QUOTE(clowve @ Feb 11 2021, 02:08 PM)

Hey guys, I'm very new to this and have a few questions to ask.

Some background info: I have an insurance plan that is an "Investment Linked Policy" by Great Eastern Life called "SmartProtect Essential 2". As my mother was the one to secure this for me, I am unsure as to what degree this insurance covers me. The agent that sold this to her is her friend and is chinese-speaking and I am unable to communicate my questions.

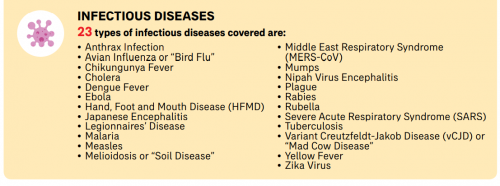

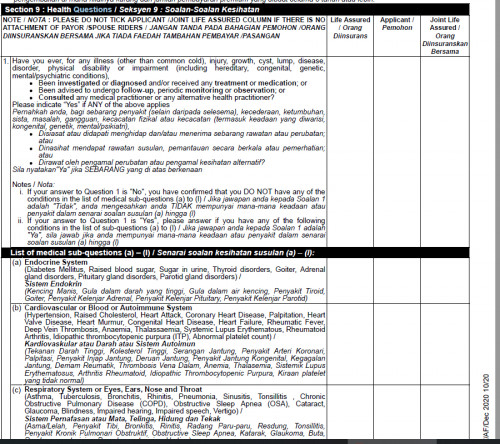

Situation: I have a lump that I have found that I would like to get checked out. But seeing as I am very new to all this, I am unsure how to go about this process or if it is even covered by this particular insurance. The condition is suspected to be a sebaceous cyst but I have not seen a doctor about this as of yet as I am unsure how and where the insurance steps in. I am also concerned as I have been told over the phone that this policy only covers "36 critical illnesses" and offers no coverage on "early detection". This worries me.

Questions:

1. Is it possible for process of diagnosis to be covered by this insurance? I'm afraid to be stuck with a preliminary bill prior to actual treatment. Any experienced people, kindly advice.

2. If it is not possible to have the process of the diagnosis covered by the insurance, how do I go about this? Is it possible to go to a GP in say, a small clinic, and then continue onto one of the "Panel of Hospitals"? If the process of diagnosis is not covered, I would like to minimize the costs as much as possible prior to actual hospital admission.

3. What are the necessary information I would need to obtain from the diagnosis phase to progress onto the admission/treatment phase? Which ones will have involvement of the insurance company?

Apologies if these are silly questions to some of you. I am very new to this and the entire process has been such a blur to me. Hopefully some of you will be able to help shed some light and guide me.

Depending on what rider you have within the policy. If your insurance policy comes with a hospitalization and surgical benefit, you're entitled to claim for the removal of the sebaceous cyst along with any follow ups.

Critical Illness benefit only pays in the event you are diagnose with a critical illness, not due to a sebaceous cyst which is really a minor operation to remove it.

I've done this claim before

The process is as followed.

You can directly see the general surgeon in the hospital to get it diagnosed. If it's indeed just a sebaceous cyst, they can tell immediately or refer to their other colleagues in other specialize area immediately than a GP could.

Then you can get them to fix a day for you to remove it while also letting the nurse know that you want to claim from insurance, they will then check with your insurance company to prepare the guarantee letter to cover for your day care surgery.

You can keep all the receipts incurred prior to admission and on the follow ups thereafter to claim back with the insurance company.

Feb 11 2021, 07:45 AM

Feb 11 2021, 07:45 AM

Quote

Quote

0.0306sec

0.0306sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled