Airasia Loan Rights

Airasia Loan Rights

|

|

Dec 7 2021, 12:45 PM Dec 7 2021, 12:45 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Dec 7 2021, 11:08 PM Dec 7 2021, 11:08 PM

|

Senior Member

879 posts Joined: Oct 2008 |

Can I do nothing ?? I don't even know what to click on rakuten

|

|

|

Dec 8 2021, 09:10 AM Dec 8 2021, 09:10 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

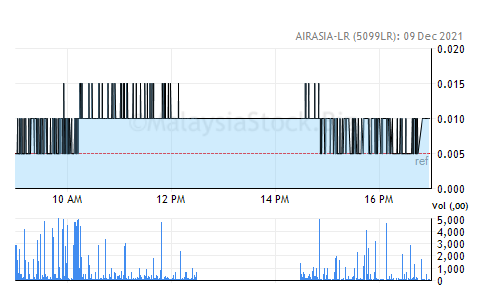

QUOTE(rotloi @ Dec 7 2021, 11:08 PM) If you do nothing, the AirAsia-LR will be worth nothing. Right now the stock is doing 0.05/01 sen... Selling at 1 sen... will be difficult, given the size of the sell Q ... which means... if wanna sell... have to sell at half sen... well at least you get back something.... |

|

|

Dec 8 2021, 09:14 AM Dec 8 2021, 09:14 AM

|

Junior Member

496 posts Joined: Sep 2008 |

QUOTE(Boon3 @ Dec 8 2021, 09:10 AM) If you do nothing, the AirAsia-LR will be worth nothing. hi , Right now the stock is doing 0.05/01 sen... Selling at 1 sen... will be difficult, given the size of the sell Q ... which means... if wanna sell... have to sell at half sen... well at least you get back something.... when is the last date to sell ? thanks |

|

|

Dec 8 2021, 09:16 AM Dec 8 2021, 09:16 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Avangelice @ Dec 7 2021, 10:57 AM) LR you are supposed to sell if you don't want to keep it. Mind you the trading window is very short. better sell it for starbucks la if you dun intend to pour in more money.You don't want to trade, you can sub rcuids. The worst you can do is don't do anything at all otherwise it is worthless.... |

|

|

Dec 8 2021, 09:21 AM Dec 8 2021, 09:21 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(yibaandre @ Dec 7 2021, 12:04 PM) at the tricor website , they have "No. of Rights Securities to Subscribe" and No. of Excess Securities to Apply" no. of rights securities to subscribe refers to the number that you wish to subscribe up to the full "entitlement" given to you.which box do I key in the unit to subscribe ? thanks no. of excess securities to apply refers to the number that you wish to subscribe over and above the "entitlement" given to you, means extra. |

|

|

|

|

|

Dec 8 2021, 10:46 AM Dec 8 2021, 10:46 AM

|

Junior Member

213 posts Joined: Feb 2008 |

QUOTE(Boon3 @ Dec 3 2021, 09:23 AM) slightly off .... as it relates more to AAX but.... it's a good read. I help u summarise, AA last time confident, so start to buy a lot of planes, then rent the planes to its own compannies within the Group. But core earnings from its flying business was still low. Resulting in AA showing high growth n earnings when the core business is not growing tat fast.https://www.msn.com/en-my/money/topstories/...=BingNewsSearch as one can see... the main issue was AirBus/Rolls-Royce and the lessors... that's the bulk of AAX debts.... okay Covid was one thing but it doesn't help when.... AirAsia went on a insane buying spree ( and yeah ... got that bribery scandal worth US$500 million ) .... look, they placed an order for way too many planes... at the peak, the planes orders totaled more than 100 Billion ringgit.... yeah.. who will bare that responsibility, eh? now AAX cannot pay... the lessor issue... yup... they went on an asset-light strategy ... ie... the sale of their airplanes and then they leaseback those planes... Such strategies always debatable... but what they did with the money is insane... they gave the bulk away as special dividends to its shareholders... leaving them with just bare minimum cash.... and when a Covid came.... die lor... minimum cash at hand .... lots of debts .... lease obligations... and no sale.... ahem..... surely someone needs to be responsible, yes? and then you see the proposed usage of the rights money.... where does it go? the bulk of it goes to... settling the fuel hedges and the paying back leases.... both again .... AA own mismanagement... THE hedging..... at the peak... b4 Covid... the hedging were insane. Yes... in a normal business school, they will teach that hedging is good for business... YES indeed... but like in most cases, abuses happen... companies will get greedy... and attempts to over hedge ... in an attempt to WIN money from their hedges... AA lost millions before with their hedges b4 and now it has happened again.... and this is the problem with the company ..... mismanagement. Covid? Only exposed them. During tat time, everyone happpy, bankers get to do IPO, the AA group show nice profits, shareholderrs happy cos AA share price went up. Not forgetting that it was due to accounting treatment rather than true business growth that make everyone happy, now the down time takes all the 'happy happy' time away edi.. |

|

|

Dec 8 2021, 11:30 AM Dec 8 2021, 11:30 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(tangtang22 @ Dec 8 2021, 10:46 AM) I help u summarise, AA last time confident, so start to buy a lot of planes, then rent the planes to its own compannies within the Group. But core earnings from its flying business was still low. Resulting in AA showing high growth n earnings when the core business is not growing tat fast. Sorry I would not use the word 'confident'. I would consider it as reckless.During tat time, everyone happpy, bankers get to do IPO, the AA group show nice profits, shareholderrs happy cos AA share price went up. Not forgetting that it was due to accounting treatment rather than true business growth that make everyone happy, now the down time takes all the 'happy happy' time away edi.. But if wanna a summary... post post #997 otherwise you can read the detailed summary inside... » Click to show Spoiler - click again to hide... « |

|

|

Dec 8 2021, 11:39 AM Dec 8 2021, 11:39 AM

Show posts by this member only | IPv6 | Post

#49

|

Senior Member

4,503 posts Joined: Mar 2014 |

|

|

|

Dec 8 2021, 12:27 PM Dec 8 2021, 12:27 PM

|

Senior Member

879 posts Joined: Oct 2008 |

I did not even subscribe anything then it become loan right ???

|

|

|

Dec 8 2021, 01:19 PM Dec 8 2021, 01:19 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(rotloi @ Dec 8 2021, 12:27 PM) Firstly... AA is in a really, really bad condition with liabilities more than its assets.So it needs a bailout/rescue package... The loan stock offering is one such rescue package. (AA did a share placement earlier) The loan stock offering. AA is asking folks to buy this loan stock. In return, it's giving a 8% payment on the loan stock + its giving a free warrant as a sweetener. To be entitled to this offering shareholders are given rights to subscribe to the loan stock. IT IS FREE, so if you own AA shares, you are given free RIGHTS. Now this RIGHTS is tradeable. It is an option for the shareholder. If they believe in the company, all they need to do is to subscribe to those loan stocks. Now if don't believe in this rescue package, they have the option to sell the RIGHTS (the rights now is trading at a miserable 0.05/0.1 sen) before the rights cease trading. Once the rights cease trading, the rights shares becomes NOTHING. (yup, 0.05 sen is still better than 0!!!) get a better picture now? This post has been edited by Boon3: Dec 8 2021, 01:20 PM |

|

|

Dec 8 2021, 02:02 PM Dec 8 2021, 02:02 PM

Show posts by this member only | IPv6 | Post

#52

|

Junior Member

649 posts Joined: Jan 2011 |

Nowadays I would even hesitate to order anything from AA Food. You pay first , get your food later. Those same steps turned many customers into creditors and getting back only 0.05% of their money. Trouble is, you don't know when this will hit you next, so you are always playing a poker game with your transactions with AA.

|

|

|

Dec 8 2021, 03:57 PM Dec 8 2021, 03:57 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(rotloi @ Dec 8 2021, 12:27 PM) The -LR is given to you free if you are existing shareholder.The -LR enable you to buy the RCUIDS at RM0.75 and a free warrant for every 2 RCUIDS subscribed. Now your option : 1. Sell the -LR to the market (currently at RM0.005/0.01), get some money. 2. Using the -LR to subscribed the RCUIDS aka pay the RM0.75 and you will have the RCUIDS and a free warrant for every 2 RCUIDS subscribed which will be listed later on. 3. Do nothing. The -LR expired and ceased trading the in the market. |

|

|

|

|

|

Dec 9 2021, 04:08 PM Dec 9 2021, 04:08 PM

Show posts by this member only | IPv6 | Post

#54

|

Junior Member

577 posts Joined: May 2012 |

Left 32 million LR on the market. Tomorrow last day trading.

|

|

|

Dec 9 2021, 06:57 PM Dec 9 2021, 06:57 PM

|

Junior Member

822 posts Joined: Apr 2006 |

QUOTE(cherroy @ Dec 8 2021, 04:57 PM) The -LR is given to you free if you are existing shareholder. option 3 is absolutely no go, if go for option3 might as well sell it at option 1, for a decent meal and no needed to worries on the RCUIDS.The -LR enable you to buy the RCUIDS at RM0.75 and a free warrant for every 2 RCUIDS subscribed. Now your option : 1. Sell the -LR to the market (currently at RM0.005/0.01), get some money. 2. Using the -LR to subscribed the RCUIDS aka pay the RM0.75 and you will have the RCUIDS and a free warrant for every 2 RCUIDS subscribed which will be listed later on. 3. Do nothing. The -LR expired and ceased trading the in the market. 10/12/2021 (Friday) is the last trading day  |

|

|

Dec 10 2021, 06:00 AM Dec 10 2021, 06:00 AM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

Dec 10 2021, 08:14 AM Dec 10 2021, 08:14 AM

Show posts by this member only | IPv6 | Post

#57

|

Junior Member

577 posts Joined: May 2012 |

QUOTE(MasBoleh! @ Dec 10 2021, 07:00 AM) If I wanna subscribe instead of selling off the LR, how do I do it in Rakuten? Go to Buy, insert AirAsia LR and buy the amount based on the LR amount I have? If you currently hold the LR Go to my account > Corporate action subscription Then subscribe + payment. |

|

|

Dec 10 2021, 01:53 PM Dec 10 2021, 01:53 PM

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

Dec 10 2021, 01:54 PM Dec 10 2021, 01:54 PM

Show posts by this member only | IPv6 | Post

#59

|

Junior Member

577 posts Joined: May 2012 |

|

|

|

Dec 10 2021, 02:38 PM Dec 10 2021, 02:38 PM

|

Senior Member

3,812 posts Joined: Apr 2009 From: West Malaysia |

totally noob on this.

just got the huge envelope today, what can i do with the pink form? not many shares with aa though.. jz for fun when bought that time.. currently stated number of rcuid allocated = 166, and warrants = 83.. amount payable 124.50 |

| Change to: |  0.0308sec 0.0308sec

0.90 0.90

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 09:14 AM |