QUOTE(Ewa Wa @ Aug 2 2021, 09:51 PM)

Dear YK looi,

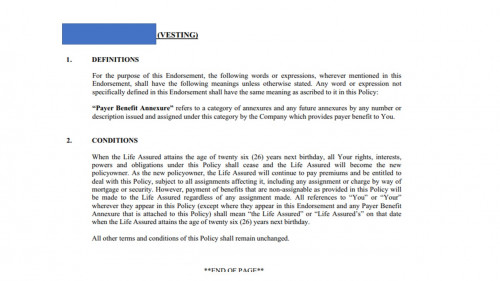

if talking about child policy. Your are the policy owner and ur child is the Life assured. in the policy contract we called it "Vesting Clause" when the child reaches 26yo where the payer benefit cease age. Read my print screen from policy contract.

is not done by "absolute assignment" but vesting clause.

Adult policy don't have this vesting clause only apply on child policy. refer my print screen for more information.

For wan tan mee's case, better refer to ur policy contract and find this statement "if the policy owner death, all her interest, power.. shall transfer to the life assured." Kindly read through the contract to clear ur doubts. Policy contract is much better than all the guessing here.

so if before 26 yrs old or lets say at 20 when my children started to work and had money of their own....can i use "absolute assignment"if talking about child policy. Your are the policy owner and ur child is the Life assured. in the policy contract we called it "Vesting Clause" when the child reaches 26yo where the payer benefit cease age. Read my print screen from policy contract.

is not done by "absolute assignment" but vesting clause.

Adult policy don't have this vesting clause only apply on child policy. refer my print screen for more information.

For wan tan mee's case, better refer to ur policy contract and find this statement "if the policy owner death, all her interest, power.. shall transfer to the life assured." Kindly read through the contract to clear ur doubts. Policy contract is much better than all the guessing here.

for 1tanmee case,....what if the policy owner is not yet die, cannot transfer?

mind telling what type of insurance are having that now? so as to take note of them and tell my relatives and buddies about it.

Aug 2 2021, 09:58 PM

Aug 2 2021, 09:58 PM

Quote

Quote

0.0193sec

0.0193sec

0.23

0.23

6 queries

6 queries

GZIP Disabled

GZIP Disabled