Outline ·

[ Standard ] ·

Linear+

Money market fund

|

TSrocketm

|

May 16 2020, 10:51 PM, updated 4y ago May 16 2020, 10:51 PM, updated 4y ago

|

|

Hi all,

I have some questions.

Recently, FD rates are low now. It is a good investment to consider money market fund since it is low fees as compare to other types of unit trust fund and waiting time to withdraw is probably about 2 days with no charges.

The typical return to investor is 6 months or one year based on the NAV at that time.

Does my understanding correct?

Will it be the return for money market fund will lower than banks FD promo rate about 2.80%?

|

|

|

|

|

|

Ramjade

|

May 16 2020, 11:57 PM May 16 2020, 11:57 PM

|

|

QUOTE(rocketm @ May 16 2020, 10:51 PM) Hi all, I have some questions. Recently, FD rates are low now. It is a good investment to consider money market fund since it is low fees as compare to other types of unit trust fund and waiting time to withdraw is probably about 2 days with no charges. The typical return to investor is 6 months or one year based on the NAV at that time. Does my understanding correct? Will it be the return for money market fund will lower than banks FD promo rate about 2.80%? Possible. You need to see the rate every month. It will change monthly. Highest is Philip money market fund. |

|

|

|

|

|

GrumpyNooby

|

May 17 2020, 12:20 AM May 17 2020, 12:20 AM

|

|

QUOTE(Ramjade @ May 16 2020, 11:57 PM) Possible. You need to see the rate every month. It will change monthly. Highest is Philip money market fund. This one? https://www.eunittrust.com.my/pdf/Factsheet...00042020_fs.pdf |

|

|

|

|

|

Ramjade

|

May 17 2020, 03:10 PM May 17 2020, 03:10 PM

|

|

|

|

|

|

|

|

GrumpyNooby

|

May 17 2020, 03:46 PM May 17 2020, 03:46 PM

|

|

QUOTE(Ramjade @ May 17 2020, 03:10 PM) It is a fixed NAV fund. Basically no need to track at all; probably once a month right? |

|

|

|

|

|

tadashi987

|

May 17 2020, 04:03 PM May 17 2020, 04:03 PM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 03:46 PM) It is a fixed NAV fund. Basically no need to track at all; probably once a month right? I think distribution is once a month so rate is refreshed monthly in a way MMF funds somehow rate will be affected by OPR as well. |

|

|

|

|

|

GrumpyNooby

|

May 17 2020, 04:06 PM May 17 2020, 04:06 PM

|

|

QUOTE(tadashi987 @ May 17 2020, 04:03 PM) I think distribution is once a month so rate is refreshed monthly in a way MMF funds somehow rate will be affected by OPR as well. *I guess only* The distribution will give you extra units but NAV is still fixed at 0.500.  |

|

|

|

|

|

tadashi987

|

May 17 2020, 04:12 PM May 17 2020, 04:12 PM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 04:06 PM) *I guess only* The distribution will give you extra units but NAV is still fixed at 0.500.  Correct it is how fixed NAV MMF funds works. |

|

|

|

|

|

GrumpyNooby

|

May 17 2020, 04:15 PM May 17 2020, 04:15 PM

|

|

QUOTE(tadashi987 @ May 17 2020, 04:12 PM) Correct it is how fixed NAV MMF funds works. Now I'm more curious on this "Monthly income*distribution (calculated daily)". Let's say it has a fixed date for monthly distribution on every 30th. If I deposit RM 1000 on 1st and redeem on 15th, with NAV fixed at 0.500 during buy and sell, I gain nothing. But at the end of the month, will I still get the "extra units" for the 15 days provided if I still got units in the account. If I do a full redemption on 15th, do I lose everything? This post has been edited by GrumpyNooby: May 17 2020, 04:17 PM |

|

|

|

|

|

Ramjade

|

May 17 2020, 04:20 PM May 17 2020, 04:20 PM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 03:46 PM) It is a fixed NAV fund. Basically no need to track at all; probably once a month right? Yup you just need to see what's the rate you are getting for that month (once a month) QUOTE(GrumpyNooby @ May 17 2020, 04:15 PM) Now I'm more curious on this "Monthly income*distribution (calculated daily)". Let's say it has a fixed date for monthly distribution on every 30th. If I deposit RM 1000 on 1st and redeem on 15th, with NAV fixed at 0.500 during buy and sell, I gain nothing. But at the end of the month, will I still get the "extra units" for the 15 days provided if I still got units in the account. If I do a full redemption on 15th, do I lose everything? Even if you putting for one day and sell all, you will get something on pay day. Personal experience. This post has been edited by Ramjade: May 17 2020, 07:13 PM |

|

|

|

|

|

tadashi987

|

May 17 2020, 04:21 PM May 17 2020, 04:21 PM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 04:15 PM) Now I'm more curious on this "Monthly income*distribution (calculated daily)". Let's say it has a fixed date for monthly distribution on every 30th. If I deposit RM 1000 on 1st and redeem on 15th, with NAV fixed at 0.500 during buy and sell, I gain nothing. But at the end of the month, will I still get the "extra units" for the 15 days provided if I still got units in the account. If I do a full redemption on 15th, do I lose everything? *disclaimer * not 100% sure but I think it will I saw the factsheet it is distributed monthly, but calculated dailyso i think if you sell all, but when come to monthend, ur distribution will still be credited to your account even you have sold all. |

|

|

|

|

|

jutamind

|

May 20 2020, 10:50 PM May 20 2020, 10:50 PM

|

|

I've got some investable money. I'm seeking opinions whether I should park this money in money market fund or invest in Stashaway lowest risk index.

Not looking at Bursa for now as the index has got up substantially

|

|

|

|

|

|

MrTaxxi

|

May 20 2020, 11:17 PM May 20 2020, 11:17 PM

|

|

So, if i'm not wrong - this is the best place to park some money right now?

the interest rate for saving accounts are super low right now

|

|

|

|

|

|

GrumpyNooby

|

May 20 2020, 11:20 PM May 20 2020, 11:20 PM

|

|

Bear in mind that money market fund is also subjected to OPR movement risk.

Depends on the fund asset allocation either how much weightage into short term debt papers (less 365 days or up to 2 years).

Some money market funds are purely into deposits; not debt papers.

Not all money market funds are created equally. Read the respective fund PDS/PHS/FFS.

This post has been edited by GrumpyNooby: May 20 2020, 11:22 PM

|

|

|

|

|

|

jutamind

|

Jun 1 2020, 12:09 AM Jun 1 2020, 12:09 AM

|

|

Why is Philip money market fund better than let's say Maybank FD rate? If I compare Maybank 12 months FD, current rate is 2.1% p.a but Philip money market fund 1 year performance is only 0.9%. Do I miss out something or I don't understand correctly? QUOTE(Ramjade @ May 16 2020, 11:57 PM) Possible. You need to see the rate every month. It will change monthly. Highest is Philip money market fund. |

|

|

|

|

|

Ramjade

|

Jun 1 2020, 07:57 AM Jun 1 2020, 07:57 AM

|

|

QUOTE(jutamind @ Jun 1 2020, 12:09 AM) Why is Philip money market fund better than let's say Maybank FD rate? If I compare Maybank 12 months FD, current rate is 2.1% p.a but Philip money market fund 1 year performance is only 0.9%. Do I miss out something or I don't understand correctly? Go to https://www.eunittrust.com.my scroll down and you will see returns of the money market fund returns for that month. |

|

|

|

|

|

encikbuta

|

Jun 1 2020, 09:19 PM Jun 1 2020, 09:19 PM

|

Getting Started

|

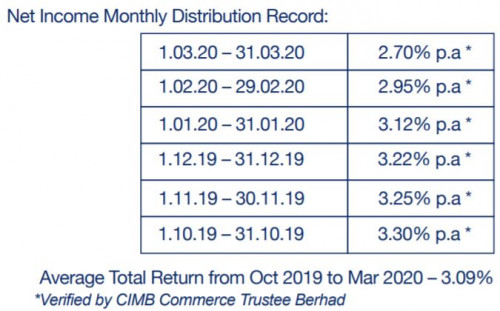

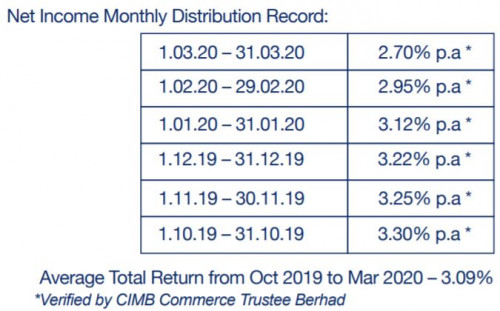

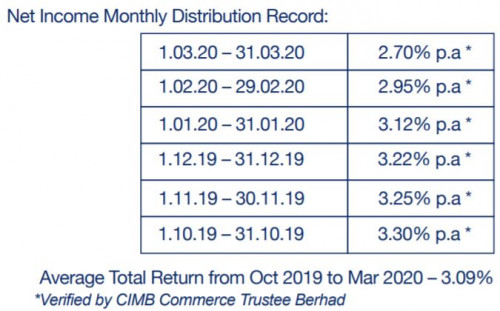

curious why nobody talks about the RHB Cash Management Fund 2 offered in FundSuperMart?

Comparing the recent rates vs Philip Master Money Market, quite on par.

I deposited on 28th Jan 2020 till now, my annualised return is about 2.8% p.a.

or is it easier to open account in Philip Mutual?

|

|

|

|

|

|

Ramjade

|

Jun 1 2020, 09:28 PM Jun 1 2020, 09:28 PM

|

|

QUOTE(encikbuta @ Jun 1 2020, 09:19 PM) curious why nobody talks about the RHB Cash Management Fund 2 offered in FundSuperMart? Comparing the recent rates vs Philip Master Money Market, quite on par. I deposited on 28th Jan 2020 till now, my annualised return is about 2.8% p.a. or is it easier to open account in Philip Mutual? Rhb takes longer to withdraw money. Phillip is same day if use Maybank and put in withdrawal before 11am. Last time Philip rates was very high like 4.1% while rhb was like 3 5-3.7%. This was before feds cut interest to zero. |

|

|

|

|

|

TSrocketm

|

Jun 2 2020, 02:11 AM Jun 2 2020, 02:11 AM

|

|

QUOTE(encikbuta @ Jun 1 2020, 10:19 PM) curious why nobody talks about the RHB Cash Management Fund 2 offered in FundSuperMart? Comparing the recent rates vs Philip Master Money Market, quite on par. I deposited on 28th Jan 2020 till now, my annualised return is about 2.8% p.a. or is it easier to open account in Philip Mutual? I think 2.8% is still better than the current promo FD rate. But only if the rate is consistent over then past months. However, after deducted the management fee and annual fee is it still better than the FD rate? When you buy with FSM, do you still require to open account with the participating bank/financial company offering the fund? This post has been edited by rocketm: Jun 2 2020, 02:13 AM |

|

|

|

|

|

Ramjade

|

Jun 2 2020, 05:04 AM Jun 2 2020, 05:04 AM

|

|

QUOTE(rocketm @ Jun 2 2020, 02:11 AM) I think 2.8% is still better than the current promo FD rate. But only if the rate is consistent over then past months. However, after deducted the management fee and annual fee is it still better than the FD rate? When you buy with FSM, do you still require to open account with the participating bank/financial company offering the fund? 2.8% is after all the fees. No need to open unless you are buying PRS. If PRS yes you need to open. |

|

|

|

|

May 16 2020, 10:51 PM, updated 4y ago

May 16 2020, 10:51 PM, updated 4y ago

Quote

Quote

0.0268sec

0.0268sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled