AM

Return to original view | Post

#20

|

Senior Member

1,260 posts Joined: Sep 2021 |

made partial withdrawal yesterday to put into fd..

withdraw @ 10.30am, money in bank acc at 7pm. very nice, very efficient. This post has been edited by Optizorb: Jun 7 2023, 06:13 PM |

| Change to: |  0.1063sec 0.1063sec

0.67 0.67

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 01:37 PM |