Outline ·

[ Standard ] ·

Linear+

Insurance Talk V7!, Your one stop Insurance Discussion

|

codercoder

|

Sep 1 2023, 09:29 AM Sep 1 2023, 09:29 AM

|

Getting Started

|

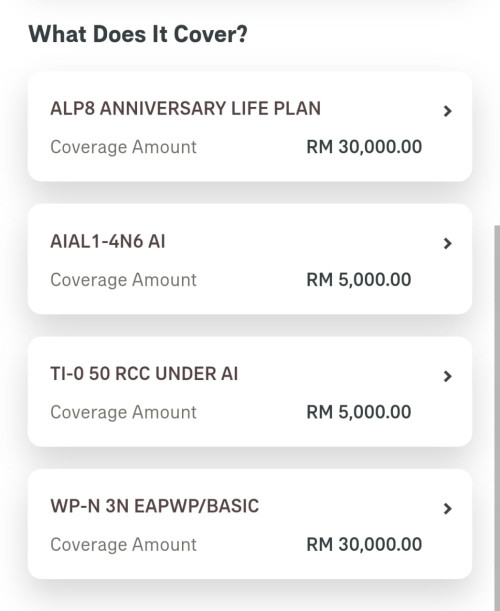

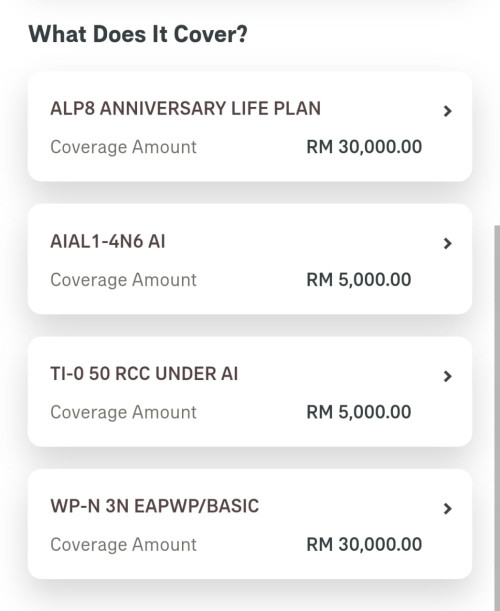

I have this old traditional basic life insurance policy which I bot during my first job in 2002. Monthly premium is around RM50plus. The sum assured is only RM30k. Latest I have checked if I surrender the policy now, I will get back RM17k to move into other investment channel which can give like 5-7% p.a. Even if I surrender this policy, I still have other life insurance and I think the sum assured is big enough to protect my family. Do you think I should keep this old policy or surrender it to move to better investment? Anyone knows the advantage of traditional policy vs investment link policy?  |

|

|

|

|

|

codercoder

|

Apr 30 2024, 02:49 PM Apr 30 2024, 02:49 PM

|

Getting Started

|

My daughter medical card is AIA plan 2, 1.5 mil annual limit. Now agent said got option to upgrade to unlimited annual limit. 1.5 mil annual limit not enough nowadays?

|

|

|

|

|

|

codercoder

|

May 2 2024, 09:26 AM May 2 2024, 09:26 AM

|

Getting Started

|

Hi, anyone heard of Medisaver medical card from longpac? My friend recommended me to switch my daughter medical card from AIA to Medisaver. Premium that I am paying now can be reduced with even more benefits coz no need agent commission. no annual limit (now my aia annual limit is 1.5mil). also Got doc to support for the claim. What is your opinion? Anyone here switched before?

|

|

|

|

|

|

codercoder

|

May 2 2024, 09:41 AM May 2 2024, 09:41 AM

|

Getting Started

|

QUOTE(Ramjade @ May 2 2024, 09:30 AM) It's legit. You wont lose much except post hospitalisation coverage. Theirs is 60 days only while AIA is 120 days to 180 days. Depending on plan. Lonpac is part of public bank. You won't see people recommend medisavers here cause no commission for them. thanks for the info  QUOTE(lifebalance @ May 2 2024, 09:33 AM) oh why? |

|

|

|

|

|

codercoder

|

May 2 2024, 10:02 AM May 2 2024, 10:02 AM

|

Getting Started

|

QUOTE(adele123 @ May 2 2024, 09:49 AM) What plan do you have with AIA now? How much is the coverage? How much are you paying now? You say 1.5mil annual limit? Is it called a-plus health, with room & board 200? How long have you bought it? How much coverage will you get if you switch to medisavers? If you are considering to change, why not visit lonpac website directly and sought out other options? Who is the person who recommended? Does he get a cut if you change? I am paying rm275 for plan 200. I think got 2 years already. if switch to medisaver, I think save around rm600 per year. that person who recommended me can some kind of referer fee this one https://www.lonpac.com/personal-insurance/health/medisecure is lonpac generic product. not the one they design for medisaver. |

|

|

|

|

|

codercoder

|

May 2 2024, 10:03 AM May 2 2024, 10:03 AM

|

Getting Started

|

QUOTE(Ramjade @ May 2 2024, 09:56 AM) If you don't mind lesser post hospitalisation coverage, can go for medisavers. The cheapest option is gathersave. No agent is no big deal for me. You can practically do everything yourself if you read and fill up the forms correctly. what is gathersave? from medisavers? |

|

|

|

|

Sep 1 2023, 09:29 AM

Sep 1 2023, 09:29 AM

Quote

Quote

0.0231sec

0.0231sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled