QUOTE(Andr3w @ Mar 20 2025, 05:43 PM)

1) I been diligently keeping to my original premium payment schedule since 2013 until today and never withdraw anything. Recently , i still got another letter saying i need to pay increase premium because no more sustainable anymore to the promised age. So how can i ask insurer to foot the bill because they still insist i pay the increased premium from this year on? (not to confuse situation as I got this letter the same time as the letter to level up me to a new plan campaign which i say in earlier thread). So is there really a strong case that i can make or is it just at the mercy that they say no choice by saying no more sustainable due to whole country COI increasing which is official in news and they already say can increase COI due to unforeseen circumstances if passed by BNM etc. This letter i also wondering if i defy and not agree, not sure what they can do to my policy (like what i am wondering if i don't pay premium)

2) If I stick to my current plan, there is no waiting period or medical exclusion concern risk as like when i start 2013 medical record status. Although still have risk but it is better than the risk of moving to new plan right?

3) How to hold them accountable? It is a norm COI table charges is not guaranteed and especially it is out on the news with BNM say approved, what else can do....About sustainability, they also can say due to unforeseen circumstances like medical inflation all out in the news, they cannot promise the sustainability promised anymore...

4) At what coverage may I ask? yearly 1 million or 5 million or ?

1 & 3) You have every right to insist on the insurers and takaful operators (ITOs) footing the bill as they have not kept up with your reasonable expectation in relation to the original annual premium amount. The expectation implied in the pricing of the product was for the original annual premium to be sufficient to sustain the policy until the end of term.

If the ITOs weren't comfortable in taking on this risk, they should not have had the authority to set the minimum amount of sustainable annual premium for given insurance policy coverages nor would BNM be able to make it a requirement for the ITOs to price the IL contract such that it was expected to be sustainable until the end of term. There is legal force and value to this expectation. It is not zilch or zero. It has value. The question is , what is the value?

And to me, the value implied is a no lapse guarantee if policyholders keep to their original annual premium payments and didn't make any withdrawals. Also, if the ITOs didn't want to take on pricing risk, they should not have allowed for investment returns to be considered in pricing the IL policies nor should they have sold long term products. The moment the ITOs did that, they effectively implied a certain expectation in relation to the investment performance of the IL unit funds as well as the fixed nature of the cost of insurance and other long term charges in the product.

Policyholders have an ironclad case. But whether our courts have competent, impartial judges and whether we have true professional actuaries who have very strong ethics is a separate matter.

Our Malaysian actuaries are not competent especially when it comes to consumer rights and doing right by them and a lot of these issues are due to their lapses/incompetence.

But I still think consumers have the winning hand as this issue is beyond bonkers. I mean just look at the retained and ongoing earnings of life insurers. They are earning beyond RM 4 billion per annum and have over RM 20 billion in equity/retained earnings. There is no good reason to reprice the products/IL contracts. They are not facing going concern risks. The question is, do you as a consumer want to go through the hassle of fighting for your rights? I say you should, but it is ultimately up to you. Your call. If you keep letting them ride roughshod over you, they will keep increasing the premiums, but if some of you or a significant minority of you start complaining and taking action, this whole house of cards will fall. They will cry uncle.

How to hold them to account? By lodging complaints with BNM and the financial ombudsman and by launching a class action lawsuit. It's time for you guys to band together. Either band together and fight back or keep getting bullied. The choice is yours. None of you have to eat their spit.

