If direct IBKR to local maybank, or IBKR >wise > local maybank, the FX rate is more expensive?

This post has been edited by Davidtcf: Dec 8 2021, 09:09 AM

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Dec 8 2021, 09:08 AM Dec 8 2021, 09:08 AM

Return to original view | IPv6 | Post

#1

|

Senior Member

3,520 posts Joined: Jan 2003 |

For withdrawal of funds, best to go through wise then cimb sg, then only to our local bank? As per this video?

If direct IBKR to local maybank, or IBKR >wise > local maybank, the FX rate is more expensive? This post has been edited by Davidtcf: Dec 8 2021, 09:09 AM |

|

|

|

|

|

Dec 9 2021, 01:27 AM Dec 9 2021, 01:27 AM

Return to original view | IPv6 | Post

#2

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Yggdrasil @ Dec 8 2021, 08:13 PM) Why need to go through Wise? Just convert to SGD in IBKR then send back to CIMB SG then CIMB MY. Thanks.. Will take note one day when I want to withdraw. For now just deposit and see funds grow.Yeah if you do direct, only god knows what shitty rate they give you especially if you withdraw foreign currency direct to an MYR account. |

|

|

Dec 16 2021, 10:56 PM Dec 16 2021, 10:56 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(HolyAssasin4444 @ Dec 16 2021, 10:23 PM) Some of you may realize that Wise has added Multi Currency account for us Malaysians again (finally..) Have you tried withdraw directly from IBKR (convert to MYR in IBKR) to Wise, then to local bank account?I've experimented with deposits, here's what I have confirmed, and what I recommend to do for the cheapest route: 1) USD ACH is allowed. No need to go thru wire. Confirmed with transactions made yesterday and went thru. 2) If you need USD in IB, convert directly to USD in TW and send via ACH. For other currencies needed to buy stuff in IBKR, refer below for cheapest: - EUR, AUD, GBP, SEK, DKK, CAD, NZD, SGD, CZK - convert MYR in TW and send directly to IBKR - HUF - (>28.2K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - NOK - (>27.1K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - CHF - (>19.1K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - PLN - (>18.7K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - HKD - (>17.3K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - JPY - (>2.8K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - MXN - (>2K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - TRY, CNY, RUB, ZAR - convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (converting directly if below 1k for TRY CNY and RUB is cheaper but I don't think it's useful info) 3) To spend MYR locally buy rice, convert into GBP in IBKR and send to TW. Then convert into MYR within TW, and withdraw to local bank account (not tested, but should work). Total fee is 2USD(IBKR) + 0.44% (TW) + 1RM (local account withdraw). This is the cheapest route as far as I'm aware of Numbers above is based on Wise fees as of 16th Dec 2021, and USDMYR of 4.2 To compare the fees, if you should convert in TW and send directly, or convert to EUR in TW and then exchange to wanted currency in IBKR, you can compare using: TW fees (wanted currency) vs TW fees (EUR) + 8.4 OR amount threshold = (9.93- fixed fee of wanted currency in TW)/(variable fee of wanted currency in TW - 0.0045) Curious if its rate will beat transferring from IBKR (convert to SGD) to SG CIMB, then using wise (convert to MYR here) transfer to MY Cimb account. Troublesome part here is need to purposely go open a cimb MY and SG account and maintain both. This post has been edited by Davidtcf: Dec 16 2021, 10:58 PM |

|

|

Dec 17 2021, 12:37 AM Dec 17 2021, 12:37 AM

Return to original view | IPv6 | Post

#4

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(HolyAssasin4444 @ Dec 17 2021, 12:02 AM) Can't convert to MYR in IBKR. Ringgit is not traded there. If you want to convert to SGD and withdraw, can directly transfer to Wise SGD balance instead then convert to MYR. No need for CIMB anymore. Only reason why I suggested GBP is because the conversion fees is slightly lower than SGD (.44% vs .53%) Cool will do that one day. Yea doesn't make sense for me to open 2 bank accounts just for one withdrawal.Earlier follow Ziet Invest video but since now Wise got option might as well utilize it. We know it charge good rates for transferring and FX conversion too. Thanks a lot! This post has been edited by Davidtcf: Dec 17 2021, 12:38 AM |

|

|

Dec 23 2021, 10:45 AM Dec 23 2021, 10:45 AM

Return to original view | Post

#5

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(hghg.hg @ Dec 22 2021, 01:01 AM) Hi all, start investing la. what are you waiting for? earlier you invest the more you earn. US stocks and ETFs worth to buy.I just created my ibkr acct and approved last week. Today received this email 'while sufficient to subscribe to real-time quotes this month, is projected to be below the minimum threshold necessary to subscribe the following month. Should the equity in your account remain below the minimum threshold requirement, your subscriptions will be terminated at the end of next month. There is no requirement that you subscribe to real-time data through IBKR to trade. However, we recommend that you take the steps necessary now to deposit funds in order to prevent any future potential interruptions in service.' Do we need to transact ASAP? Didn't subscribe to any real time data though just the non professional default subscription which I don't see any fees associated. Anyone have the same email or any advice what does it means? Update: According to the response, it is just a general system generated message sent out. Start off with ETFs first, later comfy already then try stocks (research first before buy stocks). Check the below videos they will guide you: (if wanna withdraw next time check his other video) Why US stocks? check this: This post has been edited by Davidtcf: Dec 23 2021, 10:46 AM |

|

|

Dec 24 2021, 01:08 AM Dec 24 2021, 01:08 AM

Return to original view | Post

#6

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Ivan113 @ Dec 23 2021, 08:44 PM) after procrastinated for half a year, I finally opened an IBKR and CIMB Singapore account. Transferring from Wise to CIMB Singapore has a fee, then currency conversion from SGD to USD in IBKR also got a fee, this is normal right? Ziet recommend direct from MY bank to Wise then to IBKR as the fees via Wise is much cheaper now. Someone correct me if I'm wrong.Wise fee is ok, but the currency conversion in IBKR from SGD to USD is really pain, I lost like around 3 usd for a 490 SGD conversion to USD, is there a better way to convert to usd? Also not required to maintain SG CIMB + MY CIMB account. Savings account if left dormant after some time will close (who knows one day might stop dca?) with some charges. Then I heard from others now can direct transfer from IBKR to Wise (as Wise now has your personal name on it for transfer) then to MY bank. Have not tried this yet. Wise conversion rate also almost close to market rate. |

|

|

|

|

|

Dec 24 2021, 08:38 AM Dec 24 2021, 08:38 AM

Return to original view | Post

#7

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Dec 24 2021, 10:49 AM Dec 24 2021, 10:49 AM

Return to original view | Post

#8

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Ivan113 @ Dec 24 2021, 10:07 AM) I followed the guide below. The reason why we need CIMB SG is to keep the money trail clean and to prevent audit right? Though I am wondering isn't it the same through Wise > IBKR because Wise has KYC , it is licensed in Malaysia and the name in Wise and my IBKR is the same. I have transferred many times to my IBKR using Ziet's latest method.Also I read somewhere USD transfer from Wise > IBKR does not work, not sure it this is still case. https://ringgitfreedom.com/investing/beginn...-from-malaysia/ Maybank MY > Wise (conversion from MYR to USD happens here) > IBKR (last step your money will only arrive next day). Can bypass steps via SG CIMB bank. Wise there will ask the reason of transfer also as per required by Malaysian law. Happy to see my investments at IBKR growing.. much better than Bursa. This post has been edited by Davidtcf: Dec 24 2021, 10:51 AM Ivan113 liked this post

|

|

|

Dec 24 2021, 01:18 PM Dec 24 2021, 01:18 PM

Return to original view | Post

#9

|

Senior Member

3,520 posts Joined: Jan 2003 |

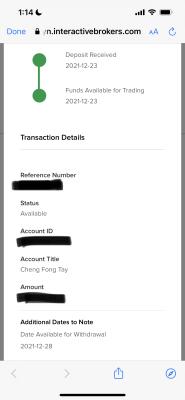

QUOTE(Ramjade @ Dec 24 2021, 12:04 PM) If you are using TransferWise to transfer instead of their borderless account, Interactive broker will send you an email 6-7 months later asking you to proof source of money. Show proof of the email else it didn't happen. Just checked on reddit, Google etc for what u said and no one else reported such incident. If you use wise, the money comes from wise and not in your name. If you use banks, the money comes with your name. Unless it's their borderless account. If you cannot prove it, account will be closed. Real story from some user in Interactive broker sg telegram group. Hence I use sg banks. Avoid the above problem. No email form interactive broker to prove anything so far. Also when I deposit through Wise my name is shown in the transaction history. As attached. Also at Wise there I got provide my full name and address also. So it wouldn't be any different from transferring from SG bank account. When creating Wise account also provided my IC copy. This post has been edited by Davidtcf: Dec 24 2021, 01:25 PM Attached thumbnail(s)

Ivan113 liked this post

|

|

|

Dec 24 2021, 01:32 PM Dec 24 2021, 01:32 PM

Return to original view | Post

#10

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Dec 24 2021, 04:25 PM Dec 24 2021, 04:25 PM

Return to original view | Post

#11

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(premier239 @ Dec 24 2021, 04:14 PM) last time, we use [MY bank acc - cimb sg - ibkr sgd - convert to usd] Ya can.. Refer to Ziet's video.now we can directly register usd ach at wise, then [MY bank acc - top up usd in wise - ibkr usd] ? ----- Ziet had uploaded latest video on withdrawing from IBKR to Wise. If transfer above USD2k this method is cheaper. Else use the usual SG CIMB method but need wait longer time to get funds for that: Really through video for this. Earlier I tried failed coz enter a few details wrong. Finally know how to! Do support him by liking and subscribe 👍 This post has been edited by Davidtcf: Dec 24 2021, 04:26 PM |

|

|

Dec 25 2021, 01:46 PM Dec 25 2021, 01:46 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Dec 24 2021, 11:59 PM) QUOTE(Yggdrasil @ Dec 25 2021, 12:50 AM) I don't have a borderless account. Previously, I've done transfers without issues. Thanks both. Will set aside all the proof of transaction between my maybank and wise. And also all proof of statements between Wise to IBKR. Whatever pdf documents got just save them into a folder. Scare corrupt computer save into cloud drive then settle.However, lately they have been asking questions and sent the warning to me as well. Now I send to my SG bank account first then send to IBKR. At least it's under my name. Means if transfer direct from CIMB SG to IBKR only can avoid this compliance check? Won't it be expensive for the FX rate since bank conversion to USD is shitty rate? Or u guys are converting SGD to USD at IBKR? Confused here. I rather use Wise if get to save on the FX conversion. Direct FPX transfer from my local Maybank to Wise, convert to USD also chun there, then straight send to IBKR. Save all the statements if IBKR ask. We not doing anything wrong so nothing to worry. FX = Forex conversion This post has been edited by Davidtcf: Dec 25 2021, 01:54 PM |

|

|

Dec 25 2021, 03:36 PM Dec 25 2021, 03:36 PM

Return to original view | Post

#13

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Dec 25 2021, 02:08 PM) Cimb sg -> Ibkr using FAST transfer (sg version of duitnow/ibft) of SGD then convert inside Ibkr for usd2.00. IBKR gives you spot exchange rate (real time market rates without any markup). Ibkr rates > TransferWise rates anytime, anyday. |

|

|

|

|

|

Dec 25 2021, 04:20 PM Dec 25 2021, 04:20 PM

Return to original view | Post

#14

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Dec 25 2021, 03:49 PM) Got. You need usd25k for margin I believed. Rates is currently 1.5%p.a. Sure to increase next once fed increase interest rate. not cheap.. Ziet already did comparison between transferring from traditional SG CIMB method vs Wise method. Jump direct here:Finteh is basically giving you money changer ratr already which is cheaper than banks. Ibkr on the other hand give you real time market rates. Ibkr not popular for Forex cause I think they strict with their margin. Cheap. For someone who regularly transfer RM12-15k per transaction. https://youtu.be/dJYzHEnBhJs?t=449 Wise method still cheapest. So now most important is to keep all the receipt once transfer done. I'm saving them all to my Dropbox and will access these files on my mobile as well. Everyday make sure check email in case got audit request from IBKR. It is up to you if want to continue use SG CIMB transfer to IBKR. For me will stick to Wise method. Last time Ziet recommend CIMB SG to IBKR is due to IBKR not accepting transfers from Wise. Then later on only they started accepting transfers from Wise hence his updated video. Ziet also got state that IBKR recommends us to keep all receipts of transfers in case of audit (for Wise direct transfer method): https://youtu.be/dJYzHEnBhJs?t=690 Not everyone has RM12-15k to transfer each time lol. (just found out for maybank downloadable statement is once every 3 months via M2U: https://www.maybank2u.com.my/maybank2u/mala..._statement.page ). If newer transactions can screenshot at M2U only. This post has been edited by Davidtcf: Dec 25 2021, 10:13 PM |

|

|

Dec 26 2021, 12:09 AM Dec 26 2021, 12:09 AM

Return to original view | Post

#15

|

Senior Member

3,520 posts Joined: Jan 2003 |

Yes I had did many deposits from wise to IBKR.. All next day arrive, so far no delays. As long input as to how he had guided in the video.

|

|

|

Dec 28 2021, 08:56 AM Dec 28 2021, 08:56 AM

Return to original view | IPv6 | Post

#16

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Dec 28 2021, 10:41 AM Dec 28 2021, 10:41 AM

Return to original view | Post

#17

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Ivan113 @ Dec 28 2021, 10:21 AM) I done a test last night at around 10pm of sending USD from Wise directly to IBKR, received in IBKR this morning. Is this the recommended way? Hope they won't audit me in the future once transfer in Wise complete can save the deposit and transfer out receipts from the page. I save them all in my dropbox folder that I can access on my PC and phone. Also added in dates for each file. So in case one day kena korek/audited, can quickly send to IBKR. Ivan113 liked this post

|

|

|

Dec 28 2021, 10:45 AM Dec 28 2021, 10:45 AM

Return to original view | Post

#18

|

Senior Member

3,520 posts Joined: Jan 2003 |

I ask their chat support.. they just reply me as long I got the money in IBKR it's fine. Don't need to keep the receipts also ok. (but to be safe will still download and keep) QUOTE ChatSys: This chat is associated with ticket #337089. Please record this number for use in future inquiries. You are currently in room 'Funds And Banking'. the above chat support need to be accessed while you are still logged in. Go to help there > support and search for chat function. If not logged in can't trigger this.davidtcf85: how long do I have to keep my Transferwise deposit receipts? Alfred L: Hello, this is 'Alfred L'. Please allow me a moment to read the question you submitted to iBot and I'll respond to you shortly. Hello, this is 'Alfred L'. Could you please explain more? davidtcf85: I would like to know how long do I have to keep my Transferwise deposit receipts into IBKR? I have known others that have been audited by IBKR via email asking for more documents to prove that the fund is theirs? Hence would like to know how long do I have to keep the receipts, is it 1 year, 3 years, 5 years, or indefinitely? Thanks. Transferwise website: https://wise.com/ Alfred L: You should keep the receipts until you receive the fund ChatSys: ATTACHED FILE : audit1.jpg davidtcf85: ^the audit looks like this ChatSys: ATTACHED FILE : audit1.jpg ATTACHED FILE : audit2.jpg Alfred L: do you receive the fund in IB? davidtcf85: yea I received so far transferred many times, will receive next day Alfred L: so it should be fine. davidtcf85: i just concern of being audited one day ChatSys: ATTACHED FILE : chat in whatsapp group IBKR - usine Wise transfer.pdf davidtcf85: ^ i combined all 3 pics into one if there's any info u have on IBKR's audit for such deposits do let me know cant find it anywhere in the FAQ about such audit also this one someone posted in whatsapp group chat for IBKR Alfred L: there may be some review of your account only when compliance think the fund is suspicious (eg. third party) This post has been edited by Davidtcf: Dec 28 2021, 10:49 AM Ivan113 liked this post

|

|

|

Dec 30 2021, 08:44 AM Dec 30 2021, 08:44 AM

Return to original view | Post

#19

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(tadashi987 @ Dec 29 2021, 10:38 PM) if their fees are competitive it will be better than IBKR? provided if we can direct FPX from our local banks to it. Can save so much on Wise fees and avoid audit also. Will wait for launch and compare the difference. |

|

|

Dec 30 2021, 10:24 AM Dec 30 2021, 10:24 AM

Return to original view | Post

#20

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(tadashi987 @ Dec 30 2021, 09:27 AM) yep it will be good but doubt it will be as competitive as IBKR, for the tax side still remain unclear how the implementation will be yea let them try that FSI tax for a year.. i bet those datuk2 and gov ppl will start complain since many of them have holdings and stocks overseas. not like we gonna withdraw soon if invest in US anyway... just parking my funds there till I'm old or in need of money only withdraw. hope for change in gov also.. opposition parties have all disagreed with this tax implementation. no other better choice, if invest in Bursa as small fish die also.. rather invest long term in IBKR. This post has been edited by Davidtcf: Dec 30 2021, 10:28 AM |

| Change to: |  0.0346sec 0.0346sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 05:29 PM |