My favourite would be OCBC 360 Account. It is easy to fulfill the conditions to get 4.1%. Even without the credit card spend, it is still easy to fulfill the conditions to get 2.9%. It is flexible in the sense that you do not need to fulfill all conditions to get the bonus interest. There is also an Islamic version, OCBC 360 Account-i which is similar although one of the bonus category is based on debit card spending instead of credit card spending.

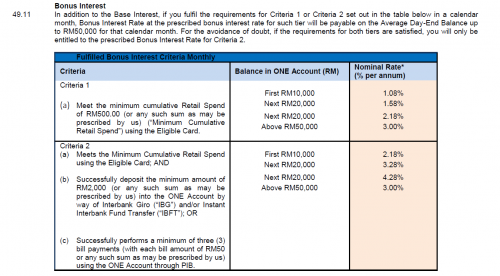

Personally speaking, I think the RHB Smart Account and UOB ONE Account are not that worth it as the actual effective rate is not that high and they are too restrictive. Must fulfill one condition first before other conditions to qualify for the bonus interest rate. UOB ONE Account bonus interest rate is based on split-tier, meaning the maximum effective rate is much lower than the advertised maximum rate of 4.28%. UOB EAccount is much better if one has more than 50k, as the rate is 3.6% without any hassle.

HLB Pay & Save account is also not bad but a bit troublesome to fulfill all the conditions to get the maximum rate (3.5%). At least, it is more flexible in the sense one does not need to fulfill one condition first before fulfilling other conditions to be eligible for the bonus interest. Beware of the islamic version Pay & Save Account-i, as the rate is based on split-tier similar to UOB ONE account. Although both are similar in terms of features, the conventional one has higher interest rate as it is based on the whole balance.

Conditional High Yield Savings Account

Oct 26 2017, 03:26 PM

Oct 26 2017, 03:26 PM

Quote

Quote

1.4137sec

1.4137sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled