What happened to air Asia creditors will likely happen to shareholders. No prize given who will be the winner at the end.

Airasia Loan Rights

Airasia Loan Rights

|

|

Jan 14 2022, 12:19 PM Jan 14 2022, 12:19 PM

Return to original view | IPv6 | Post

#1

|

All Stars

21,458 posts Joined: Jul 2012 |

What happened to air Asia creditors will likely happen to shareholders. No prize given who will be the winner at the end.

|

|

|

|

|

|

Jan 15 2022, 03:49 AM Jan 15 2022, 03:49 AM

Return to original view | IPv6 | Post

#2

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Boon3 @ Jan 14 2022, 06:49 PM) Even now.... what's the future hurdles? sell and lease back the fleet was to 1. The lease liabilities, which runs over 10 billion currently. 2. The insane commitment to buy 100 billion worth of airplanes. 3. The depreciation of leased assets. Yup. It's leased planes has a age factor. 4. Can the shareholder trust the boss not to simply bet on its hedges? Last but not least covid wasn't the reason why the company is in such a hold. COVID only exposed its failings. 100 billions order is typical of flamboyant leader to project a very rosy prospect. it is normal for airlines to hedge on fuel and forex rate. however, after some initial wins, greed overrode prudency. guess this is a classic case of 'only after the tide turned would reveal who was swimming naked'. air asia business is sustainable and financially feasible post covid; believe tf could muster enough backing to revive the operation. whether oren kato politicians allow non to be successful remain uncertain and another matter. believe some wanted malaysia airlines to return to former glory with monopoly. |

|

|

Jan 15 2022, 10:19 AM Jan 15 2022, 10:19 AM

Return to original view | IPv6 | Post

#3

|

All Stars

21,458 posts Joined: Jul 2012 |

Due to capital intensive and highly depreciated assets, it is normal for airlines to build on debts even well run airlines like sq. how debts is managed is another debts. |

|

|

Jan 15 2022, 01:48 PM Jan 15 2022, 01:48 PM

Return to original view | Post

#4

|

All Stars

21,458 posts Joined: Jul 2012 |

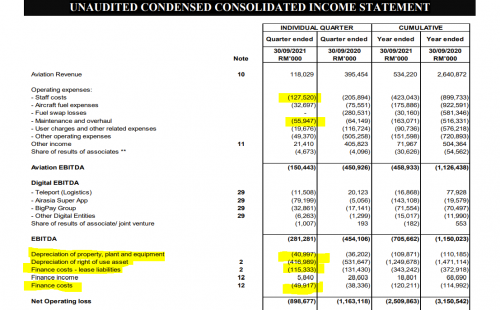

QUOTE(Boon3 @ Jan 15 2022, 12:51 PM) You are welcome. Depreciation is non cash and is before EBITDA.The condensed income statement is useful too! https://www.malaysiastock.biz/GetReport.asp...021%20Final.pdf  As you can see, the big ticket items ... 1. Depreciation of right of use asset = 416m per quarter 2. Lease liabilities = 115m per quarter 3. Finance costs = 50m per quarter and yeah... staff cost ~ 120 million per quarter... Yea... if I do a simple rough count, that's close to 700m per quarter. and the Aviation revenue was only 118m.... even if Aviation revenue increases 3 fold, revenue will only be around 450 million... As you can see, it's a long way off now for AA to even register a profit.... and TIME is never a friend of a lousy business.... the leased airplanes will depreciate more as time passes..... the shelf live tioo....... yup...... AA will have to take in new planes in the future too, but how? Which sky will the money drop from? Borrow again? |

|

|

Jan 16 2022, 09:36 AM Jan 16 2022, 09:36 AM

Return to original view | Post

#5

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Boon3 @ Jan 15 2022, 08:19 PM) And also, will the company acknowledge that... Without huge airplanes order, couldn't justify for airbus to sponsor tf F1 racing team.1. They were wrong to place the orders for so many planes? 2. They were wrong to distribute the bulk of the money they raised from their sale and leaseback? 3. They were wrong to issue a special placement of shares to the 2 big boss, just b4 they gave out the money stated in (2) I wonder...... big fish eat small fish, typical in the food chain. What fascinated me are those minions promoting recovery without considering pn17 status. This post has been edited by icemanfx: Jan 16 2022, 09:40 AM |

| Change to: |  0.0250sec 0.0250sec

0.77 0.77

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:43 AM |