Outline ·

[ Standard ] ·

Linear+

Money market fund

|

Ramjade

|

May 16 2020, 11:57 PM May 16 2020, 11:57 PM

|

|

QUOTE(rocketm @ May 16 2020, 10:51 PM) Hi all, I have some questions. Recently, FD rates are low now. It is a good investment to consider money market fund since it is low fees as compare to other types of unit trust fund and waiting time to withdraw is probably about 2 days with no charges. The typical return to investor is 6 months or one year based on the NAV at that time. Does my understanding correct? Will it be the return for money market fund will lower than banks FD promo rate about 2.80%? Possible. You need to see the rate every month. It will change monthly. Highest is Philip money market fund. |

|

|

|

|

|

Ramjade

|

May 17 2020, 03:10 PM May 17 2020, 03:10 PM

|

|

|

|

|

|

|

|

Ramjade

|

May 17 2020, 04:20 PM May 17 2020, 04:20 PM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 03:46 PM) It is a fixed NAV fund. Basically no need to track at all; probably once a month right? Yup you just need to see what's the rate you are getting for that month (once a month) QUOTE(GrumpyNooby @ May 17 2020, 04:15 PM) Now I'm more curious on this "Monthly income*distribution (calculated daily)". Let's say it has a fixed date for monthly distribution on every 30th. If I deposit RM 1000 on 1st and redeem on 15th, with NAV fixed at 0.500 during buy and sell, I gain nothing. But at the end of the month, will I still get the "extra units" for the 15 days provided if I still got units in the account. If I do a full redemption on 15th, do I lose everything? Even if you putting for one day and sell all, you will get something on pay day. Personal experience. This post has been edited by Ramjade: May 17 2020, 07:13 PM |

|

|

|

|

|

Ramjade

|

Jun 1 2020, 07:57 AM Jun 1 2020, 07:57 AM

|

|

QUOTE(jutamind @ Jun 1 2020, 12:09 AM) Why is Philip money market fund better than let's say Maybank FD rate? If I compare Maybank 12 months FD, current rate is 2.1% p.a but Philip money market fund 1 year performance is only 0.9%. Do I miss out something or I don't understand correctly? Go to https://www.eunittrust.com.my scroll down and you will see returns of the money market fund returns for that month. |

|

|

|

|

|

Ramjade

|

Jun 1 2020, 09:28 PM Jun 1 2020, 09:28 PM

|

|

QUOTE(encikbuta @ Jun 1 2020, 09:19 PM) curious why nobody talks about the RHB Cash Management Fund 2 offered in FundSuperMart? Comparing the recent rates vs Philip Master Money Market, quite on par. I deposited on 28th Jan 2020 till now, my annualised return is about 2.8% p.a. or is it easier to open account in Philip Mutual? Rhb takes longer to withdraw money. Phillip is same day if use Maybank and put in withdrawal before 11am. Last time Philip rates was very high like 4.1% while rhb was like 3 5-3.7%. This was before feds cut interest to zero. |

|

|

|

|

|

Ramjade

|

Jun 2 2020, 05:04 AM Jun 2 2020, 05:04 AM

|

|

QUOTE(rocketm @ Jun 2 2020, 02:11 AM) I think 2.8% is still better than the current promo FD rate. But only if the rate is consistent over then past months. However, after deducted the management fee and annual fee is it still better than the FD rate? When you buy with FSM, do you still require to open account with the participating bank/financial company offering the fund? 2.8% is after all the fees. No need to open unless you are buying PRS. If PRS yes you need to open. |

|

|

|

|

|

Ramjade

|

Jun 2 2020, 11:08 AM Jun 2 2020, 11:08 AM

|

|

QUOTE(woolala @ Jun 2 2020, 06:48 AM) For the emergency funds, is it better to keep it in FD or MMF? Or is it better to keep a mix between both? I don't even bother with FD. I use money market and cash . |

|

|

|

|

|

Ramjade

|

Jun 2 2020, 12:55 PM Jun 2 2020, 12:55 PM

|

|

QUOTE(GrumpyNooby @ Jun 2 2020, 11:23 AM) No la. Put in banks account. |

|

|

|

|

|

Ramjade

|

Jun 30 2020, 08:28 AM Jun 30 2020, 08:28 AM

|

|

QUOTE(wendygoh @ Jun 30 2020, 08:25 AM) But what if we buy at 1 Jan and sell at 16 Jan, will we still get the dividend? Yes still get. |

|

|

|

|

|

Ramjade

|

Jul 19 2020, 01:03 PM Jul 19 2020, 01:03 PM

|

|

QUOTE(asil66 @ Jul 18 2020, 10:23 PM) Would like to ask a noob question. Notice that PMMMF is fixed NAV but with monthly distribution. However, RHB Cash Management Fund 2 (RHBCMF2) has variable NAV but no distribution. If I want to know which is better, what metrics do I look at for an apple to apple comparison? Check the returns. Fsm money market fund return is listed on product page PMMMF is on homepage. |

|

|

|

|

|

Ramjade

|

Jul 20 2020, 08:11 AM Jul 20 2020, 08:11 AM

|

|

QUOTE(seanlam @ Jul 20 2020, 07:59 AM) do consider Stashaway Simple It takes 2-3 days to get money out. PMMMF takes same day if using Maybank before 11am |

|

|

|

|

|

Ramjade

|

Jul 21 2020, 09:55 PM Jul 21 2020, 09:55 PM

|

|

QUOTE(rocketm @ Jul 21 2020, 09:49 PM) May I ask buying PMMMF require to open a brokerage account with Philip mutual or any CDS account is fine? The website mention can open an account online and fund the MMF using bank transfer to the designated account. Yet, I cannot find their online account page. No brokerage or CDS account needed. All you need to do is go to https://www.eunittrust.com.my/Home/Index, click "Open an Account" |

|

|

|

|

|

Ramjade

|

Jul 26 2020, 10:53 AM Jul 26 2020, 10:53 AM

|

|

QUOTE(David_Yang @ Jul 26 2020, 10:44 AM) No money market fund will beat FD promos. Especially now with so low FD rates. To earn the 0.5 percent Management Fees they need to climb up to 3.25% compared to the 2.75% Bank Rakyat offers. Thats almost 20%, no fund manager can do this with zero risk MYR papers. FD promo cannot remove early. 2.4% is already nett fees. Some money market fund already beat FD promo. |

|

|

|

|

|

Ramjade

|

Jul 29 2020, 10:33 AM Jul 29 2020, 10:33 AM

|

|

QUOTE(GrumpyNooby @ Jul 29 2020, 10:32 AM) 2.4% pa as of June 2020. I think Simple™ with Eastspring Investments Islamic Income Fund also can offer that: https://www.eastspring.com/my/funds-and-sol...s?fundcode=E026https://www.stashaway.my/simpleCan but they don't offer near instant same day withdrawal. |

|

|

|

|

|

Ramjade

|

Jul 29 2020, 09:31 PM Jul 29 2020, 09:31 PM

|

|

QUOTE(yklooi @ Jul 29 2020, 10:52 AM) are you also taking into the factor such as below? Rates + speed of withdrawal is my main criteria. I am ok with say higher returns than Phillips but maybe need to wait one day to get the money out. |

|

|

|

|

|

Ramjade

|

Aug 15 2020, 02:38 PM Aug 15 2020, 02:38 PM

|

|

QUOTE(GrumpyNooby @ Aug 14 2020, 06:28 PM) Simple™ competitor? Versa Collaborates With Affin Hwang To Launch New Digital Cash Management SolutionVersa Asia has collaborated with Affin Hwang Asset Management to launch a new cash management mobile app that allows Malaysians to earn returns similar to fixed deposit rates on their invested money through money market funds. It also offers them the flexibility of being able to access their funds at any time, with no lock-ins and hidden terms. Versa works like a savings account, but with returns on par with FD interest rates – and without the need to visit a bank. Once you’ve registered an account with Versa, you can then deposit an amount of money into it, which will be invested into Affin Hwang’s Enhanced Deposit Fund. Returns will then be re-deposited into your account and re-invested until you decide to withdraw them. Versa allows you to start saving at a minimum of RM100, and it charges no hidden fees, including management, transfer, and exit fees. You can also withdraw your money anytime without penalty, with income distribution calculated up to the day of withdrawal. Article link: https://ringgitplus.com/en/blog/investment/...abYeXgKSc5RxZKAVersa link: https://versa.asia/I am more interested to know how fast can I get my money back. Interest is about 2%p.a. Not very good considering simple is 2.4%, Phillips is 2.3% |

|

|

|

|

|

Ramjade

|

Dec 2 2020, 04:44 PM Dec 2 2020, 04:44 PM

|

|

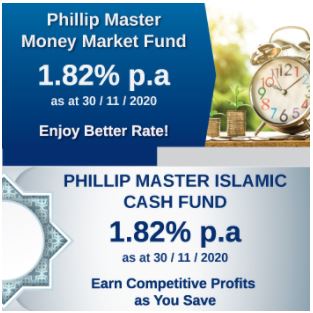

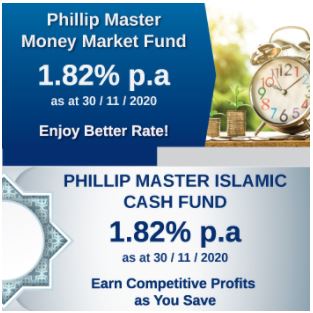

QUOTE(GrumpyNooby @ Dec 2 2020, 01:40 PM) PMMMF return as of November 2020:  Damn it's pathetic now. I have switched to stashaway simple for the mean time. Cant wait for versa. Instant withdrawal. |

|

|

|

|

|

Ramjade

|

Dec 2 2020, 05:34 PM Dec 2 2020, 05:34 PM

|

|

QUOTE(GrumpyNooby @ Dec 2 2020, 05:01 PM) Some said SAMY is subsidizing the projected return of Simple™. Real return from its underlying MMF is just 1.9% pa. Well will enjoy it while it last. |

|

|

|

|

|

Ramjade

|

Jan 30 2021, 11:52 AM Jan 30 2021, 11:52 AM

|

|

QUOTE(AnasM @ Jan 30 2021, 10:23 AM) how quite is the withdrawal time for versa? faster than opus? If you withdraw before 12pm you will get money back same day. Not sure what time. Applicable on weekdays only. |

|

|

|

|

|

Ramjade

|

Jan 30 2021, 01:48 PM Jan 30 2021, 01:48 PM

|

|

QUOTE(cybpsych @ Jan 30 2021, 12:06 PM) When will my withdrawn funds from Versa's appear in my bank account? – Versa Asianot same day withdrawal REQUEST before 12pm, will be PROCESSED on the same day. fund received in bank account the next working day. in short, T (<12pm) +1 withdrawal REQUEST after 12pm, will be PROCESSED the next working day. that means funds received the next working day too. in short, T (>12pm) +2 Thanks. Cause last time versa said it's said same time. Anyway versa is faster than stashaway cause it takes 3-4 days for the money to appear in bank account. |

|

|

|

|

May 16 2020, 11:57 PM

May 16 2020, 11:57 PM

Quote

Quote

0.0818sec

0.0818sec

1.59

1.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled