https://www.alliancebank.com.my/announcemen...on-May2020.aspx

Conditional High Yield Savings Account

|

|

May 17 2020, 04:29 PM May 17 2020, 04:29 PM

|

Senior Member

1,292 posts Joined: Jan 2003 From: The Land Before Time |

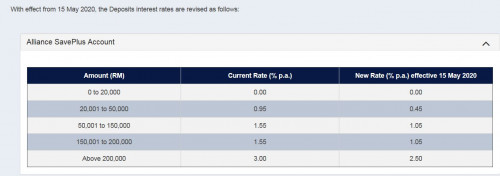

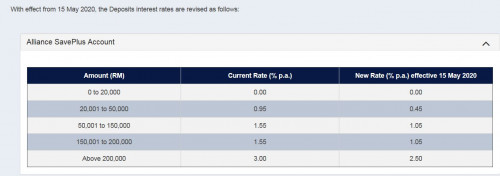

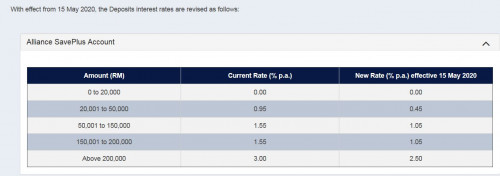

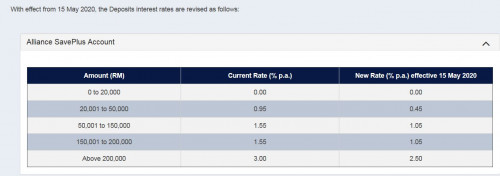

Huge drop for Alliance Saveplus Account. Now it's 2.5% wef from 15 May 2020

https://www.alliancebank.com.my/announcemen...on-May2020.aspx  |

|

|

|

|

|

May 17 2020, 04:32 PM May 17 2020, 04:32 PM

Show posts by this member only | IPv6 | Post

#422

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(btfan @ May 17 2020, 04:29 PM) Huge drop for Alliance Saveplus Account. Now it's 2.5% wef from 15 May 2020 For above 200k, that is still a good rate with 2.5% since it is not FD and can be liquidated anytime.https://www.alliancebank.com.my/announcemen...on-May2020.aspx  SC PSA gives only 2.1% for that amount. This post has been edited by GrumpyNooby: May 17 2020, 04:36 PM |

|

|

May 20 2020, 01:23 PM May 20 2020, 01:23 PM

Show posts by this member only | IPv6 | Post

#423

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(MilesAndMore @ Apr 29 2020, 02:25 PM) No problem if open rhb smart account now, have to put in 6k to avoid half yearly fees? or average 1k on the number of days till next charge?Oh yes. RHB Bonus Saver as well. I purposely excluded it as if one were to only open the account now, they can only start enjoying 2.65% (permanent) or 2.75% interest one year later. So I figured RHB Bank Smart Account is better. But in my case, until now I have not opened the RHB Bank Smart Account as I’m still using OCBC Bank 360 as my primary bank account now, and also I’m not sure if I can maintain an average balance of 1k over a 6-month period consistently to avoid the half-yearly account maintenance fee of RM10. |

|

|

May 20 2020, 10:44 PM May 20 2020, 10:44 PM

Show posts by this member only | IPv6 | Post

#424

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ May 20 2020, 01:23 PM) if open rhb smart account now, have to put in 6k to avoid half yearly fees? or average 1k on the number of days till next charge? RM10 every 6 months waived with monthly average balance of RM1,000Every month just ensure your MAB is above RM 1k. https://ringgitplus.com/en/current-account/...-Account-i.html |

|

|

May 20 2020, 10:45 PM May 20 2020, 10:45 PM

Show posts by this member only | IPv6 | Post

#425

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(GrumpyNooby @ May 20 2020, 10:44 PM) RM10 every 6 months waived with monthly average balance of RM1,000 takut although i open in May, they still count Jan to April MAB as 0. otherwise i tunggu 1st july only open.Every month just ensure your MAB is above RM 1k. https://ringgitplus.com/en/current-account/...-Account-i.html |

|

|

May 20 2020, 11:13 PM May 20 2020, 11:13 PM

|

Junior Member

123 posts Joined: Aug 2010 |

Hi Sifus, planning to move my previous eFDs (Around 50k) to this type of bank account after reading the thread. Any suggestions for long term placement & able to still cash out when needed? Thanks!

|

|

|

|

|

|

May 22 2020, 06:02 AM May 22 2020, 06:02 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(DarkknightDK @ May 20 2020, 11:13 PM) Hi Sifus, planning to move my previous eFDs (Around 50k) to this type of bank account after reading the thread. Any suggestions for long term placement & able to still cash out when needed? Thanks! there is no suggestions, it is just like normal savings account, you can withdraw anytimes u want, it isnt even "placement" relevant, just deposit and withdraw like normal saving accjust be noted that the interest need to have differnt criteria (spending/deposit etc.) to fulfill the interest rate criterion, depending which bank acc. |

|

|

Jun 2 2020, 02:41 PM Jun 2 2020, 02:41 PM

|

Senior Member

1,056 posts Joined: Apr 2016 |

QUOTE(DarkknightDK @ May 20 2020, 11:13 PM) Hi Sifus, planning to move my previous eFDs (Around 50k) to this type of bank account after reading the thread. Any suggestions for long term placement & able to still cash out when needed? Thanks! Which high yield will you be participatingI've just moved from OCBC to SC |

|

|

Jun 2 2020, 05:48 PM Jun 2 2020, 05:48 PM

|

Junior Member

722 posts Joined: Apr 2008 |

QUOTE(btfan @ May 17 2020, 04:29 PM) Huge drop for Alliance Saveplus Account. Now it's 2.5% wef from 15 May 2020 2.5% for Alliance Saveplus Account, it is still good, no choice, BNM cut interest rate, all banks cut too.https://www.alliancebank.com.my/announcemen...on-May2020.aspx  Which banking account higher than 2.5% ?? |

|

|

Jun 2 2020, 06:25 PM Jun 2 2020, 06:25 PM

|

Junior Member

45 posts Joined: Apr 2020 From: Ipoh, Perak |

UOB InvestPro now only 2% pa...

|

|

|

Jun 3 2020, 04:19 PM Jun 3 2020, 04:19 PM

Show posts by this member only | IPv6 | Post

#431

|

Junior Member

123 posts Joined: Aug 2010 |

QUOTE(taiping... @ Jun 2 2020, 02:41 PM) Hey bro, i just applied OCBC since suit my current abilities to hit the interest. I heard SC has more but let me experiment with OcBC first. No harm opening up another if i have enough funds and criteria 👍 |

|

|

Jun 6 2020, 02:21 PM Jun 6 2020, 02:21 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

QUOTE(DarkknightDK @ Jun 3 2020, 04:19 PM) Hey bro, i just applied OCBC since suit my current abilities to hit the interest. I heard SC has more but let me experiment with OcBC first. No harm opening up another if i have enough funds and criteria 👍 comparatively SC is easier to hit target, but, you need get their credit card |

|

|

Jun 10 2020, 11:49 AM Jun 10 2020, 11:49 AM

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(!@#$%^ @ May 20 2020, 10:45 PM) takut although i open in May, they still count Jan to April MAB as 0. otherwise i tunggu 1st july only open. i think if u open the account due to the interest rate, u should have enough money to keep in there...RHB Smart Account seem like can open online, no need to walk in branch... is their debit card also will courier to us? any charges for the debit card? Wonder anyone try to open online b4 QUOTE Base Rate Maintain a minimum account balance of RM1,000 and get 0.25% p.a. on your daily account balance Base Rate is calculated daily and credited monthly. Bonus Payout Deposit a minimum account balance of RM2,000 monthly to get 2.00% p.a.* and to qualify for other bonus payouts. Pay a minimum of 3 bills monthly via RHB Now Internet or Mobile Banking and get 0.5% p.a.* Spend a minimum of RM1,000 monthly using your RHB Credit or Debit Card and get 0.5% p.a.* Invest a minimum of RM1,000 monthly with selected RHB investment products and get 1.0%** Terms & Conditions: *Bonus payout based on monthly average account balance up to RM100,000 ** Bonus payout based on 1.0% of net investment amount. Bonus Payout earned will be credited on 15th calendar day of the next occurring month subject to criteria met. |

|

|

|

|

|

Jun 10 2020, 01:57 PM Jun 10 2020, 01:57 PM

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

|

|

|

Jun 13 2020, 03:46 PM Jun 13 2020, 03:46 PM

|

Newbie

7 posts Joined: Mar 2016 |

Is RHB Smart account not available now? the page is not found on the RHB website.

|

|

|

Jun 13 2020, 03:54 PM Jun 13 2020, 03:54 PM

Show posts by this member only | IPv6 | Post

#436

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(charis24 @ Jun 13 2020, 03:46 PM) It is still there https://www.rhbgroup.com/RHBOnlineDepositAc...nxoCbqsQAvD_BwE |

|

|

Jul 1 2020, 12:33 PM Jul 1 2020, 12:33 PM

Show posts by this member only | IPv6 | Post

#437

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

anybody knows if the existing RBH BSA debit card which is FOC, is tagged to a new RHB Smart Savers as primary, will I be charged annual fee?

|

|

|

Jul 1 2020, 01:59 PM Jul 1 2020, 01:59 PM

Show posts by this member only | IPv6 | Post

#438

|

|

Moderator

9,301 posts Joined: Mar 2008 |

|

|

|

Jul 1 2020, 02:40 PM Jul 1 2020, 02:40 PM

Show posts by this member only | IPv6 | Post

#439

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

|

|

|

Jul 2 2020, 06:58 PM Jul 2 2020, 06:58 PM

|

Senior Member

1,367 posts Joined: Jan 2003 |

|

| Change to: |  0.0235sec 0.0235sec

0.50 0.50

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 02:49 AM |