I... macam opened a can of worms...

Sorry guys.

Lemme just attempt to close it ya.

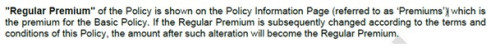

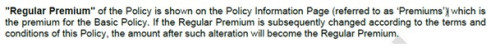

On Regular Premiums

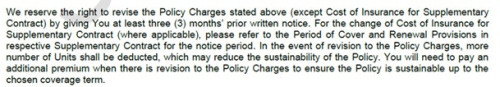

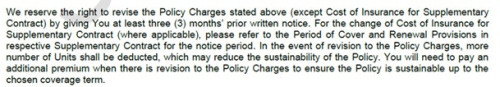

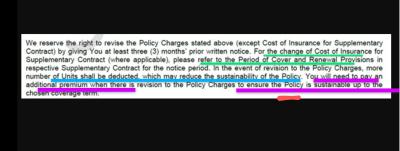

On Premium Revisions

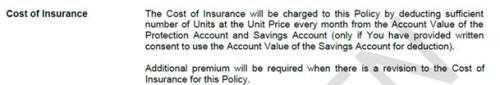

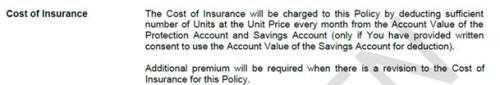

On Cost of Insurance

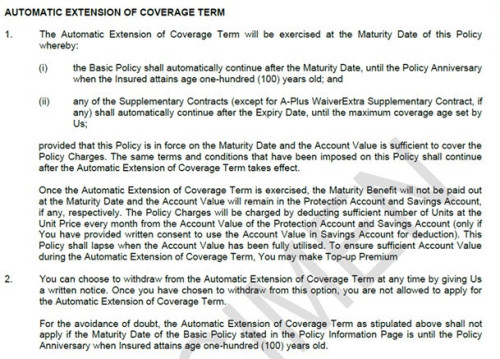

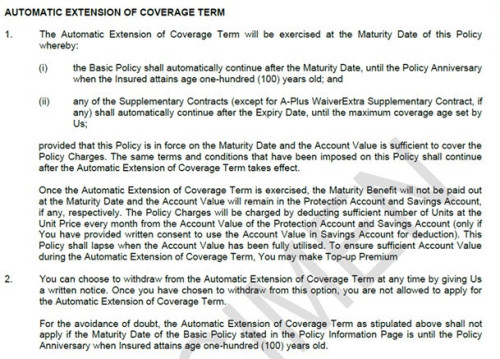

On Automatic Extension Feature (this one I don't know if it is standard across industry, please check your non-AIA policy contracts)

These are taken from the latest version of a contract specimen document.

I hope these definitions can help clear the air of confusion between differing opinions and hearsay.

As for some of the forumers who had bad experience dealing with agents in the past, I promise you that BNM, LIAM and insurers have moved WAY past that in terms of training, monitoring, random mystery caller surveys, etc. The industry is pushing really hard internally to remove the bad apples (with tangible evidence) from the system by way of enforcing quality business and sustainable business.

And for everyone else, let's not discount other people's experiences maybe.?

After all, our worldview is shaped exactly by the experiences that are only unique to us.

So maybe we can just be objective, just handle the points of discussion so that the silent readers betul2 dapat benefit.

So that this great topic thread can be known as betul2 bernas like the other topics too.

Again, there are products and plans to suit every socioeconomic segment of society.

None are necessarily better or worse than the others.

The best plan is one that is in force.

A good start to buying financial products is exactly how we buy pants - we identify the purpose then measure and find the right fit.

Lepas beli some will gain weight, some will lose weight. Then we adjust as needed lo. Buy belt ke, insert spandex ke (from personal experience)

Oct 30 2025, 02:13 PM

Oct 30 2025, 02:13 PM

Quote

Quote

0.0176sec

0.0176sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled