QUOTE(MUM @ Sep 1 2022, 11:22 PM)

I can understand, if you eventually go fully 100% into TFXI that can gives you only 7-8% and stop that DIY that can make you 10-20%, then i can understand for by doing this you want to reduce your time looking at the chart.

sort of like wanted a better life while sacrificing the rate of growth of your asset.

But if you wanted max 40% to TFXI and while maintaining 60% for DIY,....then you will still subject yourself to looking at the charts.

example previously if 100% DIY, it needs you to look at the chart

now at 60% DIY, it still needs you to look at the chart, wor.

previously if at 100% DIY, you bet play capital is RM10k,

if now 60% DIY, you bet play capital RM6k,....

i think the time and effort required to read the charts so as to enable you to make 10~20% profits is still the same wor.

why finance your DIY profit into something that will generate you lesser income, when you can finance your DIY profits into what your are currently doing and still will be doing to make greater profits?

ALAMAK, silly me, maybe you have your own "secret" strategy, (not fully disclosing) which i did not manage to read or forsee.

Bro,

1. you have a profit, then you put it into other channel, as long as it is not your capital, you can risk it

2. your question, "if have 60% still a lot of work, might as well keep 100%, right?" and, "why finance channel with lower ROI vs higher ROI?" 60/40 is just a simple example of a distribution ratio, the actual distribution, a more percise example will be as follows

27 - day trade

3 - high risk investment (tfxi)

10 - mutual fund (yes, I still have mutual fund even if the return is 5% per YEAR)

20 - dividend stock

20 - fd

20 - epf

2.1 perhaps a better way to explain things is the ratio of diy vs high risk as 90/10 to 60/40 will be easier to understand

2.2, of course, you may re-ask, why increase the portion of the high risk?, this is call risk tolerance, e.g, at 7.2% you get 100% gain within 10 cycles, does it really matters anymore on 2nd year?

2.3. base on 2.2, a careful approach will be put a little bit of risk able $, and wait till end of year 2

2.4 from here onwards whether to add or not, it's simply a matter of decision

3. yes, your ALAMAK is very justified, real information is not disclosed over here, it is just sharing education only lar.

BTW - THIS IS ONLY A SHARING ON THE FOLLOWING PRINCIPLE BUT SPIN INTO A LENGTHY POST

1. Forex trading do generate high ROI, hence 7% in 5 weeks is possible, hence, the following

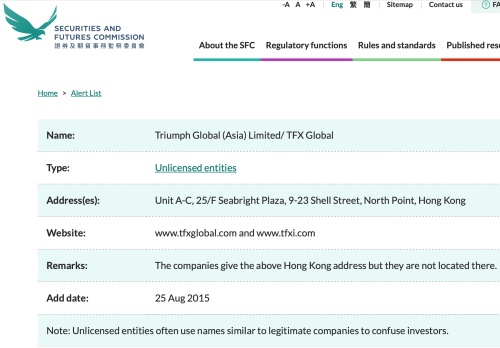

2. TFXI is a risky game (due to many reasons) - join (or increase the investment in tfxi) only if you have the risk tolerance (e.g riskable amount)

DISCLAIMER

1. FX trading is a risky and tough job - don't do it unless you have the necessary education

2. Financial planning is also a complicated process, no forum post can adequately explain it all

Sep 1 2022, 03:52 PM

Sep 1 2022, 03:52 PM

Quote

Quote

0.0421sec

0.0421sec

0.18

0.18

6 queries

6 queries

GZIP Disabled

GZIP Disabled