QUOTE(T231H @ Jul 21 2021, 09:30 AM)

no an expert in tax things or any sort of things,...

from your link,

was just wondering,

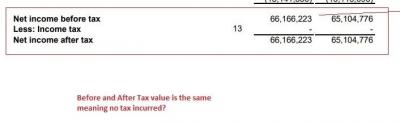

why is the value of Before tax and After Tax is the same,.... does it mean no tax incurred?

regarding "the fund has higher expense ratio due to taxation advisory services by Deloitte Tax Services Sdn Bhd"

reading from the report, the taxation advisory services money being paid ....is it 7,369 + 2,055 ?

if YES,...then what is the value of that Tax Expense Ratio be considering the value of the fund size (5,010,850,587)?

is TER calculated as being that?

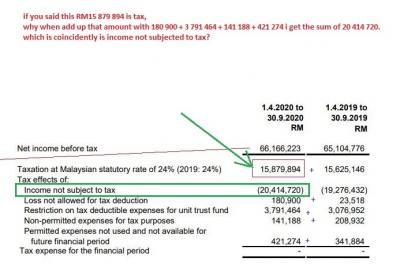

The income was deduction from expenses and if you notice there was amount of rm15million being taxed 24% which you attached on the right hand corner due to income from corporate bonds from your link,

was just wondering,

why is the value of Before tax and After Tax is the same,.... does it mean no tax incurred?

regarding "the fund has higher expense ratio due to taxation advisory services by Deloitte Tax Services Sdn Bhd"

reading from the report, the taxation advisory services money being paid ....is it 7,369 + 2,055 ?

if YES,...then what is the value of that Tax Expense Ratio be considering the value of the fund size (5,010,850,587)?

is TER calculated as being that?

For tax expenses it is about 0.02% of ter based on the amount

Jul 22 2021, 12:48 AM

Jul 22 2021, 12:48 AM

Quote

Quote

0.0430sec

0.0430sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled