Outline ·

[ Standard ] ·

Linear+

Anyone know about foreign FD?

|

Medufsaid

|

Aug 26 2023, 11:01 PM Aug 26 2023, 11:01 PM

|

|

mavistan89 can refer to this https://www.youtube.com/watch?v=mXjaob63K2w- create a MY CIMB acct (can be physically at branch, can be online)

- create a SG cimb account online, with your malaysian IC, after creating, apply to link from MY cimb via your NRIC

- after 3-4 days, you'll get a notification that linkage is successful, deposit S$1 from CIMB my to CIMB sg for e-KYC purpose

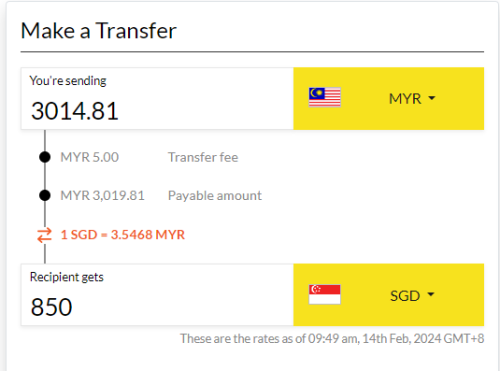

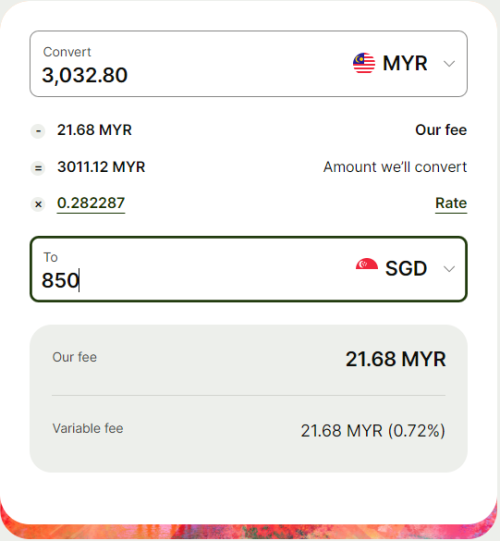

- use remittance agents like transferwise (if newly opened, you can key in referral code and get first RM2,500 transferred for free) or moneymatch (cheapest rate) to deposit S$1k

- wait 2 weeks for CIMB sg to get back to you to complete the CIMB sg acct opening process

- wait few days for them to send you confirmation code to officially open a CIMB clicks sg acct

- use cimb clicks sg to deposit SG FD

|

|

|

|

|

|

Medufsaid

|

Oct 15 2023, 03:32 PM Oct 15 2023, 03:32 PM

|

|

QUOTE(TOS @ Sep 7 2023, 01:20 PM) if one can buy BIL etf already, is there any advantages to go for RHB MCA USD 5% interest? |

|

|

|

|

|

Medufsaid

|

Oct 16 2023, 11:04 PM Oct 16 2023, 11:04 PM

|

|

basically PIDM is still useful if it's only RHB that failed. if Ringgit ship tenggelam then haha

|

|

|

|

|

|

Medufsaid

|

Oct 19 2023, 11:56 AM Oct 19 2023, 11:56 AM

|

|

looks like need SingPass  |

|

|

|

|

|

Medufsaid

|

Oct 23 2023, 11:05 PM Oct 23 2023, 11:05 PM

|

|

QUOTE(Ramjade @ Oct 23 2023, 08:06 PM) QUOTE(abcn1n @ Oct 23 2023, 08:11 PM) thanks for the fact checking... just opened SA sg too... |

|

|

|

|

|

Medufsaid

|

Oct 25 2023, 02:05 PM Oct 25 2023, 02:05 PM

|

|

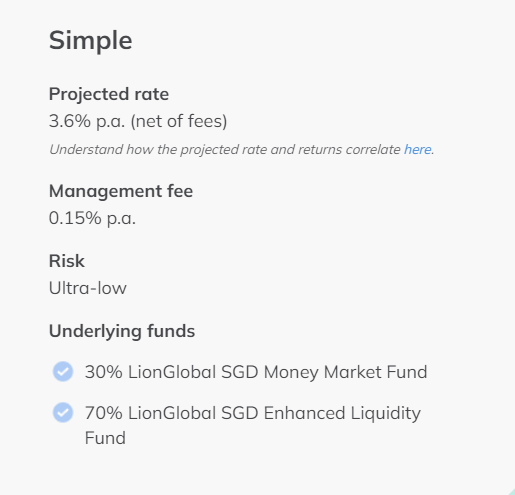

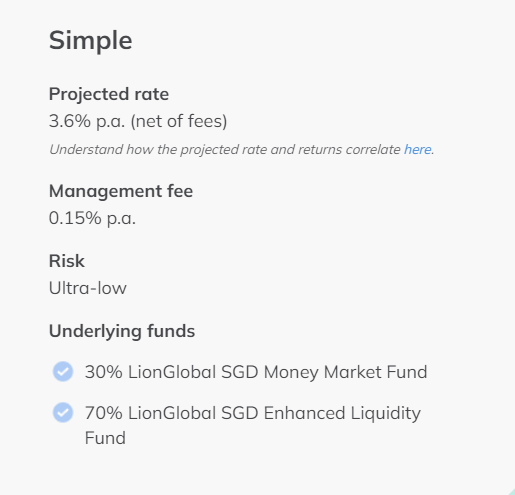

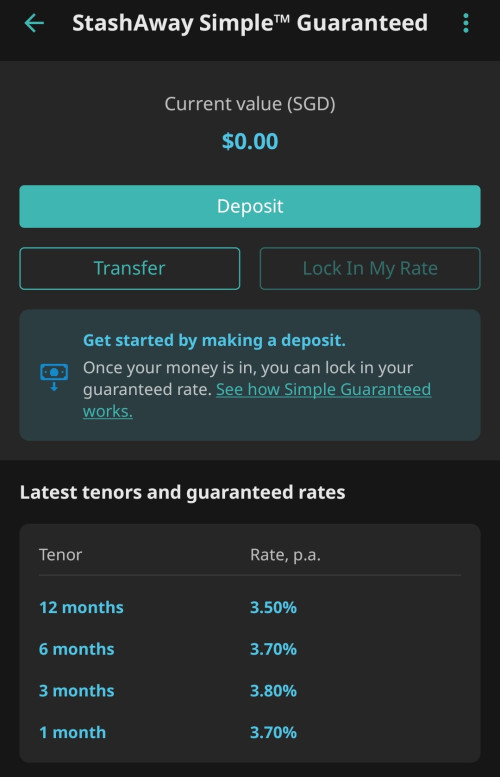

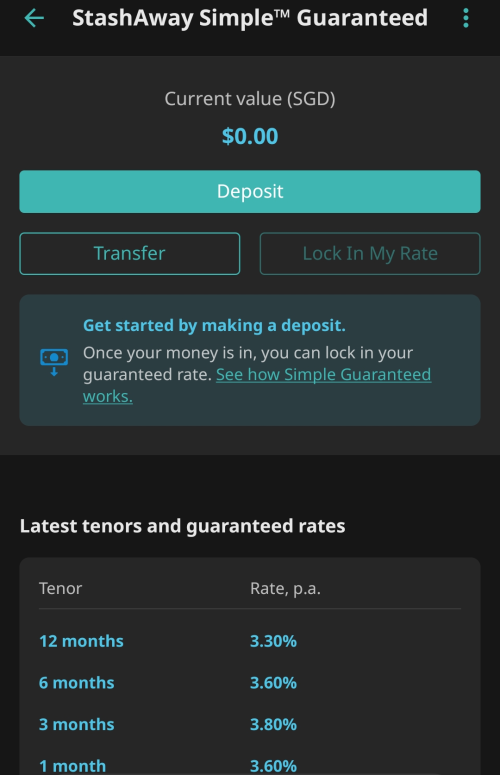

why not go for Stashaway SG Simple? no lock in periods  |

|

|

|

|

|

Medufsaid

|

Oct 25 2023, 08:28 PM Oct 25 2023, 08:28 PM

|

|

QUOTE(dwRK @ Oct 25 2023, 06:01 PM) rhb mca giving 3.7... no fake 3.5... no jumping through hoops... etc etc  but the SGD in rhb mca is not part of singapore eco system right? I can't FAST in and out from my CIMB sg acct. investors or savers need to be made aware of this |

|

|

|

|

|

Medufsaid

|

Nov 1 2023, 05:33 PM Nov 1 2023, 05:33 PM

|

|

QUOTE(CommodoreAmiga @ Nov 1 2023, 05:15 PM) Anybody have FD in Singapore CIMB? Now got a problem, they have change their password rules and needs to reset password. I kena this. you have to call them during working hours 9am-6pm. so basically... if it takes 10 mins to get to them via phone, and your mobile phone charges you 27 sen per minute, it's a RM2.70 process. DO NOT call them after office hours. Only their credit card personnel will be on duty. So yea... I paid 6min*27 sen for the off-hours futile call, and another RM2.70 for the actual call to reset pwd |

|

|

|

|

|

Medufsaid

|

Nov 1 2023, 05:41 PM Nov 1 2023, 05:41 PM

|

|

they'll ask you some personal questions + send you an OTP to your mobile phone to verify your identiy. after that, they'll send you another SMS to reset pwd on the website

