QUOTE(GrumpyNooby @ Feb 17 2021, 12:13 PM)

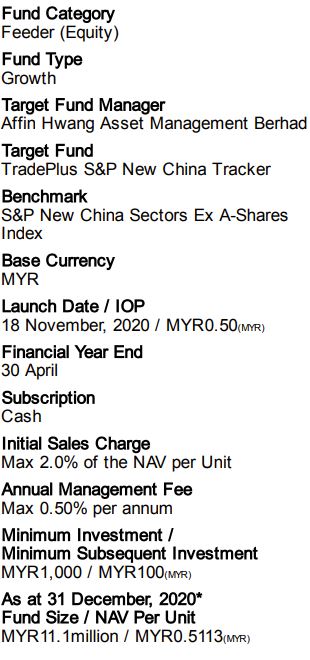

It is a feeder fund feeding into that ETF.

Affin Hwang New China Tracker Fund:

https://nadiablob.blob.core.windows.net/fun...FFS_NCTFHCF.pdf

ya , i know but seen like i not familiar with etf, so stick to this mutual fund first.... Affin Hwang New China Tracker Fund:

https://nadiablob.blob.core.windows.net/fun...FFS_NCTFHCF.pdf

QUOTE(Hoshiyuu @ Feb 17 2021, 12:19 PM)

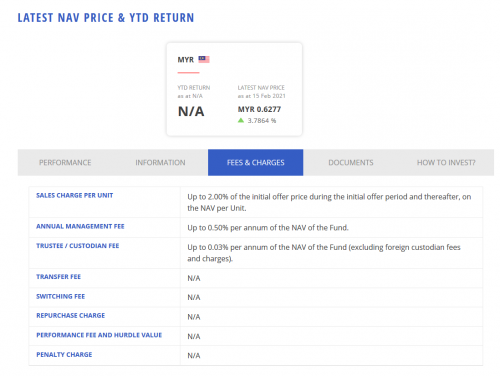

Yeap looking at it too, just found it at https://affinhwangam.com/invest-with-us/lis...tails?q=NCTFHCF

This product was launched very recently at 2020 Nov compared to the ETF which was launched Jan 2019 (AFAIK)

Fees wise they seem to match each other on management fee, so there is just the difference in sale charge. You seem to get to buy at RM100 increments too after initial investment.

It does mention about 6.8% of your investment is held in cash/money market funds/deposits instead of all in, so maybe there is a tiny bit of difference?

i think may b not berbaloi sikit seen it charge 2 times in affin , but nvm, now is promo period, 0% sales charge....in dulu... This product was launched very recently at 2020 Nov compared to the ETF which was launched Jan 2019 (AFAIK)

Fees wise they seem to match each other on management fee, so there is just the difference in sale charge. You seem to get to buy at RM100 increments too after initial investment.

It does mention about 6.8% of your investment is held in cash/money market funds/deposits instead of all in, so maybe there is a tiny bit of difference?

Feb 17 2021, 01:06 PM

Feb 17 2021, 01:06 PM

Quote

Quote 0.0249sec

0.0249sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled