QUOTE(avinlim @ Sep 10 2020, 11:58 AM)

Still no one mention about the waiving of SST for DUO right? Lets try call bank after getting the card. Haha.

NTB got rebate, subject to availability of the campaignCredit Cards Affin Duo Credit Card, great rewards for eWallet

|

|

Sep 10 2020, 12:01 PM Sep 10 2020, 12:01 PM

|

All Stars

65,270 posts Joined: Jan 2003 |

|

|

|

|

|

|

Sep 10 2020, 12:10 PM Sep 10 2020, 12:10 PM

Show posts by this member only | IPv6 | Post

#462

|

Junior Member

438 posts Joined: May 2008 |

QUOTE(cybpsych @ Sep 10 2020, 11:34 AM) by policies, cannot cancel. also, do keep it longer so that the hardworking affin staffs can get commission la. yea so cannot means wont be signing up for it (unless some agent got "WOW" freebie to offer) ... wait you mean RM25 for 2 card for year 1 only ? since year 1 only get charged RM25 SST for Duo, still acceptable. by system, not known if it's hard-bundled or soft-bundled (like PBB Quantum) Anyway my style is always to keep the card (cold storage or not) for about 6-7 months before I cancel even after I get my freebie gift cause a couple of agents did mention to me that 6 months is like some judging point for "good" signed cardholders for them not sure how true it is though. This post has been edited by frozz@holic: Sep 10 2020, 12:11 PM |

|

|

Sep 10 2020, 12:18 PM Sep 10 2020, 12:18 PM

|

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(fruitie @ Sep 10 2020, 12:00 PM) I miss out the part of this, pay RM25 ONLY for 2 cards... entitled automatically or need to call to request?QUOTE(cybpsych @ Sep 10 2020, 12:01 PM) Ya, read dao this part giving RM30. but I am expecting sth like after sst charged to card, we call and request for rebate...lol |

|

|

Sep 10 2020, 12:22 PM Sep 10 2020, 12:22 PM

|

All Stars

65,270 posts Joined: Jan 2003 |

QUOTE(frozz@holic @ Sep 10 2020, 12:10 PM) yea so cannot means wont be signing up for it (unless some agent got "WOW" freebie to offer) ... wait you mean RM25 for 2 card for year 1 only ? rm25 for Duo is for year1 only ... but with 3yrs AF waivedAnyway my style is always to keep the card (cold storage or not) for about 6-7 months before I cancel even after I get my freebie gift cause a couple of agents did mention to me that 6 months is like some judging point for "good" signed cardholders for them not sure how true it is though. usually 6 months is the full commission payment period depending on the bank on how they structure the payout, agents doesnt earn FULL commmisison immediately. Usually banks would staggered payout the commission for few months. This is done so that agents cannot simply fraud the banks for comission by signing up ppl in bulk and run away after getting the commmision. so, agents must stay with the bank and EARN the commission by getting quality customers; they will advise you to keep longer (so that they get full payout). QUOTE(avinlim @ Sep 10 2020, 12:18 PM) Ya, read dao this part giving RM30. but I am expecting sth like after sst charged to card, we call and request for rebate...lol no need expect la, this wont be put in B&W.you can try request once gotten the card lor. This post has been edited by cybpsych: Sep 10 2020, 12:24 PM |

|

|

Sep 10 2020, 12:39 PM Sep 10 2020, 12:39 PM

Show posts by this member only | IPv6 | Post

#465

|

|

Staff

72,787 posts Joined: Sep 2005 From: KUL |

|

|

|

Sep 10 2020, 12:47 PM Sep 10 2020, 12:47 PM

|

Senior Member

1,081 posts Joined: Oct 2009 |

|

|

|

|

|

|

Sep 10 2020, 12:54 PM Sep 10 2020, 12:54 PM

|

All Stars

65,270 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Aug 31 2020, 01:26 PM) QUOTE(chrischiang @ Sep 10 2020, 12:47 PM) no explicit exclusion to ewallets, but should be finemy previous VS gotten RM30 rebate for normal purchases (during MCO). |

|

|

Sep 10 2020, 12:56 PM Sep 10 2020, 12:56 PM

|

Senior Member

3,521 posts Joined: Sep 2012 |

i just called and ask, my statement date 16 every month

and the card may not ship out or just ship to branch so likely next week when i get from branch may no chance to get cb for this cycle too risky... unlike other bank after activated only assign statement date |

|

|

Sep 10 2020, 12:57 PM Sep 10 2020, 12:57 PM

|

Senior Member

3,521 posts Joined: Sep 2012 |

QUOTE(cybpsych @ Sep 10 2020, 12:54 PM) no explicit exclusion to ewallets, but should be fine my previous VS gotten RM30 rebate for normal purchases (during MCO). QUOTE Eligibility 3.1. The Campaign is open to selected principal and supplementary Cardmember who received a Campaign invitation via Short Message Service (“SMS”) and email (“Eligible Cardmember”) by the Bank. |

|

|

Sep 10 2020, 01:02 PM Sep 10 2020, 01:02 PM

|

Senior Member

1,107 posts Joined: May 2016 |

I called my branch guy and he told me the reason for my rejection is my card O/S is too high and suggested I reduce the amount.

Well I know the O/S will be coming down in the next 2 months because the bulk is instalment payment/BT programme over 6 months/12 months ! So I will try to re-apply again. How I envy those having received approvals. |

|

|

Sep 10 2020, 01:03 PM Sep 10 2020, 01:03 PM

|

All Stars

65,270 posts Joined: Jan 2003 |

QUOTE(wjleong15 @ Sep 10 2020, 12:56 PM) i just called and ask, my statement date 16 every month usually, for NTB, statement date already predetermined based on approval date (some with formula to determine which statement date that's suitable for the approval date).and the card may not ship out or just ship to branch so likely next week when i get from branch may no chance to get cb for this cycle too risky... unlike other bank after activated only assign statement date just that some banks when we call, they cant disclose probably the card has not activated, so they cannot view more detailed info. depending on their CRM screens and level of authority or card/account status, they may see more or see less, depending some rules. for me, my existing affin card statement date already @ 22nd. my Duo also follows the current statement date (phew!) since i'm ETB and it didnt assign a separate date for Duo. |

|

|

Sep 10 2020, 01:04 PM Sep 10 2020, 01:04 PM

|

All Stars

65,270 posts Joined: Jan 2003 |

QUOTE(wjleong15 @ Sep 10 2020, 12:57 PM) QUOTE Eligibility 3.1. The Campaign is open to selected principal and supplementary Cardmember who received a Campaign invitation via Short Message Service (“SMS”) and email (“Eligible Cardmember”) by the Bank. This post has been edited by cybpsych: Sep 10 2020, 01:05 PM |

|

|

Sep 10 2020, 01:35 PM Sep 10 2020, 01:35 PM

|

Senior Member

3,521 posts Joined: Sep 2012 |

[quote=cybpsych,Sep 10 2020, 01:03 PM]

usually, for NTB, statement date already predetermined based on approval date (some with formula to determine which statement date that's suitable for the approval date). just that some banks when we call, they cant disclose probably the card has not activated, so they cannot view more detailed info. depending on their CRM screens and level of authority or card/account status, they may see more or see less, depending some rules. for me, my existing affin card statement date already @ 22nd. my Duo also follows the current statement date (phew!) since i'm ETB and it didnt assign a separate date for Duo. [/quote] i see [quote=cybpsych,Sep 10 2020, 01:04 PM] [/quote] can share the new T&C for the Activation Campaign? [/quote] i quoted the tnc from the link you shared |

|

|

|

|

|

Sep 10 2020, 01:44 PM Sep 10 2020, 01:44 PM

Show posts by this member only | IPv6 | Post

#474

|

Senior Member

3,305 posts Joined: Dec 2012 |

QUOTE(LemonJane @ Sep 10 2020, 01:02 PM) I called my branch guy and he told me the reason for my rejection is my card O/S is too high and suggested I reduce the amount. O/S stand for?Well I know the O/S will be coming down in the next 2 months because the bulk is instalment payment/BT programme over 6 months/12 months ! So I will try to re-apply again. How I envy those having received approvals. |

|

|

Sep 10 2020, 01:46 PM Sep 10 2020, 01:46 PM

|

Senior Member

1,107 posts Joined: May 2016 |

|

|

|

Sep 10 2020, 01:46 PM Sep 10 2020, 01:46 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 10 2020, 01:47 PM Sep 10 2020, 01:47 PM

|

Senior Member

1,683 posts Joined: Sep 2018 |

|

|

|

Sep 10 2020, 01:50 PM Sep 10 2020, 01:50 PM

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(LemonJane @ Sep 10 2020, 01:02 PM) I called my branch guy and he told me the reason for my rejection is my card O/S is too high and suggested I reduce the amount. And this is why i never take BT / Installment payments from banks. Gonna make u look bad in terms of credit rating if they deem your salary not high enough to cover your expenses.Well I know the O/S will be coming down in the next 2 months because the bulk is instalment payment/BT programme over 6 months/12 months ! So I will try to re-apply again. How I envy those having received approvals. |

|

|

Sep 10 2020, 01:55 PM Sep 10 2020, 01:55 PM

|

Senior Member

1,107 posts Joined: May 2016 |

QUOTE(beebee1314 @ Sep 10 2020, 01:50 PM) And this is why i never take BT / Installment payments from banks. Gonna make u look bad in terms of credit rating if they deem your salary not high enough to cover your expenses. Aiya, not that bad la. It's only when you try to apply for new cards and get into a bit of jam. It's timing issue.Balance transfer and easy-payment-plan or flexible payment-plan are good things to have, but need to manage |

|

|

Sep 10 2020, 01:57 PM Sep 10 2020, 01:57 PM

Show posts by this member only | IPv6 | Post

#480

|

Junior Member

625 posts Joined: Nov 2013 |

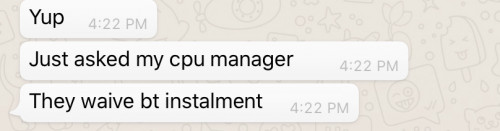

QUOTE(LemonJane @ Sep 10 2020, 01:02 PM) I called my branch guy and he told me the reason for my rejection is my card O/S is too high and suggested I reduce the amount. I applied Affin signature somewhere in May or June, that time I also have very high BT outstanding (PBB and AEON), I max up my BT availability for both banks and I told the officer I have very high BT but he told me no worries because BT can be waived, I was like huh (that time maybe). I believe is true because I got my card approved with quite high CL but I just have no idea how do they know my outstanding is BT or spending. And now adding Duo Cards also not an issue anymore.Well I know the O/S will be coming down in the next 2 months because the bulk is instalment payment/BT programme over 6 months/12 months ! So I will try to re-apply again. How I envy those having received approvals.  This post has been edited by snowswc: Sep 10 2020, 02:00 PM |

| Change to: |  0.0201sec 0.0201sec

0.63 0.63

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 03:42 PM |