QUOTE(poco loco @ Dec 28 2022, 07:41 AM)

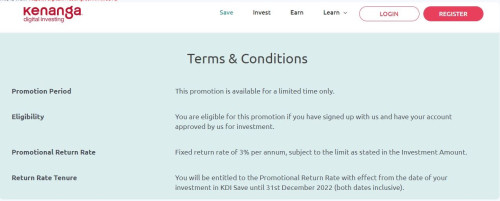

give new rate la.....near year end liao...maybank also called me give rate liao 3.8-4% aready for short burst time

still 3.5% ill withraw all out ni

already withdrew some yesterday

QUOTE(BWassup @ Dec 28 2022, 11:44 AM)

I did KDI Save deposit 1st time today, after setting up the designated bank account for deposit a few days ago.

When I clicked the Deposit button (under Online Deposit tab), I expected to see only this bank to be displayed. But instead, many banks are shown. Anyway, I clicked on my designated bank button to complete the transaction, however I still had to select the correct account when directed to the bank website.

Just wondering, since the Deposit page shows many banks, is it possible to do a deposit via a non-designated bank account? For sure, KDI has stated that only the designated and verified bank account may be used, due to security considerations.

have not tried before

but my interpretation on the following clause

so long as the bank account with the same name, no problem

but will take longer time due to verification

designated account = verified account, so faster processing time

Oct 3 2022, 04:32 PM

Oct 3 2022, 04:32 PM

Quote

Quote

0.1095sec

0.1095sec

0.92

0.92

7 queries

7 queries

GZIP Disabled

GZIP Disabled