QUOTE(Ramjade @ May 16 2020, 11:57 PM)

Possible. You need to see the rate every month. It will change monthly. Highest is Philip money market fund.

This one?https://www.eunittrust.com.my/pdf/Factsheet...00042020_fs.pdf

Money market fund

|

|

May 17 2020, 12:20 AM May 17 2020, 12:20 AM

Return to original view | IPv6 | Post

#1

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Ramjade @ May 16 2020, 11:57 PM) Possible. You need to see the rate every month. It will change monthly. Highest is Philip money market fund. This one?https://www.eunittrust.com.my/pdf/Factsheet...00042020_fs.pdf kinnasai liked this post

|

|

|

|

|

|

May 17 2020, 03:46 PM May 17 2020, 03:46 PM

Return to original view | IPv6 | Post

#2

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Ramjade @ May 17 2020, 03:10 PM) It is a fixed NAV fund.Basically no need to track at all; probably once a month right? |

|

|

May 17 2020, 04:06 PM May 17 2020, 04:06 PM

Return to original view | IPv6 | Post

#3

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 17 2020, 04:15 PM May 17 2020, 04:15 PM

Return to original view | IPv6 | Post

#4

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tadashi987 @ May 17 2020, 04:12 PM) Now I'm more curious on this "Monthly income*distribution (calculated daily)".Let's say it has a fixed date for monthly distribution on every 30th. If I deposit RM 1000 on 1st and redeem on 15th, with NAV fixed at 0.500 during buy and sell, I gain nothing. But at the end of the month, will I still get the "extra units" for the 15 days provided if I still got units in the account. If I do a full redemption on 15th, do I lose everything? This post has been edited by GrumpyNooby: May 17 2020, 04:17 PM |

|

|

May 20 2020, 11:20 PM May 20 2020, 11:20 PM

Return to original view | IPv6 | Post

#5

|

All Stars

12,387 posts Joined: Feb 2020 |

Bear in mind that money market fund is also subjected to OPR movement risk.

Depends on the fund asset allocation either how much weightage into short term debt papers (less 365 days or up to 2 years). Some money market funds are purely into deposits; not debt papers. Not all money market funds are created equally. Read the respective fund PDS/PHS/FFS. This post has been edited by GrumpyNooby: May 20 2020, 11:22 PM |

|

|

Jun 2 2020, 07:35 AM Jun 2 2020, 07:35 AM

Return to original view | IPv6 | Post

#6

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(woolala @ Jun 2 2020, 06:48 AM) For the emergency funds, is it better to keep it in FD or MMF? Or is it better to keep a mix between both? FD is interest rate is known upfront and locked upon placement but cannot uplift prematurely as earned interest could lose (varies from bank to bank).MMF is sort of daily interest. Its performance is tied much tied to KLIBOR and OPR movement. Redemption/Repurchase could take days depending on fund manager platform (some could be fast as in T+1 and some could be slow up to few working days). |

|

|

|

|

|

Jun 2 2020, 11:23 AM Jun 2 2020, 11:23 AM

Return to original view | IPv6 | Post

#7

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jun 16 2020, 07:17 PM Jun 16 2020, 07:17 PM

Return to original view | IPv6 | Post

#8

|

All Stars

12,387 posts Joined: Feb 2020 |

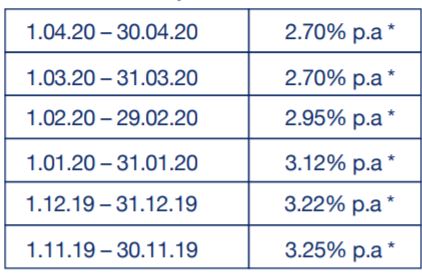

QUOTE(guy3288 @ Jun 16 2020, 07:13 PM) i try to check what is the latest Phillip Money market Fund interest rate, but found latest rate 2.7% for Mac 2020 From Factsheet:Anyone knows where to check the rate for Apr or May 2020 ? Is it still around 2.5% or already below 2%?  May ROI:  Fund Factsheet: https://www.eunittrust.com.my/pdf/Factsheet...00052020_fs.pdf Fund Page: https://www.eunittrust.com.my/Home/FundDetail/?fcode=001100 guy3288 liked this post

|

|

|

Jul 14 2020, 11:30 AM Jul 14 2020, 11:30 AM

Return to original view | Post

#9

|

All Stars

12,387 posts Joined: Feb 2020 |

June ROI

|

|

|

Jul 19 2020, 02:29 PM Jul 19 2020, 02:29 PM

Return to original view | IPv6 | Post

#10

|

All Stars

12,387 posts Joined: Feb 2020 |

PMMMF is quoted at 2.4% pa (for June 2020) while RHB CMF2 is quoted at 2.168% pa (upon login - Nett Interest Rate)

This post has been edited by GrumpyNooby: Jul 19 2020, 02:32 PM |

|

|

Jul 20 2020, 04:03 PM Jul 20 2020, 04:03 PM

Return to original view | Post

#11

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(vkashin @ Jul 20 2020, 04:00 PM) hi. total noob here, just stumbled across PMMMF , and would like to get some advice FSM doesn't carry PMMMF.how would be the best way to "put money" into PMMMF? eunittrust? fundsupermart? is there any place i can get a reference on that? thanks.. euT is under Philip Mutual. This post has been edited by GrumpyNooby: Jul 20 2020, 04:05 PM |

|

|

Jul 26 2020, 08:08 AM Jul 26 2020, 08:08 AM

Return to original view | IPv6 | Post

#12

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kobejash @ Jul 26 2020, 02:39 AM) I completely agree. Now is a good time to consider investing in a good money market fund for safety purposes. They're less risky and provide a decent return. See this article for more information: https://growthrapidly.com/money-market-funds/ Why now given OPR is on the downward trend?Return on money market fund is not affected by OPR trend? |

|

|

Jul 29 2020, 06:30 AM Jul 29 2020, 06:30 AM

Return to original view | IPv6 | Post

#13

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jul 29 2020, 10:32 AM Jul 29 2020, 10:32 AM

Return to original view | Post

#14

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Jul 29 2020, 10:29 AM) 2.4% pa as of June 2020.I think Simple™ with Eastspring Investments Islamic Income Fund also can offer that: https://www.eastspring.com/my/funds-and-sol...s?fundcode=E026 https://www.stashaway.my/simple |

|

|

Aug 4 2020, 12:47 PM Aug 4 2020, 12:47 PM

Return to original view | Post

#15

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 4 2020, 01:43 PM Aug 4 2020, 01:43 PM

Return to original view | Post

#16

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 6 2020, 08:21 PM Aug 6 2020, 08:21 PM

Return to original view | IPv6 | Post

#17

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 11 2020, 06:40 PM Aug 11 2020, 06:40 PM

Return to original view | IPv6 | Post

#18

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Gabriel03 @ Aug 11 2020, 06:37 PM) Remember that the principal fund invest in money market and Islamic FD which are suspectible to the OPR. With recent drop of OPR, the projection should be amended. But Simple™ didn't change the projection; i.e. they're confident of securing the projected rate.Could the Simple projected rate ever change? Yes, depending on economic conditions, your StashAway Simple™’s projected rate may change, as its underlying fund is affected by Malaysia's economic health and trajectory. We will always notify you in the case of a change in the projected rate. The risk level to which your money is exposed will never change within StashAway Simple™. This post has been edited by GrumpyNooby: Aug 11 2020, 06:42 PM |

|

|

Aug 11 2020, 06:58 PM Aug 11 2020, 06:58 PM

Return to original view | IPv6 | Post

#19

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(blackprince36 @ Aug 11 2020, 06:42 PM) Money market fund risky?Where you want to stash your money then? tadashi987 liked this post

|

|

|

Aug 14 2020, 06:28 PM Aug 14 2020, 06:28 PM

Return to original view | IPv6 | Post

#20

|

All Stars

12,387 posts Joined: Feb 2020 |

Simple™ competitor? Versa Collaborates With Affin Hwang To Launch New Digital Cash Management Solution Versa Asia has collaborated with Affin Hwang Asset Management to launch a new cash management mobile app that allows Malaysians to earn returns similar to fixed deposit rates on their invested money through money market funds. It also offers them the flexibility of being able to access their funds at any time, with no lock-ins and hidden terms. Versa works like a savings account, but with returns on par with FD interest rates – and without the need to visit a bank. Once you’ve registered an account with Versa, you can then deposit an amount of money into it, which will be invested into Affin Hwang’s Enhanced Deposit Fund. Returns will then be re-deposited into your account and re-invested until you decide to withdraw them. Versa allows you to start saving at a minimum of RM100, and it charges no hidden fees, including management, transfer, and exit fees. You can also withdraw your money anytime without penalty, with income distribution calculated up to the day of withdrawal. Article link: https://ringgitplus.com/en/blog/investment/...abYeXgKSc5RxZKA Versa link: https://versa.asia/ TOS liked this post

|

| Change to: |  0.0530sec 0.0530sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 01:51 PM |