Better setup both : Alipay and weixin pay before travel. Some merchant use diff payment.

Weixin - limited to 3 card (green card)

Alipay - can put more than 3 card. You can set priority payment and rename card. Can get summary of total expenses and category. You can export out as well. (blue card)

There is one time merchant help me to pay from alipay to his wechat (cross payment). If one cc failed, it will help you to failover to next cc. Therefore advice to put more cc inside

Make sure both are verified with passport before travel.

Alipay also can get metro and bus qr for payment. I prefer alipay as more friendly to non chinese people. Weixin sometime in chinese, so i use another phone to do translation. Didi also in Alipay (English)

Bring 2 phones . one for help u to do translation (non chinese). Download the language first.

Use MY roaming so u dont get block on their firewall. No need vpn.

Some tips:

a) Use Amap - navigation (english friendly)

b) Apple Map work. Amap better.

If you know chinese, then no major issue compare to me.

This post has been edited by ericlaiys: Jul 25 2025, 10:44 AM

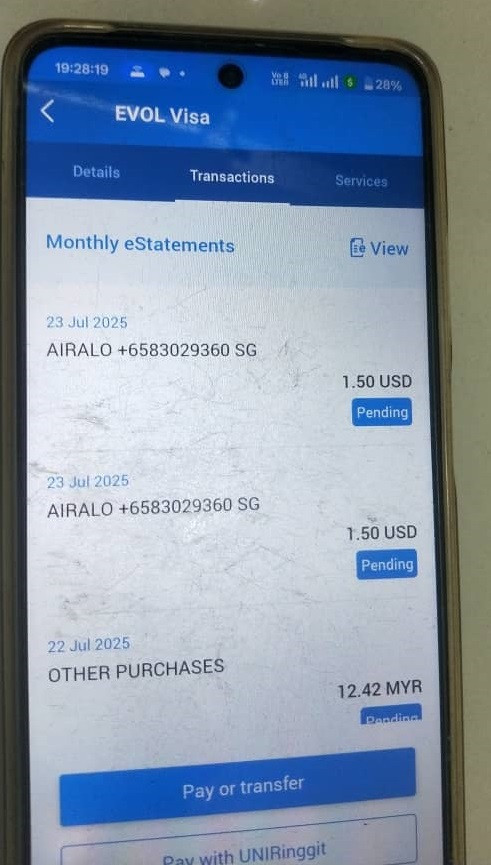

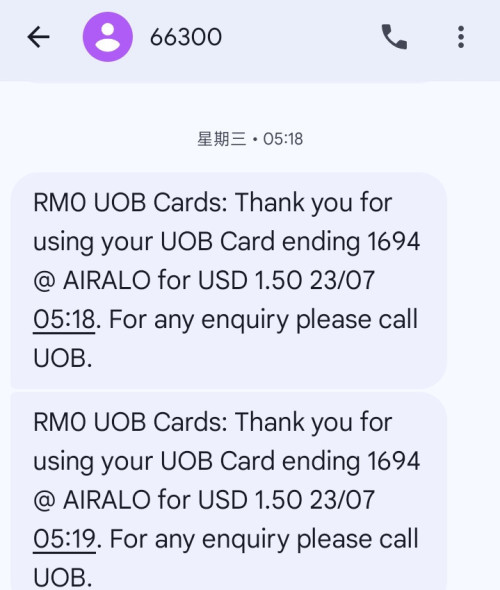

Credit Cards UOB Credit Cards v9, Ex citi read post 2

Jul 25 2025, 10:43 AM

Jul 25 2025, 10:43 AM

Quote

Quote

0.0266sec

0.0266sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled