QUOTE(koja6049 @ Oct 30 2025, 08:45 PM)

yep, as you already said, we buy insurance as a protection expense, not an investment product. But many agents are pushing it as an investment product, even ask you to buy additional investment riders so called to cover your COI increase. I hope you can feedback this back to your colleagues that this is very bad unethical practice.

My principle is this: as along as there are units to deduct, then deduct those units, don't come to ask for more money from me. You can inform me of the projected sustainability, but never force me to put in more money just to maintain the sustainability, let me make my own choice

I'm not in the position to tell other people how to run their business, their agency la.

But I have been cultivating this in my agency.

Things that I cannot do, then I don't do.

Things that I can do, so I focus and do loh.

Yea, regarding sustainability.

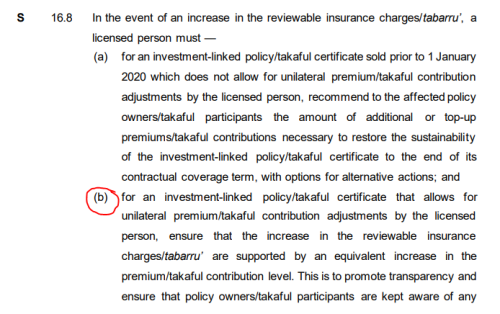

Again, ILP is designed as a Level-Premium product. Since COI increase, company have no choice but to first inform you.

Then they either charge you more premium at each billing cycle, or charge you the same but more frequently.

And at most they can charge to you the bare minimum to maintain the chosen sustainability that was chosen when you first bought the policy, while adhering to the maximum 5% projected return set by BNM.

I know it is your money. That part is clear.

It is also your policy contract to give you the coverage that you need.

And in the policy contract, it involves 3 parties - you the customer, the insurer, and the intermediary (someone like me).

Each party have a role to play.

So we each play our roles well for the symbiotic relationship to work.

The insurer requires the intermediary to go through the due diligence and for the qualified customers to be a long term parters;

the intermediary requires both the customers and the insurer to pull through on their respective ends,

and

the customer requires the insurer to honor the contract terms and the intermediary to carry out the professional services.

Let's look at the issues at hand and discuss them objectively.

You have your respective careers and you are part of the economy, just like me, just like everyone else here.

We frankly need each other to play our respective roles and to play it well.

Then whatever PMX say on stage, all the sama2 this sama2 that... doesn't sound like a pipe dream.

So let's be objective.

I just think it's really cool that contestchris did a fact check and owned it so publicly.

And koja6049 being so graceful about it at the end too.

Takes big men with big hearts to do that

This post has been edited by JIUHWEI: Oct 31 2025, 12:18 PM

This post has been edited by JIUHWEI: Oct 31 2025, 12:18 PM

Oct 30 2025, 10:33 PM

Oct 30 2025, 10:33 PM

Quote

Quote

0.0163sec

0.0163sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled