slightly off .... as it relates more to AAX but.... it's a good read.

https://www.msn.com/en-my/money/topstories/...=BingNewsSearchas one can see... the main issue was AirBus/Rolls-Royce and the lessors... that's the bulk of AAX debts....

okay Covid was one thing but it doesn't help when....

AirAsia went on a insane buying spree ( and yeah ... got that bribery scandal worth US$500 million ) ....

look, they placed an order for way too many planes... at the peak, the planes orders totaled more than 100 Billion ringgit.... yeah.. who will bare that responsibility, eh?

now AAX cannot pay...

the lessor issue...

yup... they went on an asset-light strategy ... ie... the sale of their airplanes and then they leaseback those planes...

Such strategies always debatable...

but what they did with the money is insane...

they gave the bulk away as special dividends to its shareholders...

leaving them with just bare minimum cash....

and when a Covid came....

die lor...

minimum cash at hand ....

lots of debts ....

lease obligations...

and no sale....

ahem..... surely someone needs to be responsible, yes?

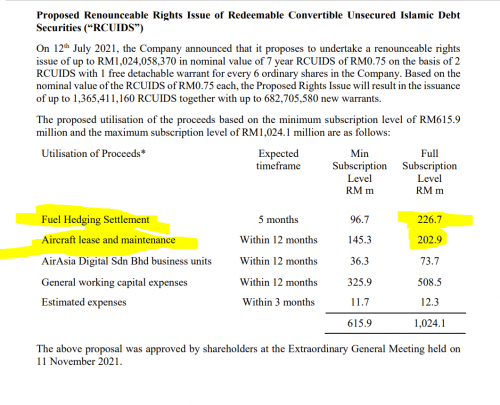

and then you see the proposed usage of the rights money....

where does it go?

the bulk of it goes to... settling the fuel hedges and the paying back leases....

both again .... AA own mismanagement...

THE hedging..... at the peak... b4 Covid... the hedging were insane.

Yes... in a normal business school, they will teach that hedging is good for business...

YES indeed...

but like in most cases, abuses happen...

companies will get greedy... and attempts to over hedge ... in an attempt to WIN money from their hedges...

AA lost millions before with their hedges b4 and now it has happened again....

and this is the problem with the company ..... mismanagement.

Covid? Only exposed them.

Dec 1 2021, 11:13 AM, updated 5y ago

Dec 1 2021, 11:13 AM, updated 5y ago

Quote

Quote

0.0220sec

0.0220sec

1.09

1.09

6 queries

6 queries

GZIP Disabled

GZIP Disabled