I called them at 9am, i got that SMS only at 12:30pm

depending on your needs, it might be better to open a Stashaway SG account to do Stashaway FD

|

|

|

|

|

|

Medufsaid

|

Nov 13 2023, 08:10 AM Nov 13 2023, 08:10 AM

|

|

just need to switch region to singapore and register all over again (with your passport). give them your malaysian statements (bank accts, utility bill etc) as proof of malaysian residence

you'll need to get yourself a sg bank account separately also, which you probably already have by now

|

|

|

|

|

|

Medufsaid

|

Nov 13 2023, 09:40 AM Nov 13 2023, 09:40 AM

|

|

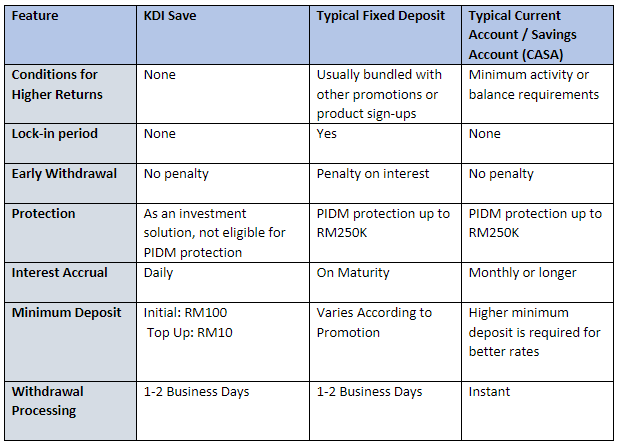

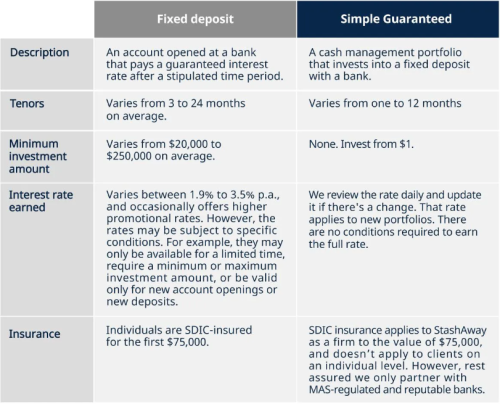

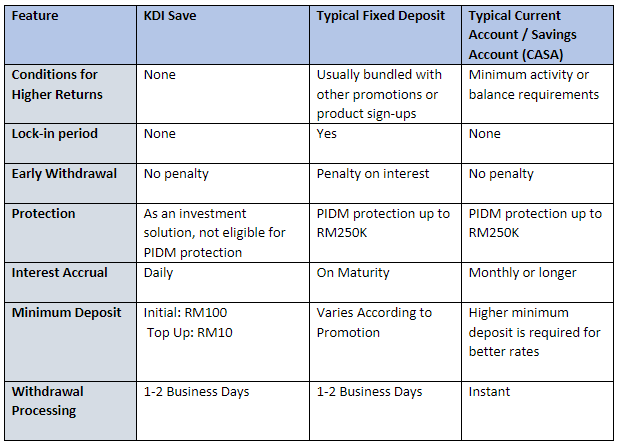

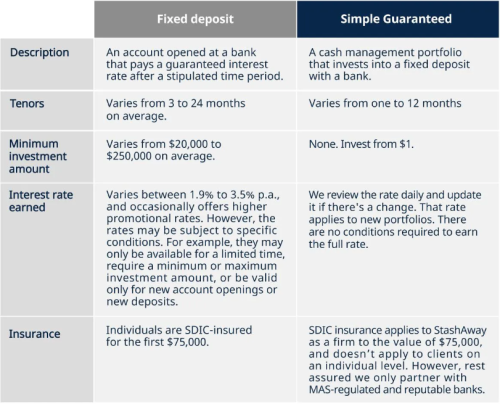

kdi save is still considered investment  Stashaway simple guaranteed is SA investing in FD on your behalf  This post has been edited by Medufsaid: Nov 13 2023, 09:43 AM This post has been edited by Medufsaid: Nov 13 2023, 09:43 AM |

|

|

|

|

|

Medufsaid

|

Feb 20 2024, 04:53 PM Feb 20 2024, 04:53 PM

|

|

he said SGD. i believe it's true also as StashAway SG has similar rate QUOTE(Medufsaid @ Feb 13 2024, 10:22 AM) |

|

|

|

|

|

Medufsaid

|

Feb 20 2024, 05:16 PM Feb 20 2024, 05:16 PM

|

|

log out, then in login screen, you have option to switch region. then login with the credentials of the other country.

i still have both MY + SG. but MY SA has RM0.00 for months already

|

|

|

|

|

|

Medufsaid

|

Feb 27 2024, 11:01 AM Feb 27 2024, 11:01 AM

|

|

Afterburner1.0 open CIMB sg account. link to your CIMB MY, send S$1 from CIMB my to CIMB sg, send S$1k via Wise then wait for CIMB sg to approve can refer to ziet's video as guide https://youtu.be/mXjaob63K2wThis post has been edited by Medufsaid: Feb 27 2024, 11:06 AM

|

|

|

|

|

|

Medufsaid

|

Feb 27 2024, 01:03 PM Feb 27 2024, 01:03 PM

|

|

QUOTE(CommodoreAmiga @ Feb 27 2024, 12:16 PM) this is sgd to rm. Not the other way around Cimb sg->my is the best rate of all during office hours |

|

|

|

|

|

Medufsaid

|

Feb 27 2024, 02:26 PM Feb 27 2024, 02:26 PM

|

|

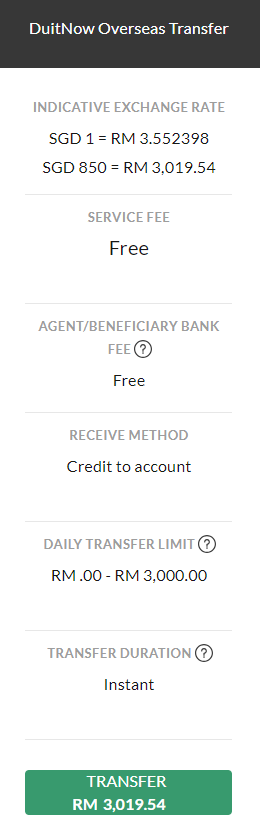

best MYRSGD rates | < RM3k | use DuitNow Overseas Transfer (not available for CIMB SG) | | above | use MoneyMatch |

|

|

|

|

|

|

Medufsaid

|

Mar 15 2024, 09:06 PM Mar 15 2024, 09:06 PM

|

|

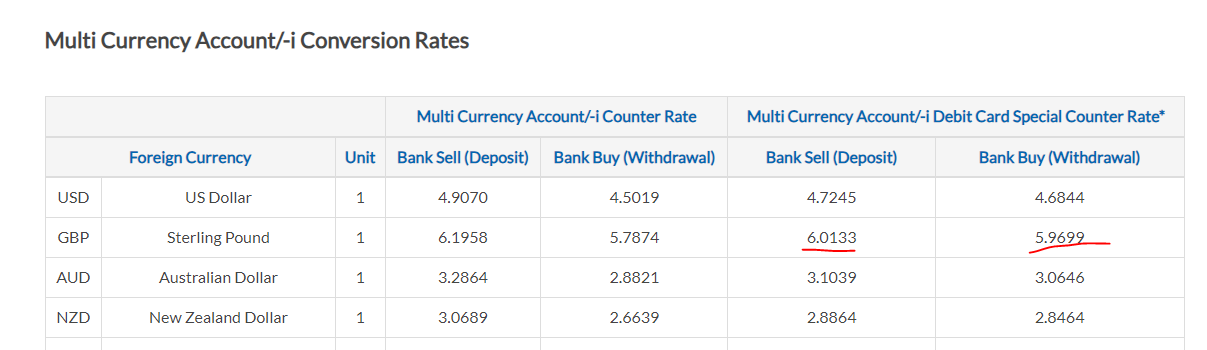

gandalfaaron if you go midvalley now and convert to MYR, and then convert back to GBP, you only lose 0.75%. this means it's 0.379% just to convert back to RM https://cashchanger.co/malaysia/mc/max-mone...ey-megamall/520you should be looking for a place that'll take it and deposit into your multi-currency acct without charge This post has been edited by Medufsaid: Mar 15 2024, 09:08 PM

|

|

|

|

|

|

Medufsaid

|

Mar 15 2024, 11:18 PM Mar 15 2024, 11:18 PM

|

|

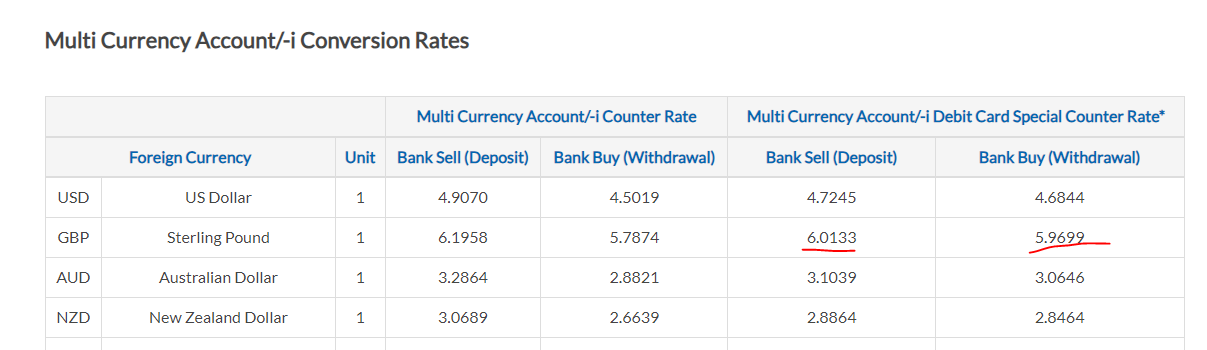

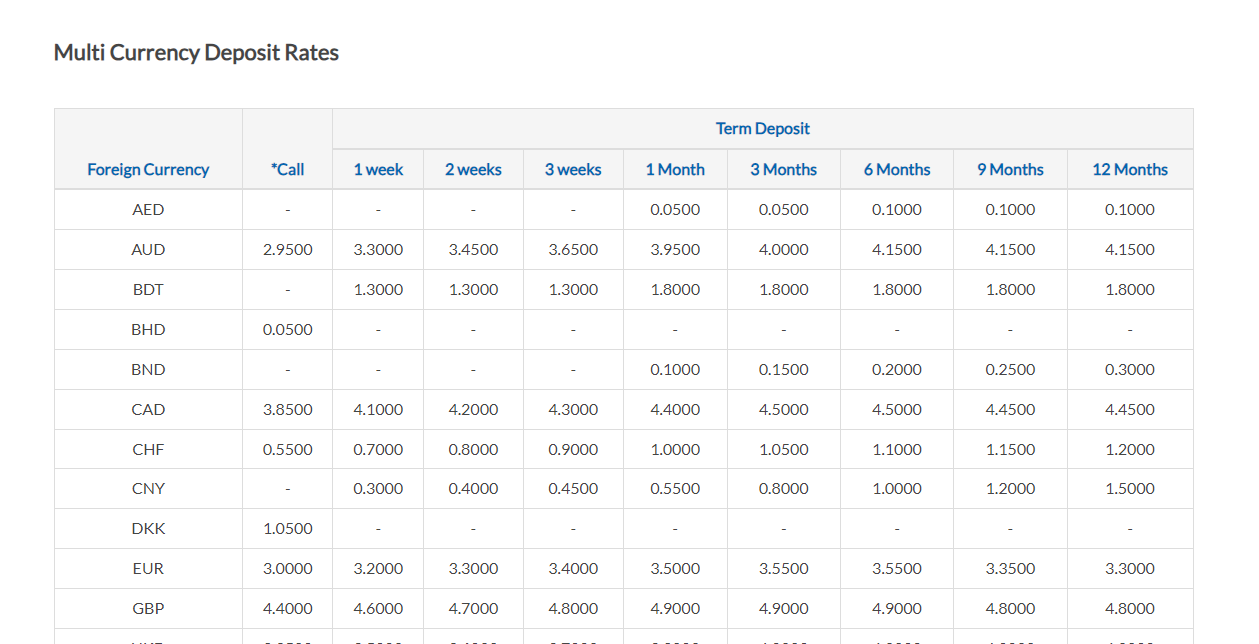

gandalfaaron my advice to you, as someone who played with futures, unrealised losses is the same as realised losses RHB MCA conversion from MYR back into GBP is as competitive as midvalley rates https://www.rhbgroup.com/treasury-rates/mul...card/index.html.  just shrink a bit of the GBP you have into RHB MCA, and then FD it. you'll recoup back the 0.7% double conversion losses, then be on your way to getting some interest  This post has been edited by Medufsaid: Mar 15 2024, 11:21 PM This post has been edited by Medufsaid: Mar 15 2024, 11:21 PM

|

|

|

|

|

Aug 26 2023, 11:01 PM

Aug 26 2023, 11:01 PM

Quote

Quote

0.0415sec

0.0415sec

1.39

1.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled