QUOTE(Barricade @ May 17 2024, 12:13 PM)

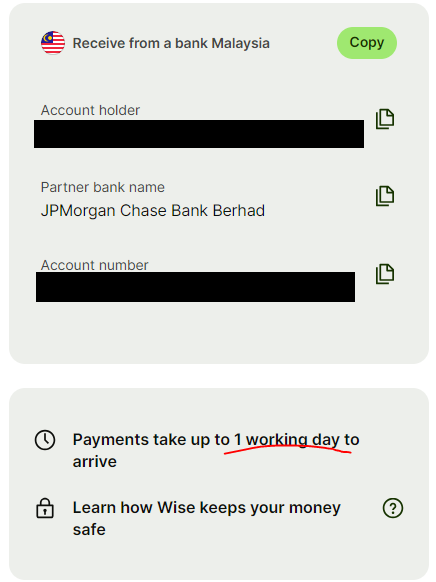

Your parents can use bank transfer. You keep the wise app cause you need to check your transaction and spending. From your wise app you can see there’s a bank account number for JP Morgan chase. Ask your parents to bank in to that account number and money will reflect in your wise app. If you didn’t convert from MYR to GBP, the app will convert for you when you use the card.

Why not consider using GXbank debit card? I was told the rates are better than Wise and you get 1% cash back on all your spending.

Thanks for the reply. From my understanding, my parents bank in JP Morgan MYR, then my Wise app will see MYR added, then I convert to GBP within the app itself OR I can straight away buy things with MYR in UK using the card right

1. Are there bank charges for MYR deposit into JP Morgan account?

2. I assume depending on exchange rate, converting in Wise the MYR received to GBP may or may not be better than directly spending MYR in UK via Wise auto conversion?

GX bank seems interesting, will check it out. Thanks again.

May 17 2024, 11:08 AM

May 17 2024, 11:08 AM

Quote

Quote

0.0895sec

0.0895sec

1.08

1.08

7 queries

7 queries

GZIP Disabled

GZIP Disabled