https://www.theedgemarkets.com/article/fern...ng-company-asia

Now everybody can makan n get a taxi ride..

Airasia Loan Rights

Airasia Loan Rights

|

|

Jan 16 2022, 09:52 PM Jan 16 2022, 09:52 PM

|

Senior Member

4,503 posts Joined: Mar 2014 |

https://www.theedgemarkets.com/article/fern...ng-company-asia

Now everybody can makan n get a taxi ride.. |

|

|

|

|

|

Jan 16 2022, 10:39 PM Jan 16 2022, 10:39 PM

Show posts by this member only | IPv6 | Post

#142

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Jan 16 2022, 09:52 PM) https://www.theedgemarkets.com/article/fern...ng-company-asia Soon some 1 will call them shoplot airline.... Now everybody can makan n get a taxi ride.. Not counting lease liabilities.. the company still carry more than 1 billion in loans according to its last reported quarterlies... |

|

|

Feb 16 2022, 11:14 AM Feb 16 2022, 11:14 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

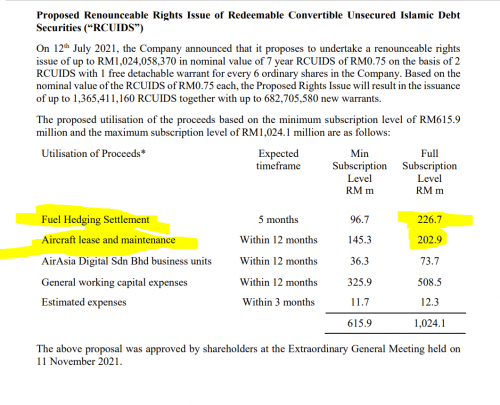

https://www.theedgemarkets.com/article/aira...engineering-arm

planning to raise? money come from ..... ? interesting eh? https://www.theedgemarkets.com/article/capi...o-facility-klia well.... we know that the money from the rights issue...  so we see a portion going to their money losing app business... and then we have .... the change of company name.... and now this engineering arm plans? well.... if one is a still holding shares, is there a reason to be worried? Is the company dieworsifying from its core business? by straying away from its core business at this moment of time, what is the company suggesting about its low cost airlines business? This post has been edited by Boon3: Feb 16 2022, 11:17 AM |

|

|

Feb 16 2022, 01:50 PM Feb 16 2022, 01:50 PM

Show posts by this member only | IPv6 | Post

#144

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(Cubalagi @ Jan 16 2022, 09:52 PM) https://www.theedgemarkets.com/article/fern...ng-company-asia e hailing business is the not the same as airline businessNow everybody can makan n get a taxi ride.. lower down fare not necessarily will lead to bigger mkt shares. Grab is not weak competitor like MAS. many small e hailing operator also done that but unsuccessful compete with grab because if fare too low the drivers just don’t want to accept the jobs….which also means customer difficult to get driver and longer waiting time….then they fed up and go back to use grabcar again although fare is higher…. This post has been edited by bcombat: Feb 16 2022, 01:50 PM |

|

|

Feb 28 2022, 08:18 PM Feb 28 2022, 08:18 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

How la to come out of PN 17 macam ini...

see how much cash it burned for the quarter? can tahan how long more? lease liabilities increased to 14 billion.... |

|

|

Feb 28 2022, 09:56 PM Feb 28 2022, 09:56 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Feb 28 2022, 08:18 PM) How la to come out of PN 17 macam ini... see how much cash it burned for the quarter? can tahan how long more? lease liabilities increased to 14 billion.... https://www.theedgemarkets.com/article/capi...h-flow-pandemic |

|

|

|

|

|

Feb 28 2022, 10:49 PM Feb 28 2022, 10:49 PM

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(Boon3 @ Feb 28 2022, 09:56 PM) The edge article reads like positive... |

|

|

Feb 28 2022, 11:32 PM Feb 28 2022, 11:32 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Mar 1 2022, 06:20 AM Mar 1 2022, 06:20 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Feb 28 2022, 10:49 PM) An article few days ago... https://www.freemalaysiatoday.com/category/...-recovery-plan/ |

|

|

Mar 1 2022, 06:32 AM Mar 1 2022, 06:32 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Mar 1 2022, 11:03 AM Mar 1 2022, 11:03 AM

Show posts by this member only | IPv6 | Post

#151

|

All Stars

15,942 posts Joined: Jun 2008 |

Yeah... in short, they started the period with 530 million.. raised about 2 billion.... ended the qtr with only 1.2 billion...

How to last? |

|

|

Mar 2 2022, 09:25 AM Mar 2 2022, 09:25 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

https://www.msn.com/en-my/money/topstories/...T?ocid=msedgntp

According to Shukor, one thing that investors are probably a bit concerned about is that SIA is one of the very few carriers in the world without a hinterland or domestic market. The airline has also been one of the hardest hit in terms of passenger traffic alongside its Hong Kong-based rival Cathay Pacific Airways Ltd. “Its cash burn rate was still in excess of S$100 million in 1HFY2022. On top of that they run all these large wide-body aircraft. Then again, they have to continue with that and persevere. I think they understand where they are coming from (and) where oil prices are likely going to be in the near future, and that is going to have a huge impact on them,” he says. He was a panellist at the recent OAG webinar. SIA has raised S$21.6 billion in fresh funds since April 1, 2020, including S$8.8 billion from a rights issue. In January, it was reportedly aiming to raise up to S$1 billion in a US dollar bond deal. “Is that (S$1 billion) going to be sufficient? Not at all. They have burnt well over S$10 billion in the last 18 months. They are still very well capitalised, well funded, but the need for cash is so huge that I think they will have to go to the market again later this year to sustain their business given the fact that interest rates and oil prices are rising and that Singapore is a hugely expensive place to do business today compared with pre-Covid-19 times. Also, they haven’t really got rid of a lot of staff so they are still very much at the previous employment level,” he adds. ................... wow...... SIA continue.............. On Capital A Bhd (formerly AirAsia Group Bhd), which recently slipped into Practice Note 17 status, Shukor is of the view that the airline’s pivot from just an airline to an investment holding company suggests that it is seeing increasingly less potential post-Covid-19 for the group to extract the sort of revenue and profits that it had done so previously. “Tony (Capital A CEO Tan Sri Tony Fernandes) didn’t come from an airline background, so he is seeing things differently. The group now has Teleport, ride hailing, food delivery, drones, etc. I am not sure that the money that they have can sustain (those ventures), but if anyone can defy the odds, Tony can. He is very sure about what he is getting into.” However, Shukor is less optimistic about AirAsia X Bhd’s (AAX) prospects. “I think there is very little that can be done with a low-cost long-haul carrier. It is very difficult post-Covid-19 to sustain that business but we understand that Airbus has a lot of exposure — with AAX being the largest airline that has ordered the A330neo — and a lot of leasing companies are also exposed to AAX. I see the reason why it has been kept going even though there is no practical or real reason for it to continue,” he says. |

|

|

Jun 29 2022, 11:58 AM Jun 29 2022, 11:58 AM

|

Junior Member

166 posts Joined: Aug 2006 |

Hey guys

Should you convert to mother share by end of 3rd year ? |

| Change to: |  0.0209sec 0.0209sec

0.65 0.65

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 09:15 AM |