QUOTE(WaCKy-Angel @ Aug 30 2023, 04:34 PM)

Yes i know about it, just want to double confirm.

Just wonder when insurance companies revise the premium for medical card it does not change anything for my case right?

I mean i wont be targeted specifically for premium increase just because cash value is low.

But rather premium revision affect all the policy holder for the same plan.

For example, assuming i'm the same profile as you (age, gender, etc) and we bought the exact same coverage, paying the same exact premium.

The difference is probably you skip about 3 months premium whereas i'm have been paying on time every month.

Insurance company do not penalise you. When they increase the price for the medical card (for ILP policies), what they mean is they increase the insurance charge. you and i will be charged the same insurance charge. but you MAY need to pay a higher premium than me due to your missed payment as they are required by BNM to ensure the premium you pay is enough to last until maturity. BUT we both have to pay higher premium anyway.

ILP Quick 101How ILP works is every month (or year or whatever frequency) you pay a fixed amount of premium. some of the premium you pay will be taken by the insurance company to pay for expenses, the rest will go into your investment account value. Every month, the insurance company deduct insurance charge to pay for the insurance coverage you have selected. As long as you have investment account value to deduct insurance charge, you will have your insurance coverage active.

Insurance charge increase as you age, but the premium you pay is the same every month. this is because in the earlier years, you pay abit more, so your investment account value has the savings and buffer to cater for higher insurance charge in future. but this buffer is based on an assumption by the insurance company (with some supervision from BNM on how the insurance company determine this i hope, i'm not from BNM, but i trust BNM with consumer protection job)

BUT in reality, investment return are rarely as expected AND due to medical inflation, the insurance charges will increase to a higher level than what was expected. Hence you will be expected to pay more premium in the future due to this reason.

QUOTE(Ramjade @ Aug 30 2023, 04:42 PM)

Everyone on that plan will be affected. Of course I have read that sometimes those on the super high room and board tier won't be affected so much compare to those in low to mid tier. From what I have seen with Axa I think those on the most expensive tier was not subjected to price increase while those on low to mid tier all get price increase. Not sure if it's applied to all insurance companies or just AXA specifically.

QUOTE(JIUHWEI @ Aug 31 2023, 04:16 PM)

» Click to show Spoiler - click again to hide... «

You're spot on.

So this is applicable across the industry.

Here's how it works:

When you buy a medical plan, there are different levels/tiers to it right?

So that's how these plans are separated into blocks.

Plan A - one block

Plan B - one block

So on and so forth.

In short, those that buy Plan A, claim from Block A.

those that buy Plan B, claim from Block B.

Naturally, Plans A, B, C will be more popular compared to Plans D, E & F.

Also naturally, members of Plans D, E & F have access to overall better things in life, it usually shows in their health.

I eat the most popular potato chips, they eat organic kale chips lightly salted with Himalayan pink and black salt, of a brand that will never appear in my life.

So when Blocks ABC claim until 7788 d, would it make sense to raise the pool reserves for Blocks ABC?

How do you think they raise the pool reserves for Blocks ABC?

By taking from Blocks DEF?

Cannot mah...

both are of you are not wrong but not right either. the problem with super high plan is, not many of them actually buy those super high plan and small sample size. i'm not an expert anyway, i also get 2nd hand information.

anyway, it really depends on what the insurance company decided to practice eventually. they do have to answer to bank negara, so dont think they will simply do this. they have to justify whatever the scenario is to bank negara. it's actually quite a complicated and painful process for the insurance companies themselves.

one thing is for sure, if you and i buy the same plan (and we are same age gender), we will get the same increase

QUOTE(codercoder @ Sep 1 2023, 09:29 AM)

» Click to show Spoiler - click again to hide... «

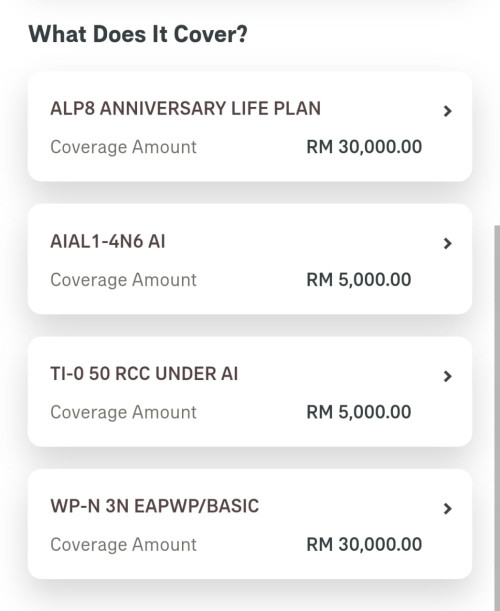

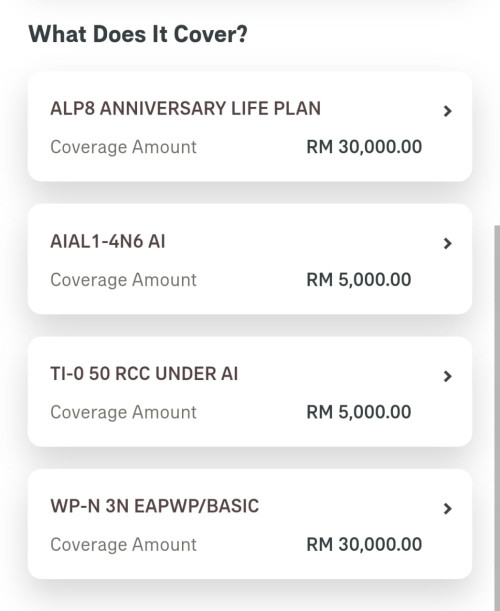

I have this old traditional basic life insurance policy which I bot during my first job in 2002. Monthly premium is around RM50plus. The sum assured is only RM30k. Latest I have checked if I surrender the policy now, I will get back RM17k to move into other investment channel which can give like 5-7% p.a.

Even if I surrender this policy, I still have other life insurance and I think the sum assured is big enough to protect my family.

Do you think I should keep this old policy or surrender it to move to better investment? Anyone knows the advantage of traditional policy vs investment link policy?

We (my spouse and i) analysed our own policy mathematically. If we continue paying what's the return? If we stop paying, what's the return. So when we did this on our old ING policy, we calculated that, our return was around 4%++ to 5%. The return does not sound great and we are aware of this. During covid it make sense to keep it. Now that interest rate has risen... we are still keeping for now. we use this as a defensive strategy, somewhat equivalent to FD. if indeed one day AIA decide to reduce the bonus or interest, we will re-assess and surrender if we deem the return too low. so whether to keep or not, it's really hard to advice without knowing the numbers.

This post has been edited by adele123: Sep 2 2023, 04:34 PM

Aug 30 2023, 06:23 PM

Aug 30 2023, 06:23 PM

Quote

Quote

0.0234sec

0.0234sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled