For the emergency funds, is it better to keep it in FD or MMF? Or is it better to keep a mix between both?

Money market fund

Money market fund

|

|

Jun 2 2020, 06:48 AM Jun 2 2020, 06:48 AM

Show posts by this member only | IPv6 | Post

#21

|

Junior Member

51 posts Joined: May 2008 |

For the emergency funds, is it better to keep it in FD or MMF? Or is it better to keep a mix between both?

|

|

|

|

|

|

Jun 2 2020, 07:35 AM Jun 2 2020, 07:35 AM

Show posts by this member only | IPv6 | Post

#22

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(woolala @ Jun 2 2020, 06:48 AM) For the emergency funds, is it better to keep it in FD or MMF? Or is it better to keep a mix between both? FD is interest rate is known upfront and locked upon placement but cannot uplift prematurely as earned interest could lose (varies from bank to bank).MMF is sort of daily interest. Its performance is tied much tied to KLIBOR and OPR movement. Redemption/Repurchase could take days depending on fund manager platform (some could be fast as in T+1 and some could be slow up to few working days). |

|

|

Jun 2 2020, 11:08 AM Jun 2 2020, 11:08 AM

Show posts by this member only | IPv6 | Post

#23

|

All Stars

24,432 posts Joined: Feb 2011 |

|

|

|

Jun 2 2020, 11:23 AM Jun 2 2020, 11:23 AM

Show posts by this member only | IPv6 | Post

#24

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 2 2020, 12:55 PM Jun 2 2020, 12:55 PM

Show posts by this member only | IPv6 | Post

#25

|

All Stars

24,432 posts Joined: Feb 2011 |

|

|

|

Jun 2 2020, 01:07 PM Jun 2 2020, 01:07 PM

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(woolala @ Jun 2 2020, 06:48 AM) For the emergency funds, is it better to keep it in FD or MMF? Or is it better to keep a mix between both? Money market fund for emergency funds and saving account for funds that form part of my monthly budgeted expenses.Everything else is invested in various asset classes from low - high risk. Best, Jiansheng |

|

|

|

|

|

Jun 16 2020, 07:13 PM Jun 16 2020, 07:13 PM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

5,926 posts Joined: Sep 2009 |

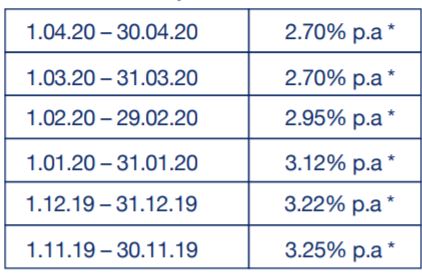

i try to check what is the latest Phillip Money market Fund interest rate, but found latest rate 2.7% for Mac 2020

Anyone knows where to check the rate for Apr or May 2020 ? Is it still around 2.5% or already below 2%? |

|

|

Jun 16 2020, 07:17 PM Jun 16 2020, 07:17 PM

Show posts by this member only | IPv6 | Post

#28

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(guy3288 @ Jun 16 2020, 07:13 PM) i try to check what is the latest Phillip Money market Fund interest rate, but found latest rate 2.7% for Mac 2020 From Factsheet:Anyone knows where to check the rate for Apr or May 2020 ? Is it still around 2.5% or already below 2%?  May ROI:  Fund Factsheet: https://www.eunittrust.com.my/pdf/Factsheet...00052020_fs.pdf Fund Page: https://www.eunittrust.com.my/Home/FundDetail/?fcode=001100 guy3288 liked this post

|

|

|

Jun 16 2020, 07:29 PM Jun 16 2020, 07:29 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

5,926 posts Joined: Sep 2009 |

QUOTE(GrumpyNooby @ Jun 16 2020, 07:17 PM) From Factsheet: thanks. May ROI:  Fund Factsheet: https://www.eunittrust.com.my/pdf/Factsheet...00052020_fs.pdf Fund Page: https://www.eunittrust.com.my/Home/FundDetail/?fcode=001100 looking for avenues to dump my MBSB FD money, heartache now 3% at BR |

|

|

Jun 29 2020, 11:39 PM Jun 29 2020, 11:39 PM

|

Junior Member

579 posts Joined: Apr 2010 |

A stupid question here. I bought some of the fund and how exactly do I see the interests? It's not really visible from the dashboard. the NAV is always 0.5.. lol

