QUOTE(TOS @ May 10 2024, 12:38 PM)

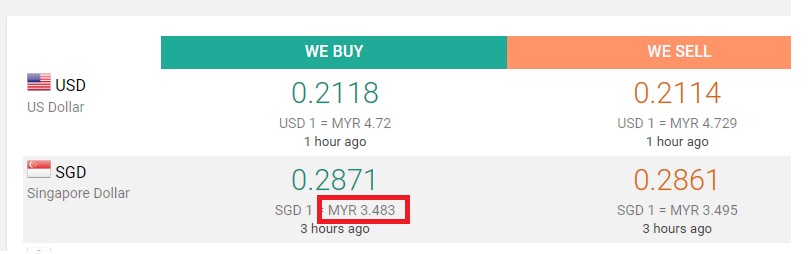

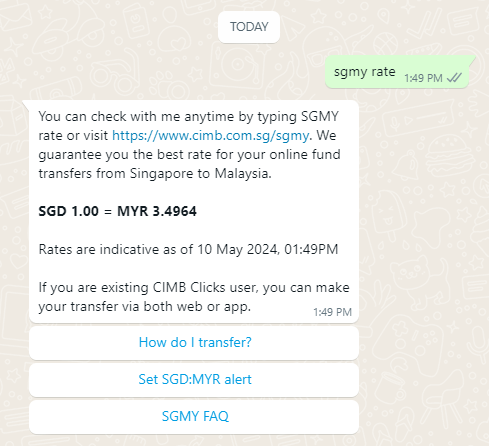

no idea how CIMB sg does it. cheaper than even Midvalley| Midvalley | CIMB SG |

|  |

This post has been edited by Medufsaid: May 10 2024, 01:52 PM

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

May 10 2024, 01:51 PM May 10 2024, 01:51 PM

|

Senior Member

3,495 posts Joined: Jan 2003 |

|

|

|

|

|

|

May 10 2024, 02:41 PM May 10 2024, 02:41 PM

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

what about cimb my to cimb sg rates?

|

|

|

May 10 2024, 02:51 PM May 10 2024, 02:51 PM

|

Senior Member

3,495 posts Joined: Jan 2003 |

|

|

|

May 10 2024, 03:06 PM May 10 2024, 03:06 PM

|

Junior Member

455 posts Joined: Jun 2012 |

Currently I convert myr to usd straight in wise before depositing into IBKR. Found out rate actually better than converting via IBKR deposit page. Wish to maximise the exchange since will be converting quite frequently to invest. Any idea or lobang that I can save more on MYR->USD process.

|

|

|

May 10 2024, 07:22 PM May 10 2024, 07:22 PM

Show posts by this member only | IPv6 | Post

#2405

|

Senior Member

1,084 posts Joined: Jul 2022 |

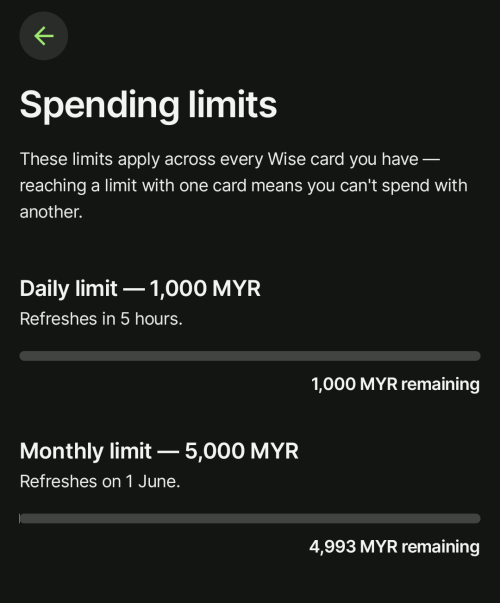

QUOTE(Medufsaid @ Apr 7 2024, 08:27 AM) i linked my google pay to my virtual wise debit card number, no issues whatsoever. no physical card to insert into ATM also For wise card, on Google payyup. daily S$0.60 surcharge Got limit for contactless? If like the setting on my screenshot, can I spend rm600 via contactless, or still limited to rm250? If yes, if exceed, enter pin at card terminal device?  This post has been edited by Natsukashii: May 10 2024, 07:23 PM |

|

|

May 11 2024, 02:10 PM May 11 2024, 02:10 PM

|

Senior Member

3,495 posts Joined: Jan 2003 |

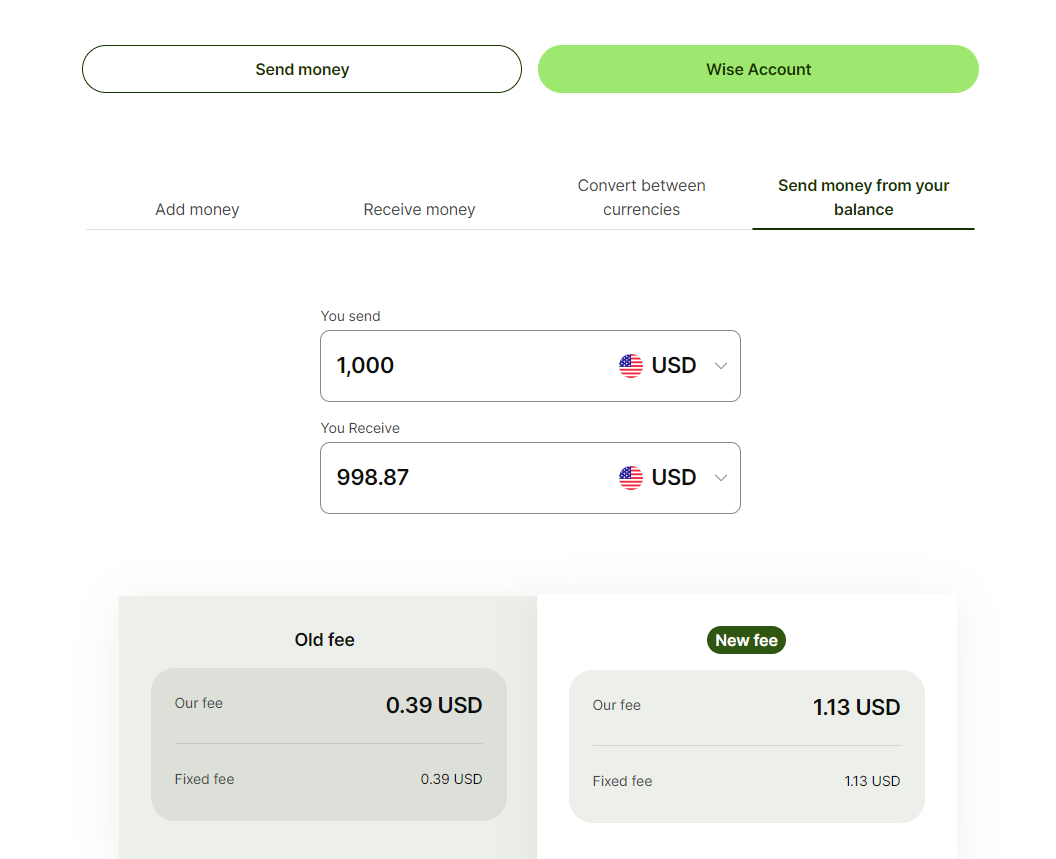

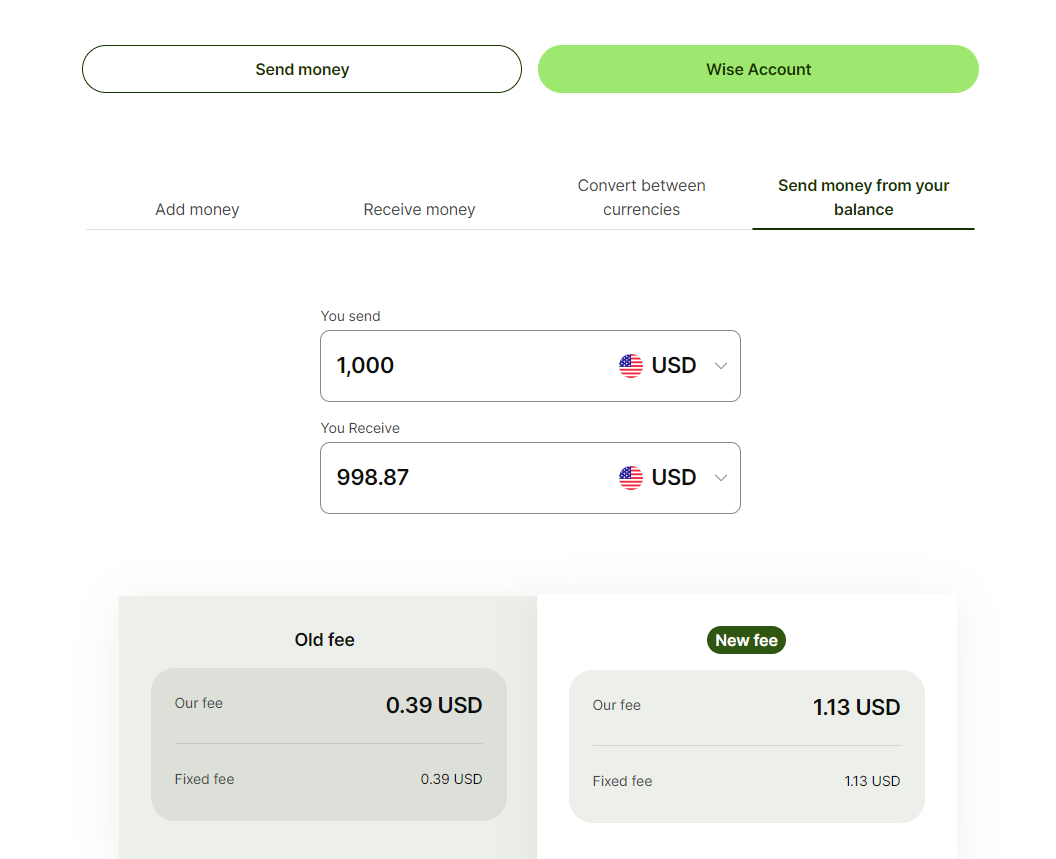

check the revised pricing before you make transactions https://wise.com/price-change/borderless-se...urceAmount=1000

|

|

|

|

|

|

May 11 2024, 04:07 PM May 11 2024, 04:07 PM

|

Senior Member

1,350 posts Joined: Nov 2004 From: HEAVEN & HELL |

does anyone encounter using WISE for exchange SGD to MYR need to submit documents(eg: bank statement , utilities bill ,ID etc)

sum below 2k SGD, previously didnt encounter such issue only recently become like this This post has been edited by heLL_bOy: May 11 2024, 04:08 PM |

|

|

May 12 2024, 08:25 AM May 12 2024, 08:25 AM

Show posts by this member only | IPv6 | Post

#2408

|

Senior Member

4,151 posts Joined: May 2005 |

QUOTE(heLL_bOy @ May 11 2024, 04:07 PM) does anyone encounter using WISE for exchange SGD to MYR need to submit documents(eg: bank statement , utilities bill ,ID etc) Nope. Transferred more than that before also no issue.sum below 2k SGD, previously didnt encounter such issue only recently become like this |

|

|

May 12 2024, 02:38 PM May 12 2024, 02:38 PM

|

Senior Member

1,350 posts Joined: Nov 2004 From: HEAVEN & HELL |

|

|

|

May 12 2024, 08:22 PM May 12 2024, 08:22 PM

Show posts by this member only | IPv6 | Post

#2410

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Medufsaid @ May 11 2024, 02:10 PM) check the revised pricing before you make transactions https://wise.com/price-change/borderless-se...urceAmount=1000 Wah getting more expensive... 😭 |

|

|

May 12 2024, 11:37 PM May 12 2024, 11:37 PM

Show posts by this member only | IPv6 | Post

#2411

|

Junior Member

455 posts Joined: Jun 2012 |

Lately I saw money match rate seems to be cheaper than wise rate. If I don’t have any cimb sg or mbb sg account. Can I actually use money match to remit money into wise account’s sg balance?

|

|

|

May 13 2024, 12:23 AM May 13 2024, 12:23 AM

|

Senior Member

3,495 posts Joined: Jan 2003 |

bokbokchai i think you can try. email moneymatch and see if they allow or nothowever, you might run into issues when u want to withdraw. there's no way to withdraw SGD out to wise (same issue with Moomoo SG now, you can deposit in via Wise, but cannot withdraw out), and in SGD/out USD might get you flagged as "trying to use IBKR as a money changer" you can always try it out and tell us if IBKR sends u a warning email This post has been edited by Medufsaid: May 13 2024, 12:39 AM bokbokchai liked this post

|

|

|

May 14 2024, 08:54 PM May 14 2024, 08:54 PM

Show posts by this member only | IPv6 | Post

#2413

|

Junior Member

567 posts Joined: Oct 2004 |

Is it better to move money on Wise during business hours or does it not matter ?

MYRNZD |

|

|

|

|

|

May 14 2024, 08:58 PM May 14 2024, 08:58 PM

|

Senior Member

3,495 posts Joined: Jan 2003 |

Chiggah doesn't matter for Wise. fee consistent all day long. according to this poster Wise NZD transfer is cheap. don't know if you'll get cheaper if u can TT via HSBC premier QUOTE the rate still better than I carry NZD to exchange at money changer in Malaysia (which I used to do in the past) This post has been edited by Medufsaid: May 14 2024, 08:59 PM Chiggah liked this post

|

|

|

May 14 2024, 09:07 PM May 14 2024, 09:07 PM

Show posts by this member only | IPv6 | Post

#2415

|

Junior Member

567 posts Joined: Oct 2004 |

QUOTE(Mr Gray @ Feb 22 2024, 01:13 AM) It's a bit unclear. So u want to transfer from NZD to MYR bank account using Wise. Correct? Both NZD and MYR account are yours, correct? No necessary to apply for wise debit card. You what to transfer money, not use the debit card. I want to transfer from MYR to NZDDo you actually have NZD bank account in New Zealand, or are you just referring to NZD account in Wise? You only need one Wise account. Have you actually signed up for one? AFAIK accounts registered outside Malaysia cannot hold MYR balance, so what happens is Wise will act as intermediary, and directly transfer your NZD to Malaysian bank account within seconds. I'm not sure if your wise account registered in Malaysia or NZ? You were a bit unclear. So to summarise: Transfer any currencies to MYR, using Malaysian bank account. Yes possible. Transfer any currencies to Wise MYR balance. Possible if wise account registered in Malaysia, not possible if registered outside of Malaysia. Shall I be concerned for the above ? No issue right ? - So my Wise was created in Malaysia - My NZ bank account is under my name - Will I save anything by transferring to my sister Wise account (in NZ) ? |

|

|

May 15 2024, 12:25 AM May 15 2024, 12:25 AM

|

Junior Member

317 posts Joined: Oct 2019 |

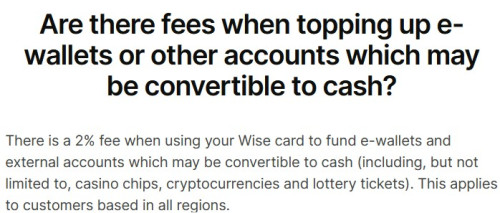

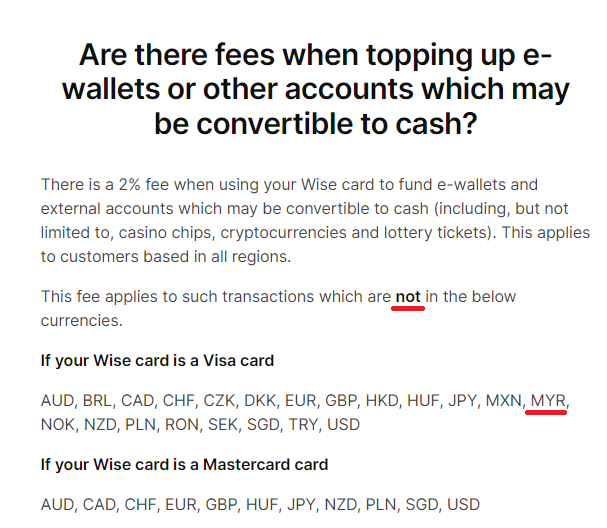

Has anyone tried to topup e-wallet, like Grab, ShopeePay, TnG, with Wise debit card? It looks like Wise charges 2% for topping up e-wallets.  This post has been edited by biertrinker: May 15 2024, 02:22 AM biertrinker liked this post

|

|

|

May 15 2024, 05:30 AM May 15 2024, 05:30 AM

|

Senior Member

3,495 posts Joined: Jan 2003 |

biertrinker i topup to Bigpay and TnG before, no fee. you didn't read the 2nd half of the Wise help article  syaaron liked this post

|

|

|

May 17 2024, 11:08 AM May 17 2024, 11:08 AM

Show posts by this member only | IPv6 | Post

#2418

|

Junior Member

112 posts Joined: Dec 2020 |

Hi all, I have some questions regarding wise. I will be heading to the UK soon for student exchange. How does the card work to transfer money from MYR to GBP?

Is it that you convert to GBP via wise then transfer into the account or straight deposit MYR, then able to use GBP in the UK? As my parents are to transfer money to me from Malaysia to the UK so I assume they also need the wise app right? |

|

|

May 17 2024, 12:13 PM May 17 2024, 12:13 PM

Show posts by this member only | IPv6 | Post

#2419

|

Senior Member

4,151 posts Joined: May 2005 |

QUOTE(df569 @ May 17 2024, 11:08 AM) Hi all, I have some questions regarding wise. I will be heading to the UK soon for student exchange. How does the card work to transfer money from MYR to GBP? Your parents can use bank transfer. You keep the wise app cause you need to check your transaction and spending. From your wise app you can see there’s a bank account number for JP Morgan chase. Ask your parents to bank in to that account number and money will reflect in your wise app. If you didn’t convert from MYR to GBP, the app will convert for you when you use the card.Is it that you convert to GBP via wise then transfer into the account or straight deposit MYR, then able to use GBP in the UK? As my parents are to transfer money to me from Malaysia to the UK so I assume they also need the wise app right? Why not consider using GXbank debit card? I was told the rates are better than Wise and you get 1% cash back on all your spending. This post has been edited by Barricade: May 17 2024, 12:16 PM |

|

|

May 17 2024, 12:24 PM May 17 2024, 12:24 PM

|

|||||||||

Senior Member

3,495 posts Joined: Jan 2003 |

crossposting this from GX bank thread. Mastercard rates itself is roughly 0.5%, but the 1% cashback should cover it

Barricade liked this post

|

|||||||||

| Change to: |  0.0255sec 0.0255sec

0.64 0.64

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 07:34 PM |