QUOTE(Boon3 @ Jan 4 2022, 01:30 PM)

Exactly!

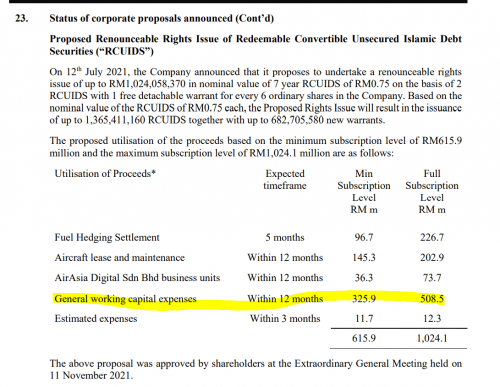

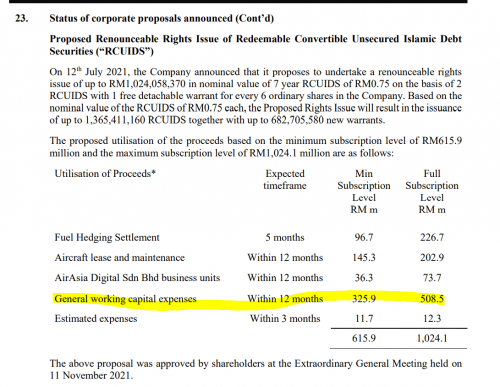

Fundamentals at this point is most crucial because the loan rights c/w warrants happened because it's a billion dollar fundraiser attempt to rescue AA.

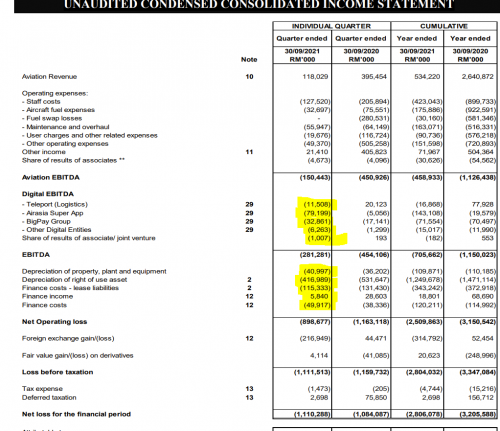

The last reporter QR...

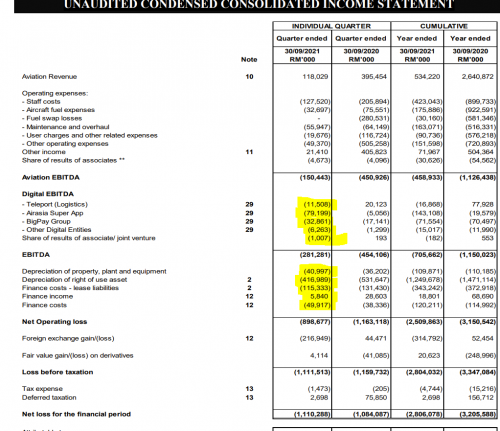

yaa..... we can see clearly the superapp/digital/big pay are all losing money.... and yea... part of the money raised from the loans stock issue will be dumped into the digital business...

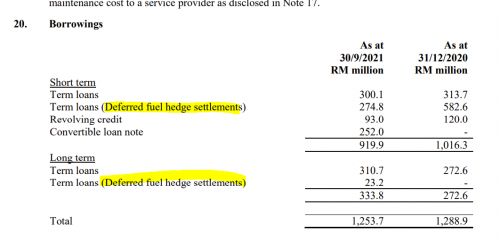

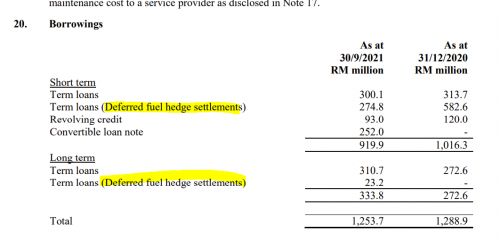

The debts AA is carrying...

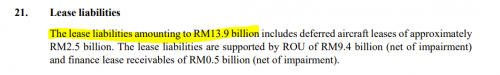

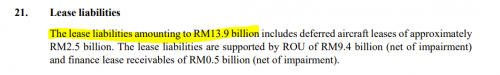

The lease burden ... 13.9 billion!!

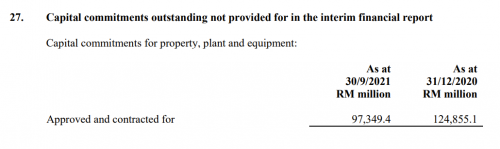

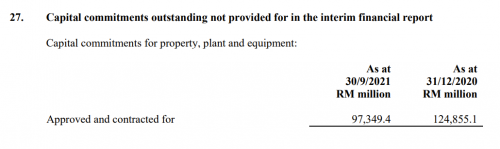

The new planes on back order.... 97 billion!!

( all of which I would argue that is all AA own gross mismanagement!! )

and this is where the money of the 1 billion loan stock issue will go to... (500 million goes for working expenses

)

)

how? Can AA survive based on these numbers??

Yes, Ah Boon. from the technical data and current prospect, this stock can keep in cold storage, no eye see.Fundamentals at this point is most crucial because the loan rights c/w warrants happened because it's a billion dollar fundraiser attempt to rescue AA.

The last reporter QR...

yaa..... we can see clearly the superapp/digital/big pay are all losing money.... and yea... part of the money raised from the loans stock issue will be dumped into the digital business...

The debts AA is carrying...

The lease burden ... 13.9 billion!!

The new planes on back order.... 97 billion!!

( all of which I would argue that is all AA own gross mismanagement!! )

and this is where the money of the 1 billion loan stock issue will go to... (500 million goes for working expenses

how? Can AA survive based on these numbers??

Previous post, got member support AirAsia merely because keep faith in Mr Tony (some said he is sifu in pursuing people/ manipulate the biz).

So my point is for this counter, we can only depend on how Tony and the team see the risk/ problem and turn into opportunity.

Plz keep posting latest news about Tony and the team action plan and strategy. May be he still got Cable besar with current PM.

Jan 4 2022, 04:16 PM

Jan 4 2022, 04:16 PM

Quote

Quote

0.0182sec

0.0182sec

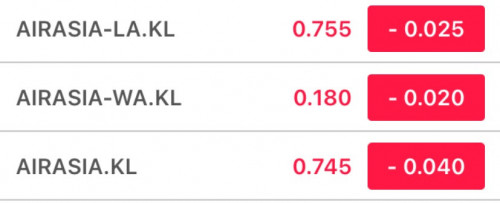

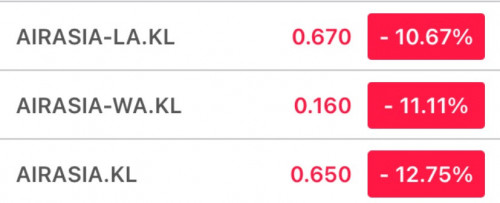

0.70

0.70

6 queries

6 queries

GZIP Disabled

GZIP Disabled