Outline ·

[ Standard ] ·

Linear+

Anyone know about foreign FD?

|

xander2k8

|

Oct 17 2023, 11:16 PM Oct 17 2023, 11:16 PM

|

|

QUOTE(abcn1n @ Oct 17 2023, 06:44 PM) Thanks. Sigh. Yeah, tax form asking how much money bring back to Malaysia. Really wish Malaysia would not be so restrictive. They should actually encourage people to bring back money to Malaysia. Its especially important if country is in trouble. Can’t do anything because it is institutional failure since back in the 90s 🤦♀️ and yet they still practice when the world has change a lot in the past 30 years QUOTE(soul78 @ Oct 17 2023, 10:15 PM) Why you count when rm goes to 3.00 to usd 1? why don't you see in positive as 5.00 to usd 1 in future? Why quote something so old back in 15 years ago 🤦♀️ when things were positive back then unlike the present |

|

|

|

|

|

abcn1n

|

Oct 18 2023, 12:09 AM Oct 18 2023, 12:09 AM

|

|

QUOTE(xander2k8 @ Oct 17 2023, 11:16 PM) Can’t do anything because it is institutional failure since back in the 90s 🤦♀️ and yet they still practice when the world has change a lot in the past 30 years Yeah. Find they getting more restrictive.  |

|

|

|

|

|

dwRK

|

Oct 18 2023, 07:43 AM Oct 18 2023, 07:43 AM

|

|

QUOTE(CommodoreAmiga @ Oct 17 2023, 10:08 PM) Hhmm...been thinking to open an MCA account. RHB better? Ambank also got. Just go to RHB branch to open MCA? Basically to hold USD and get some good FD. What about charges and spread? dunno... better today may not be so tomorrow... ya go branch to open must get mca debit card ya rm 20 per yr to enjoy low fx rate right columns, no other fees... https://www.rhbgroup.com/treasury-rates/mul...card/index.htmlinterest rates... https://www.rhbgroup.com/treasury-rates/mul...osit/index.htmlcan also buy paper gold n silver with this account... |

|

|

|

|

|

SUSTOS

|

Oct 19 2023, 11:25 AM Oct 19 2023, 11:25 AM

|

|

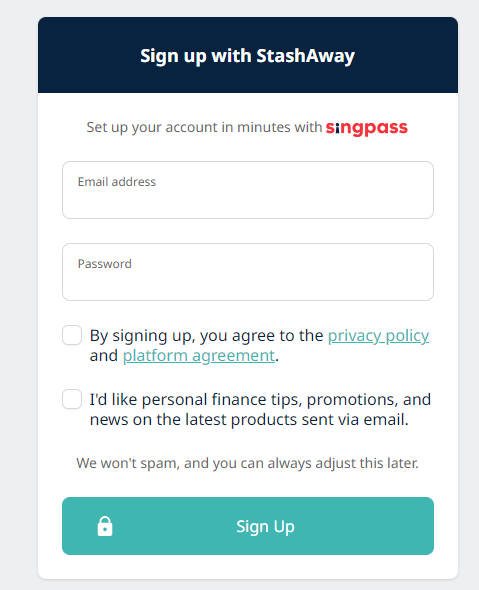

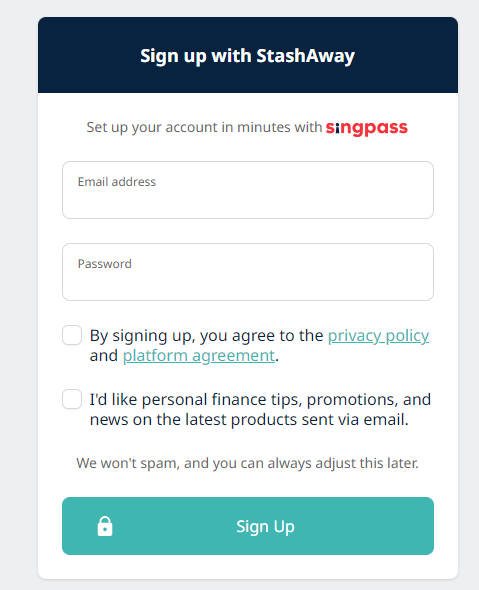

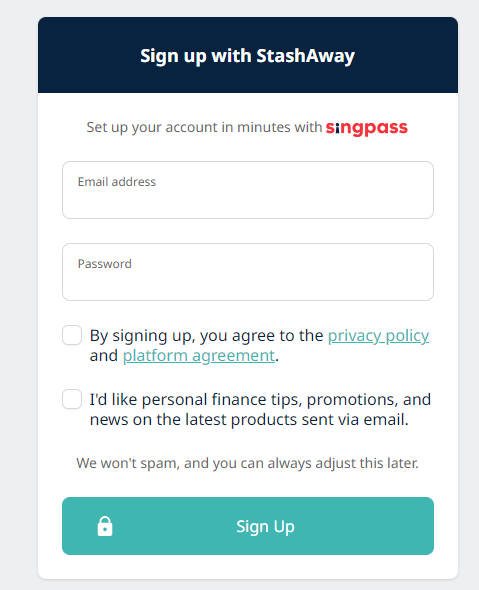

Has anyone tried this? https://www.stashaway.sg/simple-guaranteed1 month 3.8% looks tempting... Makes you wonder which MAS bank is partnering with Stashaway lol Stashaway earns a spread from the bank as well. Which means, the MAS bank is paying them around 4%, not too far from a 4-week MAS bill. This post has been edited by TOS: Oct 19 2023, 11:27 AM |

|

|

|

|

|

Medufsaid

|

Oct 19 2023, 11:56 AM Oct 19 2023, 11:56 AM

|

|

looks like need SingPass  |

|

|

|

|

|

SUSTOS

|

Oct 19 2023, 01:33 PM Oct 19 2023, 01:33 PM

|

|

QUOTE(Medufsaid @ Oct 19 2023, 11:56 AM) looks like need SingPass  lol you are right. Can see cannot touch...  |

|

|

|

|

|

abcn1n

|

Oct 23 2023, 07:51 PM Oct 23 2023, 07:51 PM

|

|

QUOTE(TOS @ Oct 19 2023, 11:25 AM) Has anyone tried this? https://www.stashaway.sg/simple-guaranteed1 month 3.8% looks tempting... Makes you wonder which MAS bank is partnering with Stashaway lol Stashaway earns a spread from the bank as well. Which means, the MAS bank is paying them around 4%, not too far from a 4-week MAS bill. Is the 3.8% net of Stashaway's fees? BTW, couldn't find the post which says can only open Stashaway Singapore with Singpass. FYI, can open without Singpass |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 08:06 PM Oct 23 2023, 08:06 PM

|

|

QUOTE(abcn1n @ Oct 23 2023, 07:51 PM) TOS Is the 3.8% net of Stashaway's fees? BTW, couldn't find the post which says can only open Stashaway Singapore with Singpass. FYI, can open without Singpass No need singpass. Can use passport. Other day I just login and next day that asked for my passport. I look just to check and see if I got any money left inside there (planning to move all loose change to moomoo). Told them want to cancel acocunt. Not net fees. Net fees around 3.5-3.6%? This post has been edited by Ramjade: Oct 23 2023, 08:07 PM |

|

|

|

|

|

abcn1n

|

Oct 23 2023, 08:11 PM Oct 23 2023, 08:11 PM

|

|

QUOTE(Ramjade @ Oct 23 2023, 08:06 PM) No need singpass. Can use passport. Other day I just login and next day that asked for my passport. I look just to check and see if I got any money left inside there (planning to move all loose change to moomoo). Told them want to cancel acocunt. Not net fees. Net fees around 3.5-3.6%? Thanks. Yeah, I suspected net fees was 3.6% but wanted confirmation. Yes, I have Stashaway Singapore. Opened it with passport. |

|

|

|

|

|

SUSTOS

|

Oct 23 2023, 08:15 PM Oct 23 2023, 08:15 PM

|

|

QUOTE(abcn1n @ Oct 23 2023, 08:11 PM) Thanks. Yeah, I suspected net fees was 3.6% but wanted confirmation. Yes, I have Stashaway Singapore. Opened it with passport. Oh no need SingPass. Great then. Finally a good place to park my SGD for short-term.  |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 08:47 PM Oct 23 2023, 08:47 PM

|

|

QUOTE(TOS @ Oct 23 2023, 08:15 PM) Oh no need SingPass. Great then. Finally a good place to park my SGD for short-term.  You got singpass just go with moomoo. Moomoo mmf is better than stashaway. |

|

|

|

|

|

SUSTOS

|

Oct 23 2023, 08:51 PM Oct 23 2023, 08:51 PM

|

|

QUOTE(Ramjade @ Oct 23 2023, 08:47 PM) You got singpass just go with moomoo. Moomoo mmf is better than stashaway. I don't use SingPass unless I am PR or Sporean.  I am looking at liquidity as well. When it matures, I think SA "guaranteed" (this marketing term is very misleading... if you know what I mean) can be withdrawn 1 day earlier than Fullerton's Cash fund. https://www.stashaway.sg/help-center/176472...mple-guaranteed |

|

|

|

|

|

abcn1n

|

Oct 23 2023, 09:54 PM Oct 23 2023, 09:54 PM

|

|

QUOTE(abcn1n @ Oct 23 2023, 08:11 PM) Thanks. Yeah, I suspected net fees was 3.6% but wanted confirmation. Yes, I have Stashaway Singapore. Opened it with passport. Just took a look again and its really 3.8% as no fees and they say the rate we see is the rate we get. So its good  https://www.stashaway.sg/simple-guaranteed https://www.stashaway.sg/simple-guaranteed |

|

|

|

|

|

Hansel

|

Oct 23 2023, 10:19 PM Oct 23 2023, 10:19 PM

|

|

There is another one : CIMB SG. Total FD of 3.5% pa, no lock-in, daily-accrual, but the comparison is vs your September month-end balance. Paid-out on every month-end and on 20th of the mth,......

|

|

|

|

|

|

Hansel

|

Oct 23 2023, 10:37 PM Oct 23 2023, 10:37 PM

|

|

QUOTE(abcn1n @ Oct 23 2023, 08:11 PM) Thanks. Yeah, I suspected net fees was 3.6% but wanted confirmation. Yes, I have Stashaway Singapore. Opened it with passport. So, we just renew every mth for one-mth tenure at every renewal. |

|

|

|

|

|

abcn1n

|

Oct 23 2023, 10:47 PM Oct 23 2023, 10:47 PM

|

|

QUOTE(Hansel @ Oct 23 2023, 10:37 PM) So, we just renew every mth for one-mth tenure at every renewal. If that's what you want. But it can go up and down depending on the environment once the lock-in period is over. Best to spread over different periods like some in 1 month, 1 year.... 1 year interest is 3.5% though fyi This post has been edited by abcn1n: Oct 23 2023, 10:48 PM |

|

|

|

|

|

SUSTOS

|

Oct 23 2023, 10:51 PM Oct 23 2023, 10:51 PM

|

|

QUOTE(Hansel @ Oct 23 2023, 10:19 PM) There is another one : CIMB SG. Total FD of 3.5% pa, no lock-in, daily-accrual, but the comparison is vs your September month-end balance. Paid-out on every month-end and on 20th of the mth,...... 3.5%...That is a fake number. I have tested for 2 months. IRR is no higher than 2.7% p.a. They delay the "bonus" interest by 20 days, effectively halving the interest rate. The bonus interest just sits for 20 days and do nothing, yet you can't get it on the end of the previous month. They lock your money for 20 days and pay you nothing. Don't be fooled by the bankers. |

|

|

|

|

|

abcn1n

|

Oct 23 2023, 10:53 PM Oct 23 2023, 10:53 PM

|

|

QUOTE(Hansel @ Oct 23 2023, 10:19 PM) There is another one : CIMB SG. Total FD of 3.5% pa, no lock-in, daily-accrual, but the comparison is vs your September month-end balance. Paid-out on every month-end and on 20th of the mth,...... QUOTE(TOS @ Oct 23 2023, 10:51 PM) 3.5%...That is a fake number. I have tested for 2 months. IRR is no higher than 2.7% p.a. They delay the "bonus" interest by 20 days, effectively halving the interest rate. The bonus interest just sits for 20 days and do nothing, yet you can't get it on the end of the previous month. They lock your money for 20 days and pay you nothing. Don't be fooled by the bankers. Wow. Thanks for the heads up |

|

|

|

|

|

Hansel

|

Oct 23 2023, 11:04 PM Oct 23 2023, 11:04 PM

|

|

QUOTE(TOS @ Oct 23 2023, 10:51 PM) 3.5%...That is a fake number. I have tested for 2 months. IRR is no higher than 2.7% p.a. They delay the "bonus" interest by 20 days, effectively halving the interest rate. The bonus interest just sits for 20 days and do nothing, yet you can't get it on the end of the previous month. They lock your money for 20 days and pay you nothing. Don't be fooled by the bankers. I think your September month-end reference amt is too high. That's why you are earning a lesser 2% amount. For myself, I have no intention to earn interest on the interest. I'll take out the interest to use, slowly load-up on shares. The advanatge here is - you can take out the funds anytime you wished. There is no lock-in at all. |

|

|

|

|

|

Medufsaid

|

Oct 23 2023, 11:05 PM Oct 23 2023, 11:05 PM

|

|

QUOTE(Ramjade @ Oct 23 2023, 08:06 PM) QUOTE(abcn1n @ Oct 23 2023, 08:11 PM) thanks for the fact checking... just opened SA sg too... |

|

|

|

|

Oct 17 2023, 11:16 PM

Oct 17 2023, 11:16 PM

Quote

Quote

0.0179sec

0.0179sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled