QUOTE(Avangelice @ Jan 1 2022, 01:04 PM)

My entry point is already very high. Like 3 myr and I just left it like that. Converting them would help to average it down alot

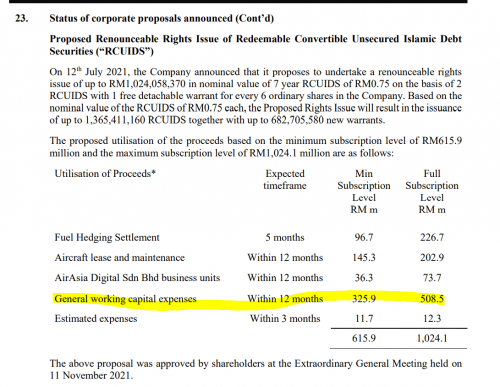

i see. But if you have been holding thus far, wouldn't it be better if you wait until Airasia share goes above 1.50, then convert? Or just buy Airasia stock to average down now? Coz the loan stock costs 0.75, conversion costs another RM0.75, but Airasia share is only 0.79 now.

Jan 1 2022, 09:28 PM

Jan 1 2022, 09:28 PM

Quote

Quote

0.0209sec

0.0209sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled