QUOTE(Boon3 @ Jan 15 2022, 09:53 AM)

And yes... whenever you read anything (be it social media, your closest friend/relative, your bosses or even news media, it pays to verify what you have read )

I made the point that AA was built on debts...

Well one can verify that statement by checking either the QR or the annual reports. Let's do it via the QR...

Not the best but for simplicity sake, I just use each year 4th QR.... and my focus is on cash, total borrowings, capital commitment for new planes

2008

https://www.malaysiastock.biz/GetReport.asp...-Dec%202008.pdfCash 593 million

Total loans 6.69 Billion

Capital commitment 24.86 billion

==>> Right from the start... net debt in loans is about 6 billion. Owe ppl 6 billion but wants to buy 24 billion worth of new planes...

2009

https://www.malaysiastock.biz/GetReport.asp...02009_FINAL.pdfCash 747 million

Total loans 7.593 Billion

Capital commitment 24.6 billion

==> debts increased

okay? ..... fast forward.... lazy sikit

2015

https://www.malaysiastock.biz/GetReport.asp...%2026%20Feb.pdfCash 1.3 Billion

Total loans 12.7 Billion

Capital commitment 66.296 billion

===> see how the company gets deeper in debts?

fast forward... 2017...

https://www.malaysiastock.biz/GetReport.asp...Feb18_Final.pdfCash 1.8 Billion

Total loans 9.3 Billion

Capital commitment 89.8 billion

===> company had started selling and leasing back its planes...

fast forward lastest QR

https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdfCash 400.7 million

Total loans 1.2 Billion

Capital commitment 97.3 billion

Lease liabilities 13.9 Billionand there you have.... since 2008.... what really has AA achieved?

when you line up the data, preferably in ur own worksheet, it's much easier to see what's happening.... and all this is the company own doing.

and yes, on hedging... run thru the QRs the same way... you can see how AA took on way too much hedging risk (yes, business hedging is always good but whatever's good can turn bad if one over do it) and you can also see, throughout its history, go see how much hedging losses has AA suffered .....

QUOTE(icemanfx @ Jan 15 2022, 10:19 AM)

Due to capital intensive and highly depreciated assets, it is normal for airlines to build on debts even well run airlines like sq. how debts is managed is another debts.

I thought of this as well.

QUOTE(Boon3 @ Jan 15 2022, 12:51 PM)

You are welcome.

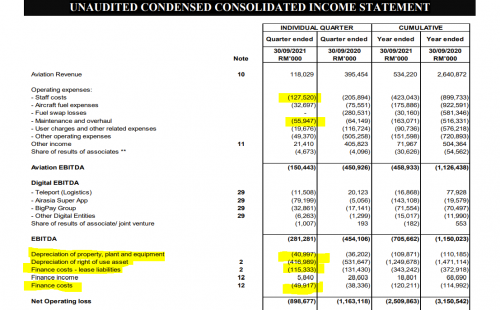

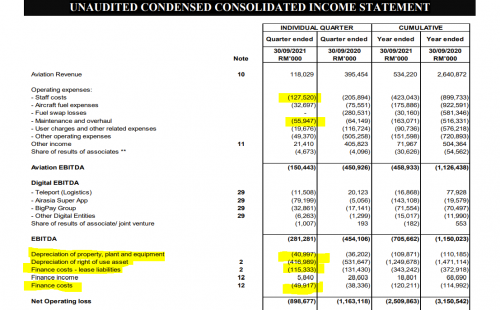

The condensed income statement is useful too!

https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdf

As you can see, the big ticket items ...

1. Depreciation of right of use asset = 416m per quarter

2. Lease liabilities = 115m per quarter

3. Finance costs = 50m per quarter

and yeah... staff cost ~ 120 million per quarter...

Yea... if I do a simple rough count, that's close to 700m per quarter.

and the Aviation revenue was only 118m.... even if Aviation revenue increases 3 fold, revenue will only be around 450 million...

As you can see, it's a long way off now for AA to even register a profit.... and TIME is never a friend of a lousy business....

the leased airplanes will depreciate more as time passes.....

the shelf live tioo.......

yup...... AA will have to take in new planes in the future too, but how? Which sky will the money drop from? Borrow again?

QUOTE(Boon3 @ Jan 15 2022, 01:11 PM)

Here's an old posting of mine in 2016....

==================================================

http://www.theedgemarkets.com/my/article/a...imb-ib-researchIn his note to investors today, Yap said investors have generally been cautious on the potential orders, fearing that AirAsia is once again over-expanding.

"Investors did not like the additional 100 orders which come at a list price of US$125.7 million each, as they come on top of the undelivered 304 A320neo orders," he said.

:x

304 belum deliver...

Order 100 lagi.....

LOL

How to write the word DIE ah?

source: posting #83==================================================

See how AA backorder of new airplanes got so big?

AA went into a buying orgy during those years (and of course later we also found out about the Airbus bribery scandal) .....

Backorder of 304 airplanes undelivered... and AA went to order another 100 new ones.... !!!!!

This is hole that AA dug itself. Covid only exposed it!

I thought is normal for Airlines to be built with debt, but from the figures, seems like AA has been overly expanded. TF may have made wrong judgements and overly confident

Jan 15 2022, 06:10 AM

Jan 15 2022, 06:10 AM

Quote

Quote

0.0301sec

0.0301sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled