QUOTE(harmonics3 @ Nov 7 2022, 12:21 PM)

That will be good, in Malaysia we have KDI save @ 2.5% p.a. (until year end) with same day deposit/withdrawal (cutoff time at 11am during weekdays). Anything similar in Singapore (especially >2.5% p.a.)?

I have checked with my SG friend, you can also check on HWZ forum for common topics/threads in the Money Mind subforum there.

The reponse from my SG friend is: DBS multipler, OCBC 360, and UOB one, all high yield saving accounts which require you to fulfill conditions (but hacks are possible and loopholes are everywhere, e.g. refund of SSB is considered income (the whole SSB amount, including principal that is), so there's double count here...)

I personally found Singlife account mentioned commonly in HWZ. Singlife is a flexible saving insurance fund which allows instant withdrawal via FAST to your bank account, but the FAQ claims may take up to 3 hours to appear. Daily withdrawal limit is 20k SGD.

https://singlife.com/en/faq/singlife-accoun...and-withdrawalsBut the returns are miserable with conditions attached.

https://singlife.com/en/singlife-accountAnyway, bro, bear in mind risk free rates in SG and MY are not the same. Please refrain from comparing 2.5% p.a. of KDI Save with SG cash management solution providers. Not only are the benchmark rates different, there is an additional foreign exchange rate factor to consider as well.

QUOTE(Ramjade @ Nov 7 2022, 12:47 PM)

It's call their SSB but I think one month withdrawal wait.

Uhm... SSB is a totally different product vs KDI Save. SSBs are government-guaranteed saving bonds. The directly-comparable product in Malaysia is Sukuk Prihatin offerred 2 years ago if you still remember.

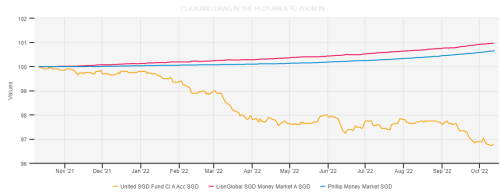

KDI Save operates like a money market mutual fund in the backend, like Versa's Affin Hwang Enhanced Deposit Fund. Its direct counterparts in SG include:

1. Stashaway SG Simple

2. Endowus SG Cash Smart

3. Syfe Cash+ (

harmonics3 Can consider this, there is quick withdrawal possible within same day and next business day:

https://help.syfe.com/hc/en-us/articles/441...-does-it-work-)

4. NTUC's MoneyOwl WiseSaver

And SG brokers offer similar products:

5. Moomoo/Futu SG SmartSave

6. Tiger Broker SG Tiger Vault

7. FSM SG Auto-Sweep Account

8. POEMS SG Smart Park

This post has been edited by TOS: Nov 8 2022, 12:13 AM

Oct 14 2022, 02:05 PM

Oct 14 2022, 02:05 PM

Quote

Quote

0.0547sec

0.0547sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled