QUOTE(kswee @ Dec 10 2021, 01:54 PM)

Thank you so much. Subscribed. Now god please bless me….

This post has been edited by MasBoleh!: Dec 10 2021, 03:37 PM

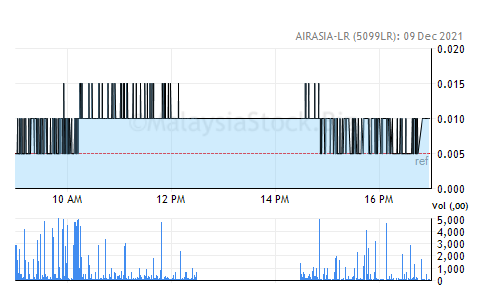

Airasia Loan Rights

|

|

Dec 10 2021, 03:36 PM Dec 10 2021, 03:36 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

|

|

|

Dec 10 2021, 03:38 PM Dec 10 2021, 03:38 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(spreeeee @ Dec 10 2021, 02:38 PM) totally noob on this. Yours if sell, too small to make a different. Just now I see… worth 0.05cent per rcuids if sell just got the huge envelope today, what can i do with the pink form? not many shares with aa though.. jz for fun when bought that time.. currently stated number of rcuid allocated = 166, and warrants = 83.. amount payable 124.50 Wanna join me and pay that 124.50? I just masuk 1k+ lol This post has been edited by MasBoleh!: Dec 10 2021, 03:39 PM |

|

|

Dec 10 2021, 04:05 PM Dec 10 2021, 04:05 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

|

|

|

Dec 10 2021, 04:43 PM Dec 10 2021, 04:43 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

i jz done TIIH online registration, but need 1 day for approval..

but: Last date and time for the sale of Provisional Allotments: Friday, 10 December 2021 at 5.00 p.m. |

|

|

Dec 10 2021, 05:01 PM Dec 10 2021, 05:01 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

tiih approved within minutes.. so just completed everything online.. sharp 5pm

|

|

|

Dec 10 2021, 05:02 PM Dec 10 2021, 05:02 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(spreeeee @ Dec 10 2021, 05:01 PM) QUOTE The low-cost airline said trading for the rights will start from Dec 6, 2021, instead of Dec 3 as scheduled earlier. The prospectus and provisional allotment letter of offer, meanwhile, would be despatched on Dec 7, 2021, instead of the day before, it said in a filing with Bursa Malaysia on Thursday. AirAsia also changed the last day and time for acceptance, renunciation and payment to Dec 20 from Dec 17 as well as for the rights cessation quotation to Dec 13 from Dec 10. The last dates for sale and transfer of provisional allotments will be Dec 14 and Dec 20, respectively, compared to Dec 13 and Dec 17 previously. The entitlement date — Dec 2, 2021 — remains unchanged. https://www.theedgemarkets.com/article/aira...-public-holiday So today is not the last day? |

|

|

|

|

|

Dec 10 2021, 05:12 PM Dec 10 2021, 05:12 PM

|

Junior Member

206 posts Joined: Sep 2005 |

QUOTE(spreeeee @ Dec 10 2021, 04:43 PM) i jz done TIIH online registration, but need 1 day for approval.. Why not you try and apply for excess sharesbut: Last date and time for the sale of Provisional Allotments: Friday, 10 December 2021 at 5.00 p.m. Currently you have 166 of LR, so you can apply for excess shares of 334 to make it a round figure of 500 shares altogether For excess shares you need to pay 334 x 0.75 = RM 250.50 Last date and time for the sale of Provisional Allotments is NOT the last day for you rights submission & payment You should be looking for Acceptance date, which is on 20th December. This is the cut off date to submit your LR payment I'm not sure you can use TIIH online for your payment for LR. Can't seem to find any AirAsia rights in there. However you can use Bursa Anywhere or manually - by applying banker's cheque and sending it by courier |

|

|

Dec 10 2021, 05:24 PM Dec 10 2021, 05:24 PM

Show posts by this member only | IPv6 | Post

#68

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Dec 10 2021, 06:32 PM Dec 10 2021, 06:32 PM

Show posts by this member only | IPv6 | Post

#69

|

All Stars

15,942 posts Joined: Jun 2008 |

Just for the record...

AirAsia closed at 0.775 |

|

|

Dec 11 2021, 12:46 AM Dec 11 2021, 12:46 AM

Show posts by this member only | IPv6 | Post

#70

|

Senior Member

879 posts Joined: Oct 2008 |

Omg ask me to subscribe 166 share.. odddddd

|

|

|

Dec 11 2021, 12:50 AM Dec 11 2021, 12:50 AM

Show posts by this member only | IPv6 | Post

#71

|

Senior Member

879 posts Joined: Oct 2008 |

QUOTE(cherroy @ Dec 8 2021, 03:57 PM) The -LR is given to you free if you are existing shareholder. The -LR enable you to buy the RCUIDS at RM0.75 and a free warrant for every 2 RCUIDS subscribed. Now your option : 1. Sell the -LR to the market (currently at RM0.005/0.01), get some money. 2. Using the -LR to subscribed the RCUIDS aka pay the RM0.75 and you will have the RCUIDS and a free warrant for every 2 RCUIDS subscribed which will be listed later on. 3. Do nothing. The -LR expired and ceased trading the in the market. QUOTE(genesic @ Dec 9 2021, 06:57 PM) option 3 is absolutely no go, if go for option3 might as well sell it at option 1, for a decent meal and no needed to worries on the RCUIDS. 10/12/2021 (Friday) is the last trading day  QUOTE(kswee @ Dec 10 2021, 08:14 AM) If you currently hold the LR Go to my account > Corporate action subscription Then subscribe + payment. QUOTE(spreeeee @ Dec 10 2021, 02:38 PM) totally noob on this. Yoy guy buy or not ????? I mean subscribe corporate actioj ??just got the huge envelope today, what can i do with the pink form? not many shares with aa though.. jz for fun when bought that time.. currently stated number of rcuid allocated = 166, and warrants = 83.. amount payable 124.50 |

|

|

Dec 11 2021, 08:40 AM Dec 11 2021, 08:40 AM

|

Junior Member

822 posts Joined: Apr 2006 |

QUOTE(spreeeee @ Dec 10 2021, 03:38 PM) totally noob on this. you miss the 10 Dec as last trading day to react to it.just got the huge envelope today, what can i do with the pink form? not many shares with aa though.. jz for fun when bought that time.. currently stated number of rcuid allocated = 166, and warrants = 83.. amount payable 124.50 now you can subsribe to the RCUIDS. |

|

|

Dec 11 2021, 09:11 AM Dec 11 2021, 09:11 AM

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(spreeeee @ Dec 10 2021, 04:43 PM) i jz done TIIH online registration, but need 1 day for approval.. Yesterday 10 Dec was last trading day of the rights (LA).but: Last date and time for the sale of Provisional Allotments: Friday, 10 December 2021 at 5.00 p.m. For subscription, via Tricor etc., last day is 20th Dec. |

|

|

|

|

|

Dec 27 2021, 09:41 PM Dec 27 2021, 09:41 PM

Show posts by this member only | IPv6 | Post

#74

|

Junior Member

577 posts Joined: May 2012 |

KUALA LUMPUR (Dec 27): AirAsia Group Bhd's RM974.5 million cash call received valid acceptances for 1.11 billion or 85.13% of the total available redeemable convertible unsecured Islamic debt securities (RCUIDS) at a nominal value of 75 sen apiece.

In a bourse filing on Monday (Dec 27), AirAsia said it had received a total of 1.11 billion in valid acceptances and excess applications for its RCUIDS as at 5pm last Monday (Dec 20). The filing revealed that there were 193.2 million RCUIDS or 14.87% of the total available RCUIDS that were not subscribed by its entitled shareholders. The aviation group added that the total number of excess RCUIDS available for allocation was 281.76 million. “In view that the total number of excess RCUIDS applied for was 88,553,443, the Board has decided to allot the excess RCUIDS to all entitled shareholders and/or their renouncee(s) or transferee(s) who have applied for the excess RCUIDS in full,” the filing said. Meanwhile a total of 193.2 million unsubscribed RCUIDS will be fully subscribed by its joint underwriters, RHB Investment Bank and Kenanga Investment Bank Berhad, based on the underwriting agreement signed between AirAsia and the banks on Nov 18. AirAsia’s two largest shareholders Tan Sri Tony Fernandes and Datuk Kamarudin Meranun via their 50-50 jointly-owned special purpose vehicle Sky Accord Sdn Bhd (SASB) have also fully subscribed to 343.03 million RCUIDS, representing 26.40% of the total RCUIDS available for subscription. Successful applicants of the RCUIS will also get one warrant for every two RCUIDS that they subscribed to. The RCUIDS and warrants are expected to be listed and quoted on Bursa Malaysia’s Main Market on Friday (Dec 31), the filing showed. This closing for acceptance of the RCUIDS would net AirAsia approximately RM829.61 million based on 75 sen per RCUIDS for 1.11 billion RCUIDS, based on a back-of-the-envelope calculation. The RCUIDS issuance, coupled with other fundraising activities that was taken by the aviation group such as the RM500 million Danajamin-guaranteed loan secured in October, as well as a private placement of 470.21 million shares which raised RM336.46 million in March, would see the aviation group raise around RM1.67 billion. AirAsia had planned to raise between RM2 billion and RM2.5 billion via a combination of equity and debt to finance, among others, working capital requirements of the group. For the six months ended June 30, 2021, AirAsia managed to narrow its losses to RM1.35 billion from RM1.8 billion a year earlier, while revenue shrank to RM686.82 million from RM2.49 billion. Its cash balance meanwhile dwindled to RM235.61 million from RM996.12 million. AirAsia shares were flat at 81.5 sen on Monday, giving the aviation group a market capitalisation of RM3.16 billion. |

|

|

Dec 28 2021, 11:19 AM Dec 28 2021, 11:19 AM

Show posts by this member only | IPv6 | Post

#75

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(kswee @ Dec 27 2021, 09:41 PM) KUALA LUMPUR (Dec 27): AirAsia Group Bhd's RM974.5 million cash call received valid acceptances for 1.11 billion or 85.13% of the total available redeemable convertible unsecured Islamic debt securities (RCUIDS) at a nominal value of 75 sen apiece. The RCUIDS and warrants are expected to be listed and quoted on Bursa Malaysia’s Main Market on Friday (Dec 31), the filing showed.In a bourse filing on Monday (Dec 27), AirAsia said it had received a total of 1.11 billion in valid acceptances and excess applications for its RCUIDS as at 5pm last Monday (Dec 20). The filing revealed that there were 193.2 million RCUIDS or 14.87% of the total available RCUIDS that were not subscribed by its entitled shareholders. The aviation group added that the total number of excess RCUIDS available for allocation was 281.76 million. “In view that the total number of excess RCUIDS applied for was 88,553,443, the Board has decided to allot the excess RCUIDS to all entitled shareholders and/or their renouncee(s) or transferee(s) who have applied for the excess RCUIDS in full,” the filing said. Meanwhile a total of 193.2 million unsubscribed RCUIDS will be fully subscribed by its joint underwriters, RHB Investment Bank and Kenanga Investment Bank Berhad, based on the underwriting agreement signed between AirAsia and the banks on Nov 18. AirAsia’s two largest shareholders Tan Sri Tony Fernandes and Datuk Kamarudin Meranun via their 50-50 jointly-owned special purpose vehicle Sky Accord Sdn Bhd (SASB) have also fully subscribed to 343.03 million RCUIDS, representing 26.40% of the total RCUIDS available for subscription. Successful applicants of the RCUIS will also get one warrant for every two RCUIDS that they subscribed to. The RCUIDS and warrants are expected to be listed and quoted on Bursa Malaysia’s Main Market on Friday (Dec 31), the filing showed. This closing for acceptance of the RCUIDS would net AirAsia approximately RM829.61 million based on 75 sen per RCUIDS for 1.11 billion RCUIDS, based on a back-of-the-envelope calculation. The RCUIDS issuance, coupled with other fundraising activities that was taken by the aviation group such as the RM500 million Danajamin-guaranteed loan secured in October, as well as a private placement of 470.21 million shares which raised RM336.46 million in March, would see the aviation group raise around RM1.67 billion. AirAsia had planned to raise between RM2 billion and RM2.5 billion via a combination of equity and debt to finance, among others, working capital requirements of the group. For the six months ended June 30, 2021, AirAsia managed to narrow its losses to RM1.35 billion from RM1.8 billion a year earlier, while revenue shrank to RM686.82 million from RM2.49 billion. Its cash balance meanwhile dwindled to RM235.61 million from RM996.12 million. AirAsia shares were flat at 81.5 sen on Monday, giving the aviation group a market capitalisation of RM3.16 billion. |

|

|

Dec 31 2021, 11:18 AM Dec 31 2021, 11:18 AM

Show posts by this member only | IPv6 | Post

#76

|

Senior Member

5,274 posts Joined: Jun 2008 |

Received my rcuids today. How do I convert them? Through my broker? Email?

|

|

|

Dec 31 2021, 04:38 PM Dec 31 2021, 04:38 PM

Show posts by this member only | IPv6 | Post

#77

|

Senior Member

4,503 posts Joined: Mar 2014 |

|

|

|

Dec 31 2021, 04:39 PM Dec 31 2021, 04:39 PM

Show posts by this member only | IPv6 | Post

#78

|

Senior Member

5,274 posts Joined: Jun 2008 |

|

|

|

Jan 1 2022, 12:04 PM Jan 1 2022, 12:04 PM

Show posts by this member only | IPv6 | Post

#79

|

Junior Member

626 posts Joined: Jul 2020 From: Land of Honah Lee |

|

|

|

Jan 1 2022, 01:04 PM Jan 1 2022, 01:04 PM

Show posts by this member only | IPv6 | Post

#80

|

Senior Member

5,274 posts Joined: Jun 2008 |

|

| Change to: |  0.0229sec 0.0229sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 10:59 AM |