Return also will have 6 months moratorium?

This post has been edited by waghyu: May 4 2020, 01:28 AM

Conditional High Yield Savings Account

Conditional High Yield Savings Account

|

|

May 4 2020, 01:27 AM May 4 2020, 01:27 AM

|

Senior Member

3,389 posts Joined: Sep 2019 |

Return also will have 6 months moratorium?

This post has been edited by waghyu: May 4 2020, 01:28 AM |

|

|

|

|

|

May 4 2020, 03:52 PM May 4 2020, 03:52 PM

|

Junior Member

283 posts Joined: Mar 2015 |

QUOTE(GigaX88 @ May 4 2020, 01:24 AM) "Your SavePlus Account has never looked better than this"???Well, it has. It started with 3.5%!!! |

|

|

May 4 2020, 03:59 PM May 4 2020, 03:59 PM

|

Newbie

32 posts Joined: Jan 2017 |

|

|

|

May 4 2020, 04:45 PM May 4 2020, 04:45 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(GigaX88 @ May 4 2020, 03:59 PM) I think it is better now right? With 3.00% + 1.2% promotional = 4.2% there is a fine print.. only applicable to tiers below RM200kThe current highest % within promotion period. so max of 2.75% only.. once u hit above 200k its 3% without gimmicks This post has been edited by zenquix: May 4 2020, 04:46 PM |

|

|

May 4 2020, 04:49 PM May 4 2020, 04:49 PM

Show posts by this member only | IPv6 | Post

#405

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

|

|

|

May 4 2020, 05:26 PM May 4 2020, 05:26 PM

|

Newbie

32 posts Joined: Jan 2017 |

|

|

|

|

|

|

May 4 2020, 09:45 PM May 4 2020, 09:45 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

new product with 3.00%p.a. eh....?

BNM later announce reduce OPR, will they reduce? if they don't reduce, then it's pretty good for those who looking for cash liquidity and has 200k after SCB & OCBC. LOL |

|

|

May 4 2020, 11:18 PM May 4 2020, 11:18 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(ProxMatoR @ May 4 2020, 09:45 PM) new product with 3.00%p.a. eh....? as per vrek it seems they have been revising .. tho no idea on frequency.BNM later announce reduce OPR, will they reduce? if they don't reduce, then it's pretty good for those who looking for cash liquidity and has 200k after SCB & OCBC. LOL |

|

|

May 5 2020, 07:59 PM May 5 2020, 07:59 PM

Show posts by this member only | IPv6 | Post

#409

|

All Stars

12,387 posts Joined: Feb 2020 |

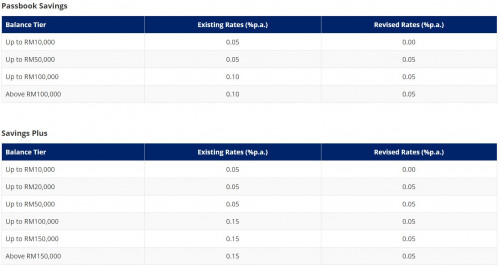

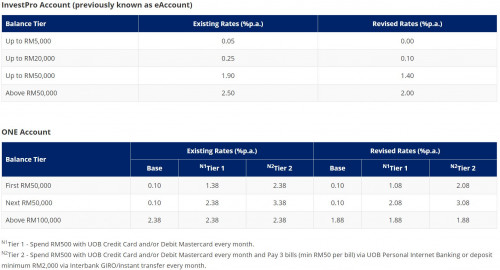

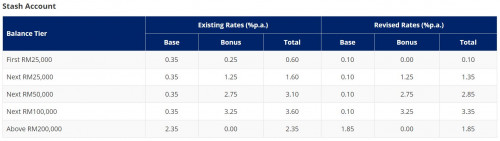

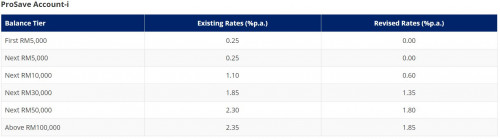

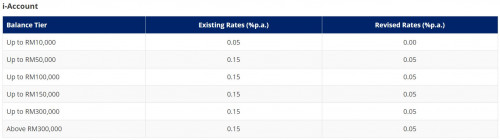

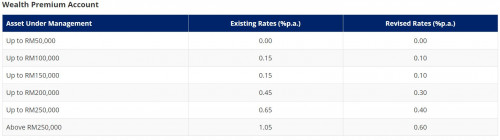

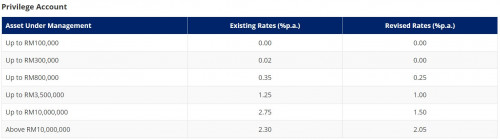

Revision of Deposit Rates (effective 6 May 2020) for UOB

Please be informed that Deposit Rates will be revised respectively to the following:        https://uniservices1.uob.com.my/jsp/finance/fin_sav.jsp https://uniservices1.uob.com.my/jsp/finance/fin_current.html T&C (Conventional): https://www.uob.com.my/web-resources/person...asa-tnc-eng.pdf T&C (Islamic): https://www.uob.com.my/web-resources/person...asa-tnc-eng.pdf This post has been edited by GrumpyNooby: May 5 2020, 08:04 PM |

|

|

May 5 2020, 08:42 PM May 5 2020, 08:42 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

Citibank Max Yield Account (Citigold) seems to be the only account unaffected by the OPR cut all this while. It is still 3% as long as you are willing to give a permanent loan of RM5 million to Citibank, but Citibank time deposit rate is also amongst the lowest amongs all the major banks.

|

|

|

May 6 2020, 12:00 PM May 6 2020, 12:00 PM

|

Junior Member

279 posts Joined: Sep 2017 |

Ambank also updated eflex saving and fixed deposit rate, other conditional accounts no reflected yet

|

|

|

May 6 2020, 01:41 PM May 6 2020, 01:41 PM

|

Senior Member

2,113 posts Joined: Jul 2013 |

|

|

|

May 6 2020, 02:26 PM May 6 2020, 02:26 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

|

|

|

|

|

|

May 6 2020, 03:01 PM May 6 2020, 03:01 PM

|

Senior Member

2,113 posts Joined: Jul 2013 |

|

|

|

May 6 2020, 07:30 PM May 6 2020, 07:30 PM

Show posts by this member only | IPv6 | Post

#415

|

All Stars

12,387 posts Joined: Feb 2020 |

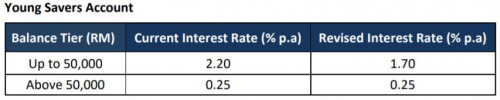

REVISION OF BOARD RATES EFFECTIVE 14 MAY 2020 (for SC)

Kindly be informed that the Fixed Deposit Board Rates and Young Savers for Standard Chartered Bank Malaysia Berhad and Term Deposit-i Board Rates for Standard Chartered Saadiq Berhad, will be revised effective 14 May 2020.  Link: https://av.sc.com/my/content/docs/revision-...youngsavers.pdf |

|

|

May 13 2020, 06:01 PM May 13 2020, 06:01 PM

Show posts by this member only | IPv6 | Post

#416

|

All Stars

12,387 posts Joined: Feb 2020 |

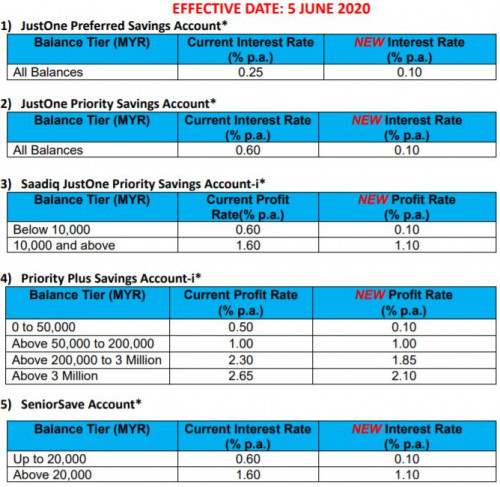

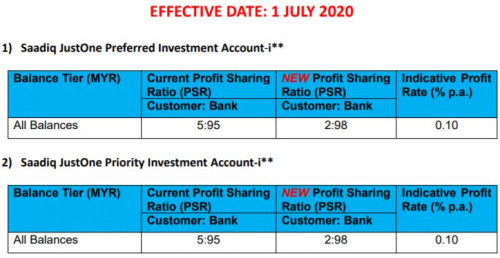

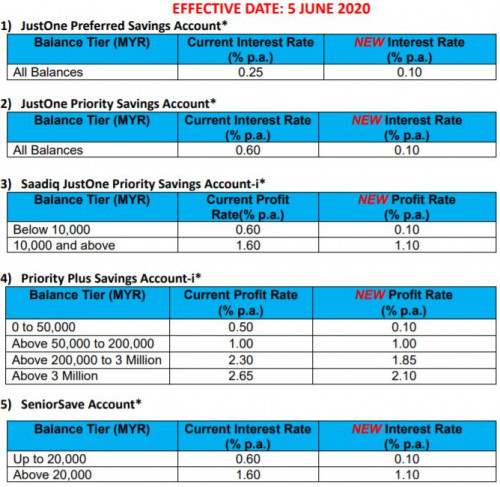

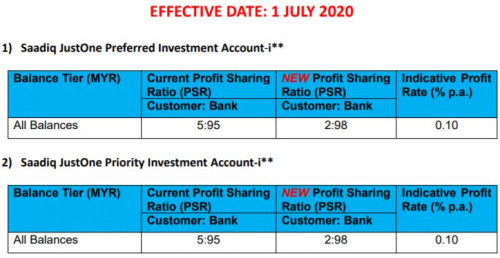

REVISION OF JUSTONE, PRIORITY PLUS-i AND SENIORSAVE INTEREST/PROFIT RATE/ PROFIT SHARING RATIO

Kindly be informed that the interest/profit rate/profit sharing ratio (PSR) for the following products will be revised as follows. All other product features, fees and charges will remain unchanged.   https://av.sc.com/my/content/docs/my-announ...seniorsaver.pdf |

|

|

May 13 2020, 09:11 PM May 13 2020, 09:11 PM

|

Junior Member

279 posts Joined: Sep 2017 |

https://www.rhbgroup.com/others/highlights/..._may/index.html

RHB revision. Bonus Saver Account get cut on one off basis, from 2.65% down to 1.40% |

|

|

May 13 2020, 10:19 PM May 13 2020, 10:19 PM

|

All Stars

18,433 posts Joined: Oct 2010 |

QUOTE(GrumpyNooby @ May 13 2020, 06:01 PM) REVISION OF JUSTONE, PRIORITY PLUS-i AND SENIORSAVE INTEREST/PROFIT RATE/ PROFIT SHARING RATIO PSA remains at 3.6%?Kindly be informed that the interest/profit rate/profit sharing ratio (PSR) for the following products will be revised as follows. All other product features, fees and charges will remain unchanged.   https://av.sc.com/my/content/docs/my-announ...seniorsaver.pdf |

|

|

May 14 2020, 09:29 AM May 14 2020, 09:29 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

Revision of Deposits Rates Effective 14 May 2020 [Affin Bank]

13 May 2020 We wish to inform that effective 14 May 2020, the revised deposits rates are as follows: Revision of Deposits Rates Effective 14 May 2020: https://www.affinonline.com/AFFINONLINE/med..._140520_ENG.pdf For more information, contact our Call Centre at 03-8230 2222, visit your nearest AFFINBANK branch or log on to www.affinonline.com |

|

|

May 15 2020, 05:06 PM May 15 2020, 05:06 PM

Show posts by this member only | IPv6 | Post

#420

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

Wrong thread. This post has been edited by GrumpyNooby: May 15 2020, 05:06 PM |

| Change to: |  0.0296sec 0.0296sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 06:39 AM |