I have an ILP with GE, but the policy holder/owner is my spouse. How do I get the policy to be transferred fully to me?

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jul 30 2021, 08:34 PM Jul 30 2021, 08:34 PM

Show posts by this member only | IPv6 | Post

#961

|

Senior Member

970 posts Joined: Jul 2016 |

I have an ILP with GE, but the policy holder/owner is my spouse. How do I get the policy to be transferred fully to me?

|

|

|

|

|

|

Jul 30 2021, 08:38 PM Jul 30 2021, 08:38 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jul 30 2021, 09:28 PM Jul 30 2021, 09:28 PM

|

Senior Member

891 posts Joined: Oct 2007 From: Penang |

|

|

|

Jul 31 2021, 06:38 AM Jul 31 2021, 06:38 AM

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(blabla987 @ Jul 29 2021, 11:41 AM) Hi sifu all, I need some advice. I plan to get a life insurance for 500k to cover for my housing loan MRTA. One AIA has quote me to pay around 492+ for an investment link life insurance for 20 years. It is worth it for me paying for 20 years? 500 per month for 20 years.. the agent told me that i can take out the money anytime if i need it.. not sure how true it is. Mind to advice. Serious yea thanks There are more than one product to choose from; each may give a different monthly premium. Check out what meets your needs. Is it just MRTA you looking for or others included. |

|

|

Jul 31 2021, 12:14 PM Jul 31 2021, 12:14 PM

Show posts by this member only | IPv6 | Post

#965

|

Senior Member

970 posts Joined: Jul 2016 |

QUOTE(1tanmee @ Jul 30 2021, 08:34 PM) I have an ILP with GE, but the policy holder/owner is my spouse. How do I get the policy to be transferred fully to me? QUOTE(lifebalance @ Jul 30 2021, 08:38 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed.Question is, is there any other way? |

|

|

Jul 31 2021, 01:36 PM Jul 31 2021, 01:36 PM

Show posts by this member only | IPv6 | Post

#966

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. hi 1tanmee, this is the time you find out if your agent is speaking the truth or not. you can call to GE customer service @ 1300-1300 88 (your spouse should call since spouse is the owner) and asked if policyowner can transfer the ownership to life assured (in this case is you right?).Question is, is there any other way? 1tanmee liked this post

|

|

|

|

|

|

Jul 31 2021, 01:37 PM Jul 31 2021, 01:37 PM

Show posts by this member only | IPv6 | Post

#967

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. You wife must do the assignment to you because she is the policy owner. If your wife dont take action, nothing can be done.Question is, is there any other way? Why was the policy bought under her name ? I did it for my other policies since I am the policy owner.

This post has been edited by mini orchard: Jul 31 2021, 01:39 PM 1tanmee liked this post

|

|

|

Jul 31 2021, 01:39 PM Jul 31 2021, 01:39 PM

Show posts by this member only | IPv6 | Post

#968

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(prescott2006 @ Jul 30 2021, 09:28 PM) ok, usually what i will do is this. i will submit any medical procedure receipt, be it can claim or not. then wait for the claim result from claim department. do you still keep the receipt? try to ask agent to try submit? prescott2006 liked this post

|

|

|

Jul 31 2021, 02:15 PM Jul 31 2021, 02:15 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

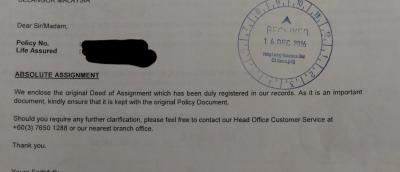

QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. I don't see issue with performing the absolute assignment with your wife signing it off.Question is, is there any other way? If your agent can't do it, then deal direct with Great Eastern Helpline 1tanmee liked this post

|

|

|

Aug 2 2021, 05:07 PM Aug 2 2021, 05:07 PM

Show posts by this member only | IPv6 | Post

#970

|

Senior Member

970 posts Joined: Jul 2016 |

QUOTE(1tanmee @ Jul 30 2021, 08:34 PM) I have an ILP with GE, but the policy holder/owner is my spouse. How do I get the policy to be transferred fully to me? QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. Question is, is there any other way? QUOTE(ckdenion @ Jul 31 2021, 01:36 PM) hi 1tanmee, this is the time you find out if your agent is speaking the truth or not. you can call to GE customer service @ 1300-1300 88 (your spouse should call since spouse is the owner) and asked if policyowner can transfer the ownership to life assured (in this case is you right?). Thanks for the number! Got my wife to call, and the response is the same QUOTE(mini orchard @ Jul 31 2021, 01:37 PM) You wife must do the assignment to you because she is the policy owner. If your wife dont take action, nothing can be done. My wife has call the customer service, and the person say cannot, coz 3rd party Why was the policy bought under her name ? I did it for my other policies since I am the policy owner.

We bought the policy under her name because she can claim tax, like i cannot coz i work in gig economy (and salary below requirement for tax) QUOTE(lifebalance @ Jul 31 2021, 02:15 PM) I don't see issue with performing the absolute assignment with your wife signing it off. Well, not the case with mine- tried but say cannot If your agent can't do it, then deal direct with Great Eastern Helpline |

|

|

Aug 2 2021, 07:06 PM Aug 2 2021, 07:06 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. any one has any idea and can elaborate more in simple layman terms,Question is, is there any other way? what is 3rd party and what is 1st party in life/health insurance? for vehicle insurance,...i think i know,...but for life/health insurance?...i am like what?? too thanks This post has been edited by yklooi: Aug 2 2021, 07:07 PM |

|

|

Aug 2 2021, 07:45 PM Aug 2 2021, 07:45 PM

Show posts by this member only | IPv6 | Post

#972

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

QUOTE(1tanmee @ Aug 2 2021, 05:07 PM) Thanks for the number! Got my wife to call, and the response is the same Yes, the information given by the customer service is right. Your wife can't transfer the ownership back to you and she can't absolute assign the policy back to u as well If it’s a Takaful plan. Do find out what type of plan u r having now.My wife has call the customer service, and the person say cannot, coz 3rd party We bought the policy under her name because she can claim tax, like i cannot coz i work in gig economy (and salary below requirement for tax) Well, not the case with mine- tried but say cannot No worries, I have done a case like your situation. Policy owner passes on and inform company by submitting the necessary documents e.g: death certificate, sign a Statutory Declaration with CTC from commission of oath then successfully transfer back to life assured. This post has been edited by Ewa Wa: Aug 5 2021, 02:29 PM 1tanmee liked this post

|

|

|

Aug 2 2021, 08:23 PM Aug 2 2021, 08:23 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(1tanmee @ Aug 2 2021, 05:07 PM) Thanks for the number! Got my wife to call, and the response is the same Interesting.My wife has call the customer service, and the person say cannot, coz 3rd party We bought the policy under her name because she can claim tax, like i cannot coz i work in gig economy (and salary below requirement for tax) Well, not the case with mine- tried but say cannot I'll wait for Great Eastern to reply me then 1tanmee liked this post

|

|

|

|

|

|

Aug 2 2021, 09:07 PM Aug 2 2021, 09:07 PM

Show posts by this member only | IPv6 | Post

#974

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(yklooi @ Aug 2 2021, 07:06 PM) any one has any idea and can elaborate more in simple layman terms, A contract between the two persons is referred to as a contract between 2 parties. Party A and Party B.what is 3rd party and what is 1st party in life/health insurance? for vehicle insurance,...i think i know,...but for life/health insurance?...i am like what?? too thanks When a 3rd person appeared in the contract but without any contractual duty, then he is considered a thirty party. Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. 3rd party dont have contractual rights. The above is my opinion and a simple explaination and one must further read the contract tnc for additional or exclusion terms. All employees under a company insurance are considered 3rd party. Any claims money goes to the company. This post has been edited by mini orchard: Aug 2 2021, 09:09 PM 1tanmee liked this post

|

|

|

Aug 2 2021, 09:18 PM Aug 2 2021, 09:18 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mini orchard @ Aug 2 2021, 09:07 PM) A contract between the two persons is referred to as a contract between 2 parties. Party A and Party B. thanks for the explanation,...When a 3rd person appeared in the contract but without any contractual duty, then he is considered a thirty party. Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. 3rd party dont have contractual rights. The above is my opinion and a simple explaination and one must further read the contract tnc for additional or exclusion terms. All employees under a company insurance are considered 3rd party. Any claims money goes to the company. in your example,... Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. (same situation i am having too...) so in this case, can i pass this policy to my children when they are working while i am not?......some thing like mentioned "absolute assignment"? |

|

|

Aug 2 2021, 09:23 PM Aug 2 2021, 09:23 PM

Show posts by this member only | IPv6 | Post

#976

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(yklooi @ Aug 2 2021, 09:18 PM) thanks for the explanation,... Yes. That is what I did with the screenshot above. They are paying the premium now and can do whatever they want.in your example,... Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. (same situation i am having too...) so in this case, can i pass this policy to my children when they are working while i am not?......some thing like mentioned "absolute assignment"? |

|

|

Aug 2 2021, 09:29 PM Aug 2 2021, 09:29 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Aug 2 2021, 09:40 PM Aug 2 2021, 09:40 PM

Show posts by this member only | IPv6 | Post

#978

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(yklooi @ Aug 2 2021, 09:29 PM) so currently still wondering "why" 1tanmee's 3rd party case is not able to use the the "absolute assignment". :confused: My spouse bought a life policy and named her mother as a beneficiary. When she wanted to change the beneficiary, they reject her application indicating cannot be done. Not sure of the exact reason then but they did mention is stated in the policy. So I am trying now to dig out the old policy (oredi surrendered) after reading 1tanmee case. Hope is still somewhere in the storage room. During that time, was naive and just listen what was told. |

|

|

Aug 2 2021, 09:51 PM Aug 2 2021, 09:51 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mini orchard @ Aug 2 2021, 09:40 PM) I am also curious. Let me share another old GE experience. thanks for telling.My spouse bought a life policy and named her mother as a beneficiary. When she wanted to change the beneficiary, they reject her application indicating cannot be done. Not sure of the exact reason then but they did mention is stated in the policy. So I am trying now to dig out the old policy (oredi surrendered) after reading 1tanmee case. Hope is still somewhere in the storage room. During that time, was naive and just listen what was told. my concern now is i had some ING>AIA insurance which i bought as a policy owner for my children and spouse......hopefully can use "absolute assignment" to change it years later when they can pay for their own. hopefully 1tanmee can find out what is the actual reason for not able to....other than the 3rd party thing wow,...now there is your 'OLD" case of cannot change to another beneficiary ,......wish you can manage to get the old policy and tell about the clause that mentioned "cannot be done" |

|

|

Aug 2 2021, 09:51 PM Aug 2 2021, 09:51 PM

Show posts by this member only | IPv6 | Post

#980

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

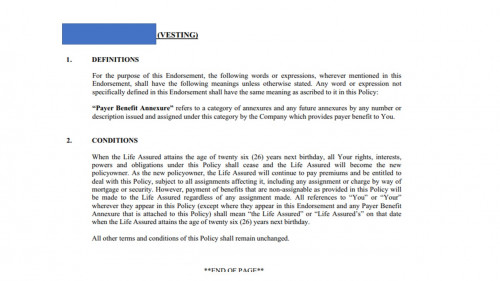

QUOTE(yklooi @ Aug 2 2021, 09:18 PM) thanks for the explanation,... Dear YK looi,in your example,... Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. (same situation i am having too...) so in this case, can i pass this policy to my children when they are working while i am not?......some thing like mentioned "absolute assignment"? if talking about child policy. Your are the policy owner and ur child is the Life assured. in the policy contract we called it "Vesting Clause" when the child reaches 26yo where the payer benefit cease age. Read my print screen from policy contract. is not done by "absolute assignment" but vesting clause. Adult policy don't have this vesting clause only apply on child policy. refer my print screen for more information.  For wan tan mee's case, better refer to ur policy contract and find this statement "if the policy owner death, all her interest, power.. shall transfer to the life assured." Kindly read through the contract to clear ur doubts. Policy contract is much better than all the guessing here.  |

| Change to: |  0.0244sec 0.0244sec

0.37 0.37

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 07:20 AM |