Edit: OK just realized they give payouts on 1st of every month This post has been edited by MrTaxxi: Jun 29 2020, 11:43 PM |

|

|

Jun 30 2020, 08:25 AM Jun 30 2020, 08:25 AM

|

Junior Member

116 posts Joined: Jun 2020 |

QUOTE(MrTaxxi @ Jun 29 2020, 11:39 PM) A stupid question here. I bought some of the fund and how exactly do I see the interests? It's not really visible from the dashboard. the NAV is always 0.5.. lol But what if we buy at 1 Jan and sell at 16 Jan, will we still get the dividend?Edit: OK just realized they give payouts on 1st of every month |

|

|

Jun 30 2020, 08:28 AM Jun 30 2020, 08:28 AM

Show posts by this member only | IPv6 | Post

#32

|

All Stars

24,432 posts Joined: Feb 2011 |

|

|

|

Jul 14 2020, 11:30 AM Jul 14 2020, 11:30 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

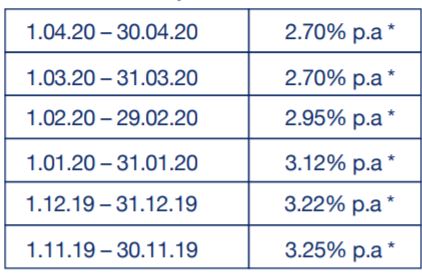

June ROI

|

|

|

|

|

|

Jul 18 2020, 10:23 PM Jul 18 2020, 10:23 PM

Show posts by this member only | IPv6 | Post

#34

|

Junior Member

400 posts Joined: Jun 2011 |

Would like to ask a noob question.

Notice that PMMMF is fixed NAV but with monthly distribution. However, RHB Cash Management Fund 2 (RHBCMF2) has variable NAV but no distribution. If I want to know which is better, what metrics do I look at for an apple to apple comparison? This post has been edited by asil66: Jul 18 2020, 10:23 PM |

|

|

Jul 18 2020, 10:31 PM Jul 18 2020, 10:31 PM

Show posts by this member only | IPv6 | Post

#35

|

All Stars

14,970 posts Joined: Mar 2015 |

QUOTE(asil66 @ Jul 18 2020, 10:23 PM) Would like to ask a noob question. For performance can try compare by calender year ROI track record?Notice that PMMMF is fixed NAV but with monthly distribution. However, RHB Cash Management Fund 2 (RHBCMF2) has variable NAV but no distribution. If I want to know which is better, what metrics do I look at for an apple to apple comparison? Is their 3yr volatity% same? asil66 liked this post

|

|

|

Jul 19 2020, 10:18 AM Jul 19 2020, 10:18 AM

|

Junior Member

400 posts Joined: Jun 2011 |

QUOTE(MUM @ Jul 18 2020, 10:31 PM) Thanks. Just saw I can compare their cumulative growth % across different periods. RHB is slightly more volatile than PMMMF. But overall I think PMMMF is better.May I know if we can open a PMMMF account without going thru an agent? This post has been edited by asil66: Jul 19 2020, 10:27 AM |

|

|

Jul 19 2020, 12:04 PM Jul 19 2020, 12:04 PM

|

All Stars

14,970 posts Joined: Mar 2015 |

QUOTE(asil66 @ Jul 19 2020, 10:18 AM) Thanks. Just saw I can compare their cumulative growth % across different periods. RHB is slightly more volatile than PMMMF. But overall I think PMMMF is better. googled and found this...May I know if we can open a PMMMF account without going thru an agent? maybe you can try explore into this site to see if you can buy it without going thru agent? How Do I Purchase Unit Trust Funds? https://www.eunittrust.com.my/Home/HowTo This post has been edited by MUM: Jul 19 2020, 12:06 PM |

|

|

Jul 19 2020, 01:03 PM Jul 19 2020, 01:03 PM

Show posts by this member only | IPv6 | Post

#38

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(asil66 @ Jul 18 2020, 10:23 PM) Would like to ask a noob question. Check the returns.Notice that PMMMF is fixed NAV but with monthly distribution. However, RHB Cash Management Fund 2 (RHBCMF2) has variable NAV but no distribution. If I want to know which is better, what metrics do I look at for an apple to apple comparison? Fsm money market fund return is listed on product page PMMMF is on homepage. asil66 liked this post

|

|

|

Jul 19 2020, 02:29 PM Jul 19 2020, 02:29 PM

Show posts by this member only | IPv6 | Post

#39

|

All Stars

12,387 posts Joined: Feb 2020 |

PMMMF is quoted at 2.4% pa (for June 2020) while RHB CMF2 is quoted at 2.168% pa (upon login - Nett Interest Rate)

This post has been edited by GrumpyNooby: Jul 19 2020, 02:32 PM |

|

|

Jul 20 2020, 07:59 AM Jul 20 2020, 07:59 AM

Show posts by this member only | IPv6 | Post

#40

|

Junior Member

489 posts Joined: Jun 2009 |

do consider Stashaway Simple

|

| Change to: |  0.0170sec 0.0170sec

0.66 0.66

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 07:25 AM |