QUOTE(stormseeker92 @ Feb 16 2021, 09:02 PM)

Siao one, dunno how they picked that ETF Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Feb 16 2021, 09:41 PM Feb 16 2021, 09:41 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

|

|

|

|

|

|

Feb 16 2021, 10:39 PM Feb 16 2021, 10:39 PM

|

Junior Member

275 posts Joined: May 2020 From: Kuala Lumpur |

|

|

|

Feb 16 2021, 10:54 PM Feb 16 2021, 10:54 PM

|

Junior Member

900 posts Joined: Oct 2009 |

wondering why some of you here have the automate executed sell then buy order...when you are not even transferring in money to SA...hmm

|

|

|

Feb 16 2021, 11:04 PM Feb 16 2021, 11:04 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(gundamsp01 @ Feb 16 2021, 10:54 PM) wondering why some of you here have the automate executed sell then buy order...when you are not even transferring in money to SA...hmm https://www.stashaway.my/r/what-is-rebalancing Quazacolt and gundamsp01 liked this post

|

|

|

Feb 16 2021, 11:28 PM Feb 16 2021, 11:28 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Feb 17 2021, 12:01 AM Feb 17 2021, 12:01 AM

Show posts by this member only | IPv6 | Post

#11906

|

Senior Member

2,610 posts Joined: Aug 2011 |

KWEB's returns are just absurd. Not complaining

|

|

|

|

|

|

Feb 17 2021, 12:15 AM Feb 17 2021, 12:15 AM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

QUOTE(DragonReine @ Feb 17 2021, 12:01 AM) KWEB's returns are just absurd. Not complaining GLD makes me depressed but KWEB leaves me impressed.StashAway giveth and taketh. encikbuta and DragonReine liked this post

|

|

|

Feb 17 2021, 12:25 AM Feb 17 2021, 12:25 AM

Show posts by this member only | IPv6 | Post

#11908

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Feb 17 2021, 12:30 AM Feb 17 2021, 12:30 AM

|

Junior Member

689 posts Joined: Mar 2020 |

Good good. my buy order is tomorrow. Drop a bit please

|

|

|

Feb 17 2021, 12:44 AM Feb 17 2021, 12:44 AM

|

Junior Member

131 posts Joined: Apr 2013 |

slightly off topic but since we are talking about KWEB. anyone knows any similar funds we can buy from FSM Malaysia ?

|

|

|

Feb 17 2021, 02:08 AM Feb 17 2021, 02:08 AM

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(timeekit @ Feb 17 2021, 12:44 AM) slightly off topic but since we are talking about KWEB. anyone knows any similar funds we can buy from FSM Malaysia ? FSMOne to my knowledge does not have ETFs (passively managed), only mutual funds (actively managed) https://www.investopedia.com/articles/inves...utual-funds.aspBecause of the different nature between ETF and mutual funds, there are very little asset overlap between available funds on FSMOne with KWEB. The closest equivalent would be funds that includes investments in China/Far East region. For the most part they have rocketed up like KWEB because of China's bull run market. This post has been edited by DragonReine: Feb 17 2021, 02:11 AM |

|

|

Feb 17 2021, 02:15 AM Feb 17 2021, 02:15 AM

Show posts by this member only | IPv6 | Post

#11912

|

Senior Member

1,210 posts Joined: Nov 2011 |

For what its worth, I've bought some MYR domiciled TradePlus S&P New China Tracker ETF on bursa myself recently. https://tradeplus.com.my/new_china-tracker can check how much overlap with KWEB if interested I guess?

|

|

|

Feb 17 2021, 06:06 AM Feb 17 2021, 06:06 AM

Show posts by this member only | IPv6 | Post

#11913

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(Hoshiyuu @ Feb 17 2021, 02:15 AM) For what its worth, I've bought some MYR domiciled TradePlus S&P New China Tracker ETF on bursa myself recently. https://tradeplus.com.my/new_china-tracker can check how much overlap with KWEB if interested I guess? Boss, wanna ask about this etf. Got sales charge for this etf? Or platform fee? I go flip2 but still dun under stand the fee involved. Only know the fee involve in mutual fund. I do purchase mutual fund that invest in this etf, by affin oso with sales charge 1% (but now is 0% sales charge) This post has been edited by ironman16: Feb 17 2021, 06:07 AM |

|

|

|

|

|

Feb 17 2021, 07:18 AM Feb 17 2021, 07:18 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Feb 17 2021, 06:06 AM) Boss, wanna ask about this etf. Fee to buy this ETF directly from Bursa Malaysia depends on your trading account that you opened with investment house/platform.Got sales charge for this etf? Or platform fee? I go flip2 but still dun under stand the fee involved. Only know the fee involve in mutual fund. I do purchase mutual fund that invest in this etf, by affin oso with sales charge 1% (but now is 0% sales charge) There is min fee for each buy and sell order. And also liquidity of local ETFs (volume) is not as inspiring as those listed at NYSE. |

|

|

Feb 17 2021, 07:21 AM Feb 17 2021, 07:21 AM

Show posts by this member only | IPv6 | Post

#11915

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Feb 17 2021, 07:18 AM) Fee to buy this ETF directly from Bursa Malaysia depends on your trading account that you opened with investment house/platform. I know it under affin, but makin tengok makin blur, totally not same with mutual fund. There is min fee for each buy and sell order. And also liquidity of local ETFs (volume) is not as inspiring as those listed at NYSE. No sales charge? If oledi add into the NAV it's OK. https://tradeplus.com.my/new_china-tracker At first wanna go with this etf but last just use allocate plus buy mutual fund that invest in this etf. This post has been edited by ironman16: Feb 17 2021, 07:22 AM |

|

|

Feb 17 2021, 07:40 AM Feb 17 2021, 07:40 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Feb 17 2021, 07:21 AM) I know it under affin, but makin tengok makin blur, totally not same with mutual fund. ETF is exchanged traded fund which is not exactly similarly to unit trust fund.No sales charge? If oledi add into the NAV it's OK. https://tradeplus.com.my/new_china-tracker At first wanna go with this etf but last just use allocate plus buy mutual fund that invest in this etf. ETF is usually be bought directly via trading platform unless there's a feed fund by mutual/unit fund manager. Each matched buy and sell order placed in the trading platform will be incurred with fee. There's also stamp duty and clearing fee which is not as significant as the brokerage fee. Also it has annual management fee like unit trust but it won't be as high as unit trust fund. This post has been edited by GrumpyNooby: Feb 17 2021, 07:49 AM |

|

|

Feb 17 2021, 07:53 AM Feb 17 2021, 07:53 AM

Show posts by this member only | IPv6 | Post

#11917

|

Senior Member

2,992 posts Joined: Feb 2015 |

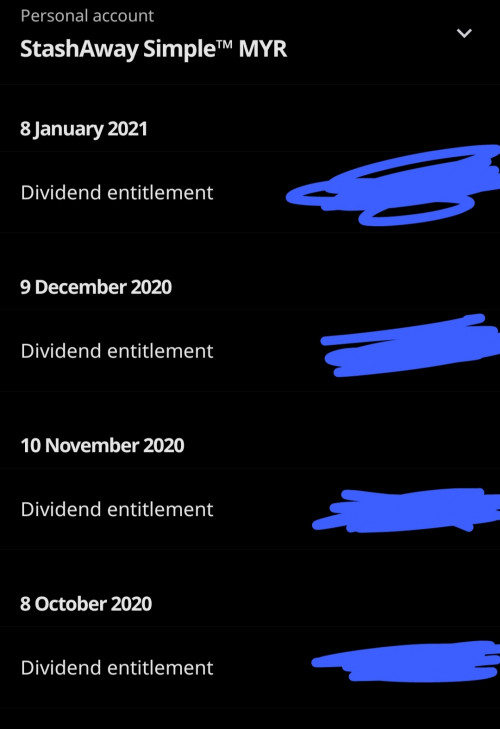

QUOTE(DragonReine @ Feb 16 2021, 05:46 PM) Need to tap Account Transactions > choose "StashAway Simple™ MYR" to see dividends I did but no update regarding dividends or interest paid shown under transaction - > SA Simple MYR but the SA simple page did show a few ringgit appreciation or earned. 🤔the account transactions general page only shows the movement of money between your bank account to your portfolios, transfer of money between portfolio, and the status of whether money have been redeemed/invested. similarly with Simple, any rebalancing, unit buy/sells, and dividend payouts for bonds within investment portfolios won't show in account transactions, if you want to see details you need to look up the portfolios the same way as above This post has been edited by AthrunIJ: Feb 17 2021, 07:54 AM |

|

|

Feb 17 2021, 08:03 AM Feb 17 2021, 08:03 AM

Show posts by this member only | IPv6 | Post

#11918

|

All Stars

12,268 posts Joined: Oct 2010 |

|

|

|

Feb 17 2021, 08:26 AM Feb 17 2021, 08:26 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 17 2021, 08:37 AM Feb 17 2021, 08:37 AM

Show posts by this member only | IPv6 | Post

#11920

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(AthrunIJ @ Feb 17 2021, 07:53 AM) I did but no update regarding dividends or interest paid shown under transaction - > SA Simple MYR but the SA simple page did show a few ringgit appreciation or earned. 🤔 odd 🤔 check with SA help? mine looks like this (filtered to show dividend entitlement entries) |

| Change to: |  0.0246sec 0.0246sec

0.35 0.35

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 04:13 AM |