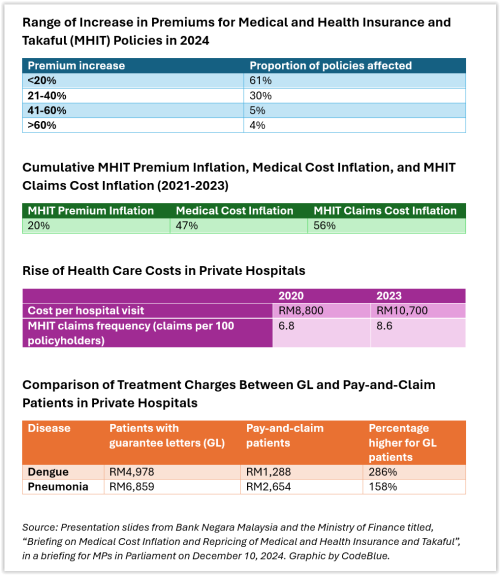

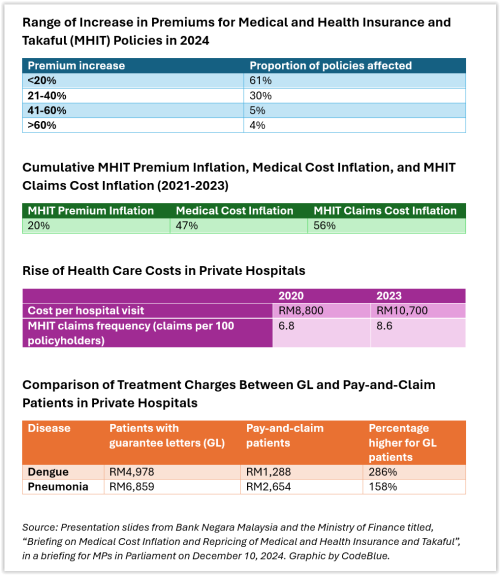

Also, please do not buy into the media, BNM and the ITOs fluff excuse of medical inflation. It's just a ruse. They are doing this solely to guard the earning power of ITOs. The only ones standing in their way is you. The consumer. You have the ultimate power. Not them. Do not be afraid of them. None of these (medical inflation and other excuses) were unforeseeable. They did not account for even a measly 8% in annual medical inflation throughout the term of the contract although this has been the case for private healthcare expenditure in Malaysia since 2011. The ITOs have huge bloated expense and commission structures in place and excessive cost of insurance profit margins. And yet, they failed to account for 8% per annum medical inflation because they are confident the media is on their side and they can paint a one sided picture of hospitals being the cause although that isn't the reality of it.

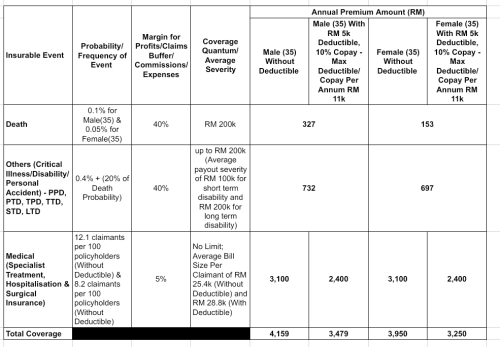

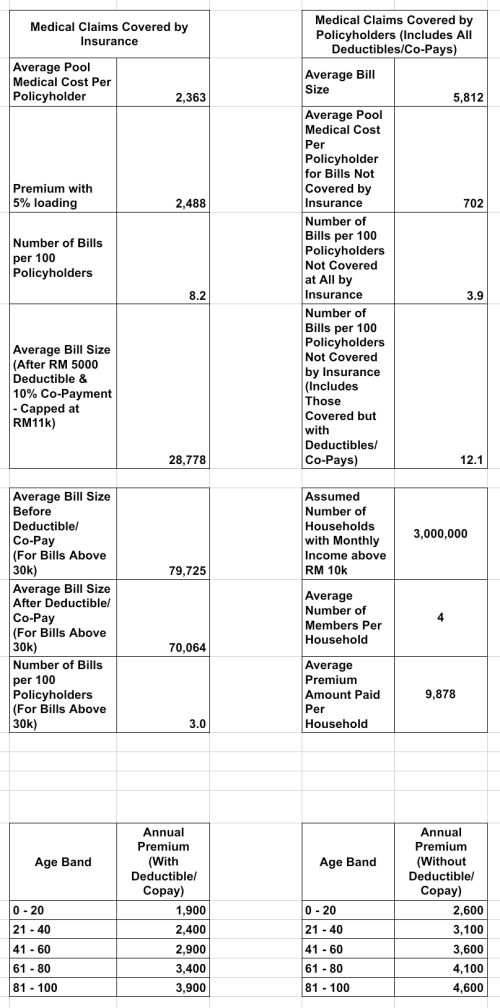

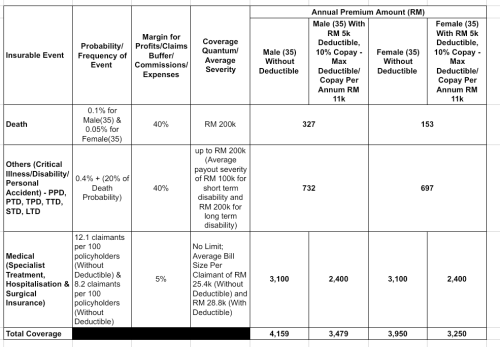

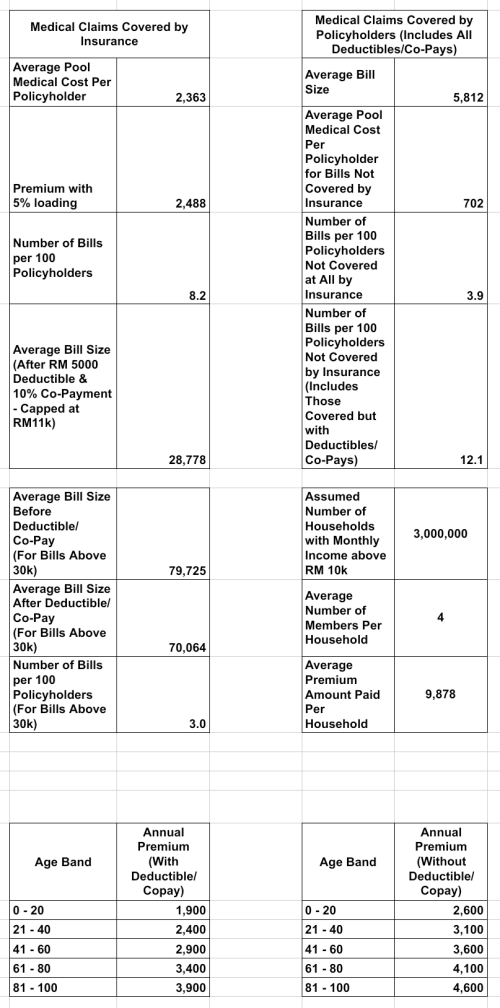

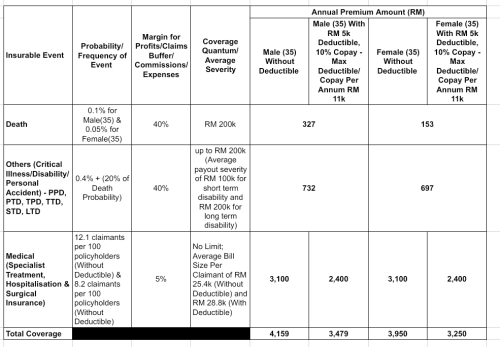

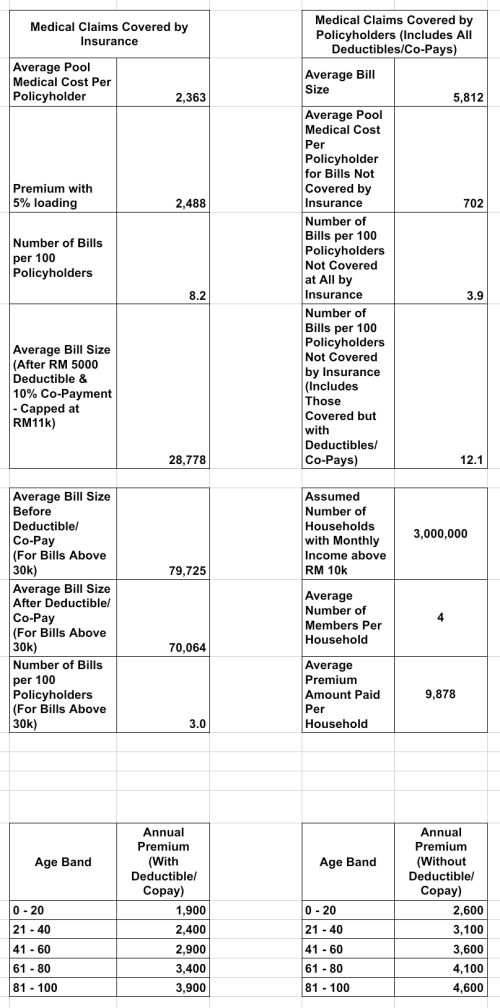

I've already proved it to you. You can have a policy with death and disability coverage of RM 200k and a medical card with average payout of over RM 25k with claim frequency of over 12 claimants per 100 policyholders for only RM4200 per annum. So, please do not buy into their medical inflation excuse.

They are crying medical inflation with only an average claim size of less than half of what I quoted, RM 10k plus compared to my RM 25k plus, with a claim frequency of only 8 plus claimants per 100 policyholders, compared to my 12 plus claimants per 100 policyholders.

2) This is something only you can answer. To me, your current plan's 50k coverage is worthless, useless and GE is milking you because they know you are in a tough spot. They know you're vulnerable, that you're paying for a useless overpriced product when they have another one in the stable, which they've offered to you for an upgrade (1 mil plus coverage), which has a lower cost of insurance charge, but comes with its own sly conditions. There may be changes to your policy's term. Maybe previously the medical card had low annual coverage but its coverage was up to age 100, but now, with the new enhanced coverage, only up to age 70 and renewal from there on. And they would have repriced it based on lower investment return rates assumed in pricing and cajoled you into taking the high deductible version to reduce premium payments. Even if you opt for the enhanced coverage, I still think you should fight for your rights to not have your policy repriced during the mid term of the contract and more importantly, to have a medical cover that is not on a renewal basis up until age 100+.

Yes, you don't have to go through the waiting period again. But what is it that you are ultimately forsaking? You have to get clear answers on this. The pain will come when you are age 70 and above and even more vulnerable then. Don't let them toy with you. Find out now.

4) The coverage I envisioned has no limit but the claims pattern shows up to be less than RM 1 million. Doesn't mean that it can't sustain RM 2 mil treatments. It's possible as long as the frequency is small.

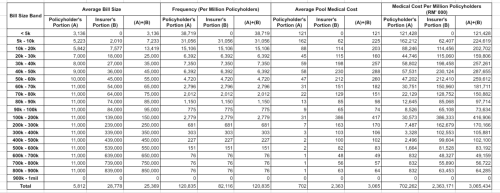

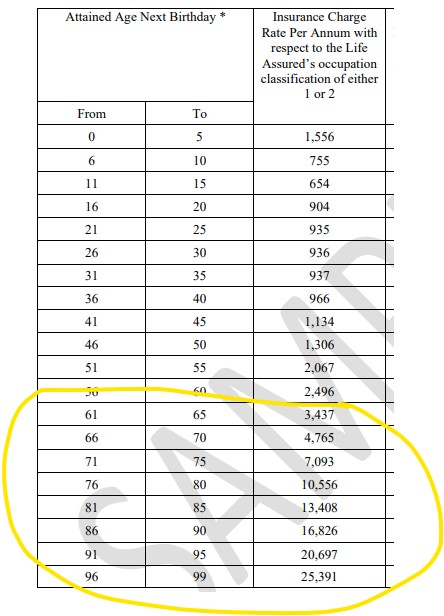

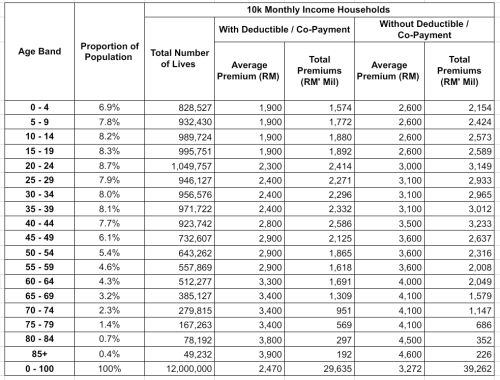

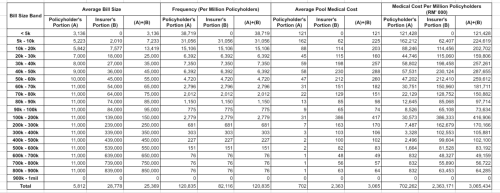

This pricing (below) is doable. Of couse, someone is going to have to do the hard work of studying and projecting the "true" hospital admissions demand for all age groups for all types of health complications and severities, and it may turn out to be insufficient, but until then, this can be a guide to assess if medical insurance products are priced excessively, especially for older age groups. In the end, it will still turn out to be a wise policy to have partial community rating.

This post has been edited by hafizmamak85: Mar 21 2025, 12:23 AM

This post has been edited by hafizmamak85: Mar 21 2025, 12:23 AM

Mar 20 2025, 01:48 PM

Mar 20 2025, 01:48 PM

Quote

Quote

0.2367sec

0.2367sec

0.96

0.96

6 queries

6 queries

GZIP Disabled

GZIP Disabled