QUOTE(dwRK @ Oct 25 2023, 12:32 PM)

your data confuses old ppl... and hard to validate...

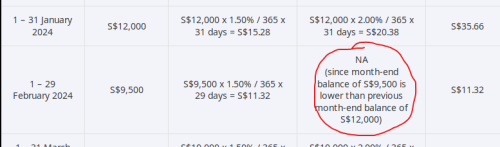

so i rolled my own... for <25k account, is 3.2% effective rate... 3.33% if they didn't forfeit bonus... so not as bad as you think, but anyways, main issues are initial 1st 20-day offset, flat rate calc not daily rest, and zero bonus if less than previous month...

did not do next tiers... but template is here if you wanna try...

[attachmentid=11483175]

No bro,... bonus amt references amt in Savings Acct at end-September, 2023. Does not benchmark against previous mth unlike the Maybank Singapore program a few years ago. So, if you've "been lucky" and your amt at end-September was $0, you will ALWAYS be receiving bonus interest till the end of program, being March 2024.so i rolled my own... for <25k account, is 3.2% effective rate... 3.33% if they didn't forfeit bonus... so not as bad as you think, but anyways, main issues are initial 1st 20-day offset, flat rate calc not daily rest, and zero bonus if less than previous month...

did not do next tiers... but template is here if you wanna try...

[attachmentid=11483175]

Oct 25 2023, 12:41 PM

Oct 25 2023, 12:41 PM

Quote

Quote

0.0179sec

0.0179sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled