QUOTE(majorarmstrong @ Mar 13 2020, 09:50 PM)

wont be 3% much longerConditional High Yield Savings Account

Conditional High Yield Savings Account

|

|

Mar 13 2020, 10:09 PM Mar 13 2020, 10:09 PM

|

All Stars

65,318 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 13 2020, 10:13 PM Mar 13 2020, 10:13 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Mar 13 2020, 10:13 PM Mar 13 2020, 10:13 PM

Show posts by this member only | IPv6 | Post

#383

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 14 2020, 12:13 AM Mar 14 2020, 12:13 AM

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Mar 14 2020, 07:14 AM Mar 14 2020, 07:14 AM

Show posts by this member only | IPv6 | Post

#385

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 27 2020, 07:54 AM Mar 27 2020, 07:54 AM

Show posts by this member only | IPv6 | Post

#386

|

All Stars

12,387 posts Joined: Feb 2020 |

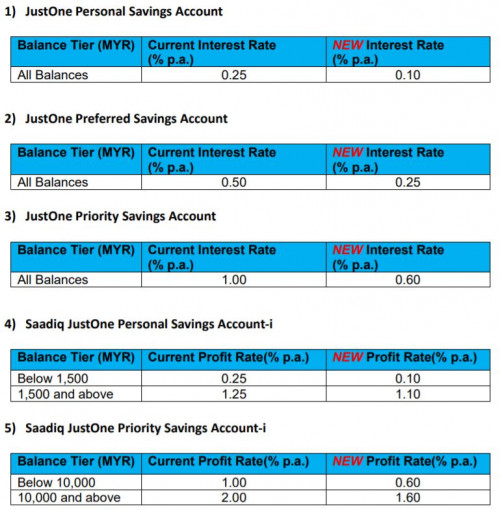

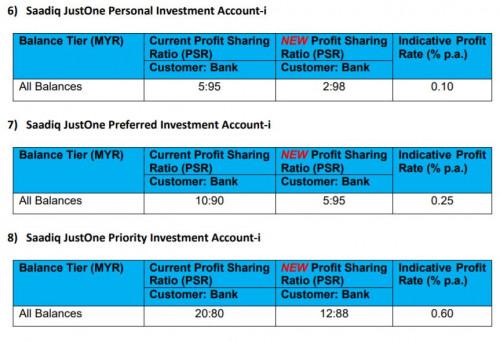

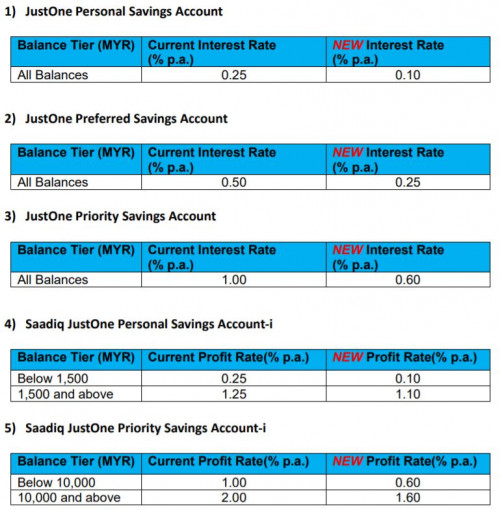

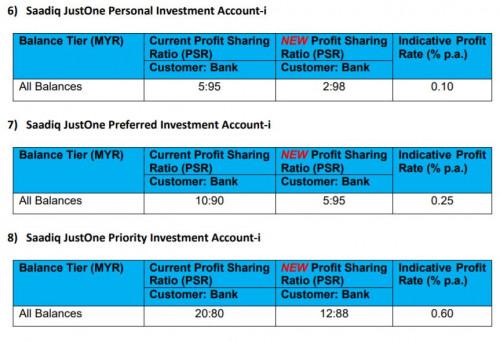

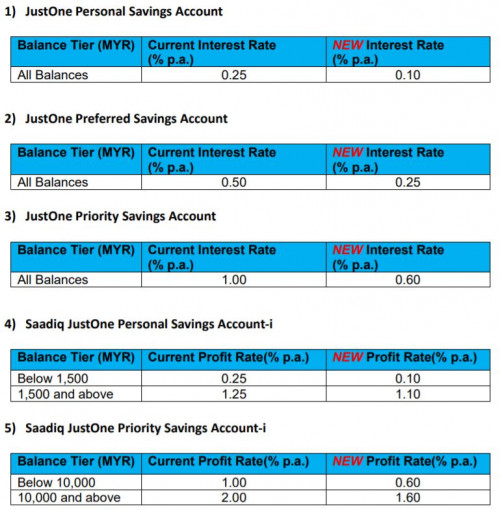

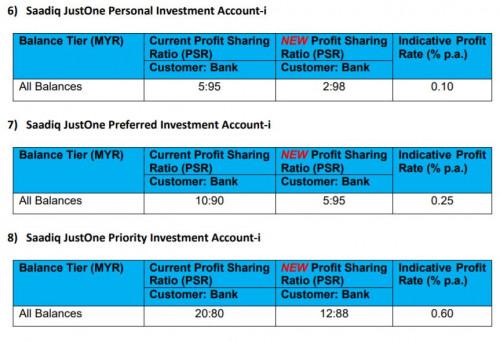

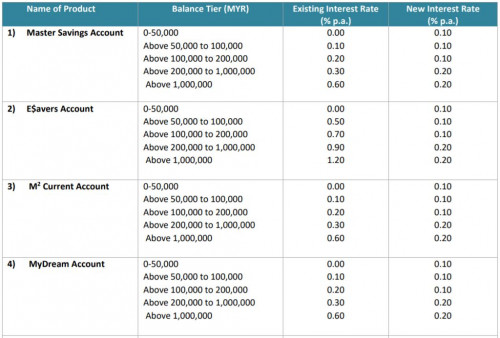

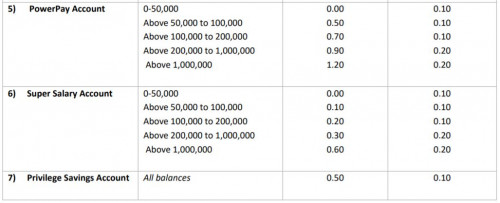

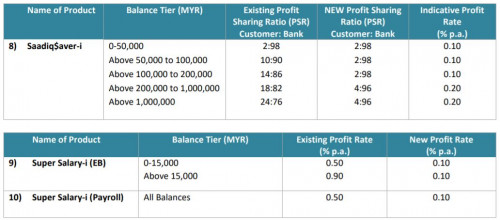

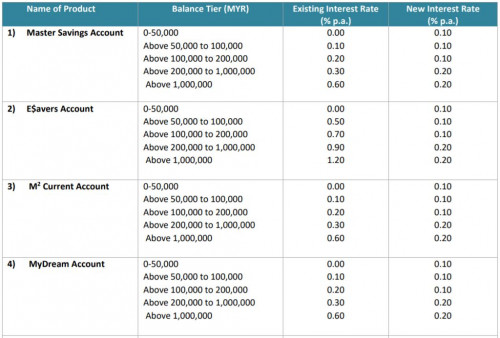

REVISION OF JUSTONE INTEREST/PROFIT RATE/ PROFIT SHARING RATIO

Kindly be informed that the interest/profit rate/profit sharing ratio (PSR) for JustOne Accounts will be revised as follows. All other product features, fees and charges will remain unchanged. EFFECTIVE DATE: 17 APRIL 2020  EFFECTIVE DATE: 1 MAY 2020  https://av.sc.com/my/content/docs/my-revisi...profit-rate.pdf |

|

|

|

|

|

Mar 27 2020, 10:02 AM Mar 27 2020, 10:02 AM

|

All Stars

18,435 posts Joined: Oct 2010 |

QUOTE(GrumpyNooby @ Mar 27 2020, 07:54 AM) REVISION OF JUSTONE INTEREST/PROFIT RATE/ PROFIT SHARING RATIO Still no changes for Privilege$aver by Standard Chartered?Kindly be informed that the interest/profit rate/profit sharing ratio (PSR) for JustOne Accounts will be revised as follows. All other product features, fees and charges will remain unchanged. EFFECTIVE DATE: 17 APRIL 2020  EFFECTIVE DATE: 1 MAY 2020  https://av.sc.com/my/content/docs/my-revisi...profit-rate.pdf |

|

|

Mar 27 2020, 10:04 AM Mar 27 2020, 10:04 AM

Show posts by this member only | IPv6 | Post

#388

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 27 2020, 10:41 AM Mar 27 2020, 10:41 AM

Show posts by this member only | IPv6 | Post

#389

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

|

|

|

Mar 27 2020, 04:50 PM Mar 27 2020, 04:50 PM

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(GrumpyNooby @ Mar 27 2020, 07:54 AM) REVISION OF JUSTONE INTEREST/PROFIT RATE/ PROFIT SHARING RATIO This is the ethical business that will give us notice, not like OCBC is immediate effect... Kindly be informed that the interest/profit rate/profit sharing ratio (PSR) for JustOne Accounts will be revised as follows. All other product features, fees and charges will remain unchanged. EFFECTIVE DATE: 17 APRIL 2020  EFFECTIVE DATE: 1 MAY 2020  https://av.sc.com/my/content/docs/my-revisi...profit-rate.pdf |

|

|

Apr 3 2020, 03:11 PM Apr 3 2020, 03:11 PM

Show posts by this member only | IPv6 | Post

#391

|

All Stars

12,387 posts Joined: Feb 2020 |

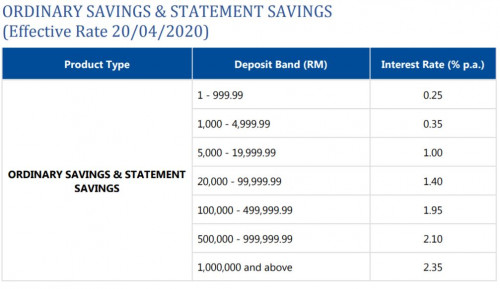

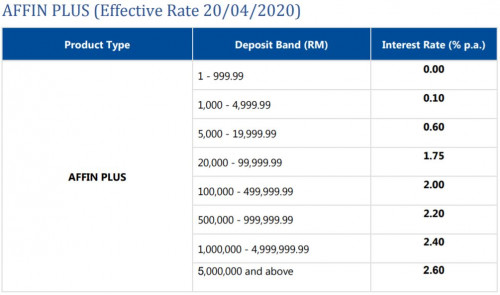

Revision of Deposits Rates Effective 20 April 2020 (dated 30 March 2020)

We wish to inform that effective 20 April 2020, the revised deposits rates are as follows: Revision of Deposits Rates Effective 20 April 2020   https://www.affinonline.com/AFFINONLINE/med...ate20042020.pdf For more information, contact our Call Centre at 03-8230 2222, visit your nearest AFFINBANK branch. |

|

|

Apr 9 2020, 08:08 PM Apr 9 2020, 08:08 PM

Show posts by this member only | IPv6 | Post

#392

|

All Stars

12,387 posts Joined: Feb 2020 |

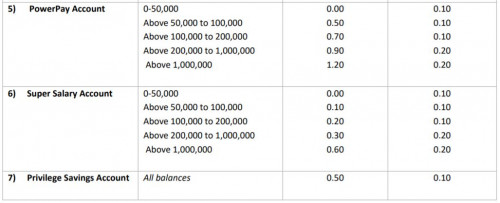

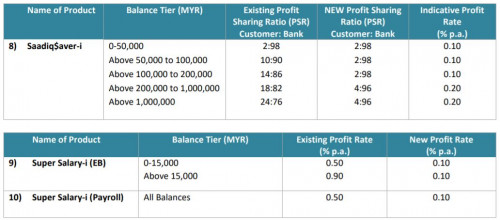

Revision of Product Board Rate and Profit Sharing Ratio (effective 1 May 2020)

Kindly be informed that effective 1 May 2020, the board rates for the following products will be revised as follows. All other product features, fees and charges will remain unchanged.    https://av.sc.com/my/content/docs/revision-...aring-ratio.pdf |

|

|

Apr 10 2020, 06:15 PM Apr 10 2020, 06:15 PM

Show posts by this member only | IPv6 | Post

#393

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(GrumpyNooby @ Apr 9 2020, 08:08 PM) Revision of Product Board Rate and Profit Sharing Ratio (effective 1 May 2020) So PSA will be 3.6% dKindly be informed that effective 1 May 2020, the board rates for the following products will be revised as follows. All other product features, fees and charges will remain unchanged.    https://av.sc.com/my/content/docs/revision-...aring-ratio.pdf |

|

|

|

|

|

Apr 10 2020, 06:26 PM Apr 10 2020, 06:26 PM

Show posts by this member only | IPv6 | Post

#394

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 21 2020, 11:02 PM Apr 21 2020, 11:02 PM

|

All Stars

65,318 posts Joined: Jan 2003 |

Earn up to 2.75% p.a. interest/profit with Pay&Save account/-i [ HLB | T&Cs ] 20 APRIL 2020-30 JUNE 2020 As we learn to navigate in this “new normal”, many are finding time for self-improvement. Make your money work harder for you and let us reward you with RM50 when you open a Pay&Save account/ -i. This post has been edited by cybpsych: Apr 21 2020, 11:03 PM |

|

|

Apr 28 2020, 09:48 PM Apr 28 2020, 09:48 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

OCBC Bank 360 Account

Up to 3.40% Standard Chartered Bank Privilege$aver Up to 5.60%, realistic return is 3.60% starting next month RHB Bank Smart Account / RHB Islamic Smart Account-I Up time 4.25%, realistic return is 3.25% **RM10 account maintenance fee to be charged every June and December if average monthly balance is less than RM1,000. This is a current account and you can request for cheque book facility if needed. UOB Bank ONE Account Up to 2.88% Hong Leong Bank Pay & Save Account Up to 2.75% Affin Bank E-Saver / Affin Islamic Bank E-Saver-I RM2,000 to RM49,999 - 2.25% RM49,999 and above - 2.50% **Do note Affin Bank savings account calculation is based on deposit band. Account can only be open via AffinOnline. So yes, you need to have a bank account with Affin Bank prior to opening this account yourself via AffinOnline. For example, you have RM50,000 in your Affin Bank E-Saver, there is no interest for the first RM1,999, then it is 2.25% for the next RM48,000, and finally 2.50% for the last RM1. MBSB Bank Cash Rich Savings Account-I 2.15% on all balances This post has been edited by MilesAndMore: Apr 28 2020, 10:00 PM |

|

|

Apr 28 2020, 10:53 PM Apr 28 2020, 10:53 PM

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(MilesAndMore @ Apr 28 2020, 09:48 PM) OCBC Bank 360 Account thank you for the hardwork Up to 3.40% Standard Chartered Bank Privilege$aver Up to 5.60%, realistic return is 3.60% starting next month RHB Bank Smart Account / RHB Islamic Smart Account-I Up time 4.25%, realistic return is 3.25% **RM10 account maintenance fee to be charged every June and December if average monthly balance is less than RM1,000. This is a current account and you can request for cheque book facility if needed. UOB Bank ONE Account Up to 2.88% Hong Leong Bank Pay & Save Account Up to 2.75% Affin Bank E-Saver / Affin Islamic Bank E-Saver-I RM2,000 to RM49,999 - 2.25% RM49,999 and above - 2.50% **Do note Affin Bank savings account calculation is based on deposit band. Account can only be open via AffinOnline. So yes, you need to have a bank account with Affin Bank prior to opening this account yourself via AffinOnline. For example, you have RM50,000 in your Affin Bank E-Saver, there is no interest for the first RM1,999, then it is 2.25% for the next RM48,000, and finally 2.50% for the last RM1. MBSB Bank Cash Rich Savings Account-I 2.15% on all balances |

|

|

Apr 28 2020, 11:14 PM Apr 28 2020, 11:14 PM

|

Junior Member

747 posts Joined: Jul 2016 |

QUOTE(MilesAndMore @ Apr 28 2020, 09:48 PM) OCBC Bank 360 Account I kinda think RHB bonus saver deserve to be in the list as it can achieve same rate as HLB pay and save with lesser effort. Anyway thank you for compiling the listUp to 3.40% Standard Chartered Bank Privilege$aver Up to 5.60%, realistic return is 3.60% starting next month RHB Bank Smart Account / RHB Islamic Smart Account-I Up time 4.25%, realistic return is 3.25% **RM10 account maintenance fee to be charged every June and December if average monthly balance is less than RM1,000. This is a current account and you can request for cheque book facility if needed. RHB Bonus Saver Up to 2.75% with RM 500 deposit per month Minimum 2.65% after completing 12 counters UOB Bank ONE Account Up to 2.88% Hong Leong Bank Pay & Save Account Up to 2.75% Affin Bank E-Saver / Affin Islamic Bank E-Saver-I RM2,000 to RM49,999 - 2.25% RM49,999 and above - 2.50% **Do note Affin Bank savings account calculation is based on deposit band. Account can only be open via AffinOnline. So yes, you need to have a bank account with Affin Bank prior to opening this account yourself via AffinOnline. For example, you have RM50,000 in your Affin Bank E-Saver, there is no interest for the first RM1,999, then it is 2.25% for the next RM48,000, and finally 2.50% for the last RM1. MBSB Bank Cash Rich Savings Account-I 2.15% on all balances |

|

|

Apr 29 2020, 02:25 PM Apr 29 2020, 02:25 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(cklimm @ Apr 28 2020, 10:53 PM) No problem QUOTE(akhito @ Apr 28 2020, 11:14 PM) I kinda think RHB bonus saver deserve to be in the list as it can achieve same rate as HLB pay and save with lesser effort. Anyway thank you for compiling the list Oh yes. RHB Bonus Saver as well. I purposely excluded it as if one were to only open the account now, they can only start enjoying 2.65% (permanent) or 2.75% interest one year later. So I figured RHB Bank Smart Account is better. But in my case, until now I have not opened the RHB Bank Smart Account as I’m still using OCBC Bank 360 as my primary bank account now, and also I’m not sure if I can maintain an average balance of 1k over a 6-month period consistently to avoid the half-yearly account maintenance fee of RM10. |

|

|

May 4 2020, 01:24 AM May 4 2020, 01:24 AM

Show posts by this member only | IPv6 | Post

#400

|

Newbie

32 posts Joined: Jan 2017 |

|

| Change to: |  0.1026sec 0.1026sec

0.74 0.74

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 10:11 AM |