|

TSBoon3

|

May 21 2020, 10:14 AM May 21 2020, 10:14 AM

|

|

QUOTE(Smurfs @ May 21 2020, 09:59 AM) This is usually how REIT is compared :  If you are ok with the yield, then you may consider to buy  To aim big, there are better opportunities out there. Especially after the great bear back in March.  I put in 100k into fd.... end of the year I will get 100k + the interest. now if I buy 100k worth of Axist Reit... in theory I get Axis Reit stocks + the diividend. But the problem is that Axis Reit stock, it can go up but it also can down (plus the fact the stock price is readjusted after giving out the dividend) what if after one year, Axis Reit stock price is lower than what I paid for? nah.... alternative income... put in the bank la. (my choice) but if I am gonna put the money into stocks.... no multiple prada bags to win... play for what?    |

|

|

|

|

|

Smurfs

|

May 21 2020, 10:24 AM May 21 2020, 10:24 AM

|

|

QUOTE(Boon3 @ May 21 2020, 10:14 AM)  I put in 100k into fd.... end of the year I will get 100k + the interest. now if I buy 100k worth of Axist Reit... in theory I get Axis Reit stocks + the diividend. But the problem is that Axis Reit stock, it can go up but it also can down (plus the fact the stock price is readjusted after giving out the dividend) what if after one year, Axis Reit stock price is lower than what I paid for? nah.... alternative income... put in the bank la. (my choice) but if I am gonna put the money into stocks.... no multiple prada bags to win... play for what?    At the end come back to the strategy part, we dont buy into REIT if the yield is very close to the FD rate. Few years back when there are some promotional FD offered, bank gives around 4.5% pa. Since risk free already can get 4.5%, at that time is is unwise to invest in REIT already  If your buying price is correct, and the REIT you select is good, you can get both appreciation of price on top of the yield that you are getting. A 12% return (6% share price appreciation + 6% yield) p.a for REIT is achievable. Buying price is very very important  |

|

|

|

|

|

TSBoon3

|

May 21 2020, 11:08 AM May 21 2020, 11:08 AM

|

|

QUOTE(Smurfs @ May 21 2020, 10:24 AM) At the end come back to the strategy part, we dont buy into REIT if the yield is very close to the FD rate. Few years back when there are some promotional FD offered, bank gives around 4.5% pa. Since risk free already can get 4.5%, at that time is is unwise to invest in REIT already  If your buying price is correct, and the REIT you select is good, you can get both appreciation of price on top of the yield that you are getting. A 12% return (6% share price appreciation + 6% yield) p.a for REIT is achievable. Buying price is very very important  To get just 12% as the reward for buying it correctly ... err... really tak cukup la... for one, I don't think I can price it correctly... Too small reward.....  |

|

|

|

|

|

ChAOoz

|

May 21 2020, 12:19 PM May 21 2020, 12:19 PM

|

|

QUOTE(Boon3 @ May 19 2020, 08:34 AM) Nice!! Some great points for and against. Understanding the risks and rewards in one trade is very important. Always ask is there enough meat (reward) to justify the position.... Market appetite is crazy. Totally underestimate them, this is not dead cat bounce but like a woken slumbering giant. I cannot take the risk, weak hand  |

|

|

|

|

|

TSBoon3

|

May 21 2020, 12:32 PM May 21 2020, 12:32 PM

|

|

QUOTE(ChAOoz @ May 21 2020, 12:19 PM) Market appetite is crazy. Totally underestimate them, this is not dead cat bounce but like a woken slumbering giant. I cannot take the risk, weak hand  Punters are coming out from everywhere...  |

|

|

|

|

|

ChAOoz

|

May 21 2020, 12:39 PM May 21 2020, 12:39 PM

|

|

QUOTE(Boon3 @ May 21 2020, 12:32 PM) Punters are coming out from everywhere...  Yeah big thanks to them. I'm closing all my covid trade position now. Only hold the very boring one for long term investment. Can't bat every pitch, else one will definitely hit me in the face. |

|

|

|

|

|

TSBoon3

|

May 21 2020, 02:08 PM May 21 2020, 02:08 PM

|

|

QUOTE(ChAOoz @ May 21 2020, 12:39 PM) Yeah big thanks to them. I'm closing all my covid trade position now. Only hold the very boring one for long term investment. Can't bat every pitch, else one will definitely hit me in the face. I only get one chance at bat.... so I do wait for my chance.... and when I do get my chance.... I do ride em out much longer.... wait to buy, wait to sell .... and when nothing to do... wait...... my simple game plan.  ( this is why my risk vs reward ratio is so, so, so important for me. I usually give them 20% potential stocks a miss. ) |

|

|

|

|

|

TSBoon3

|

May 21 2020, 02:44 PM May 21 2020, 02:44 PM

|

|

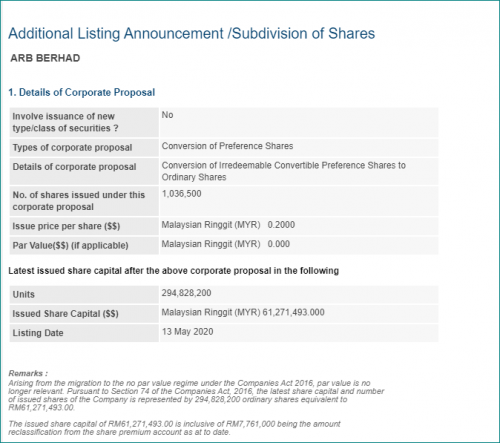

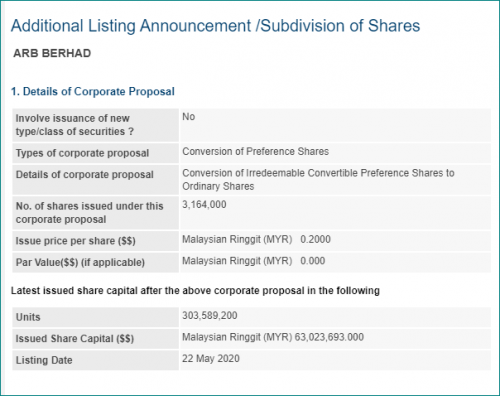

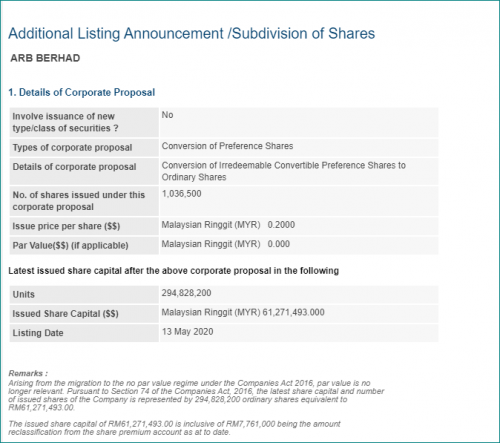

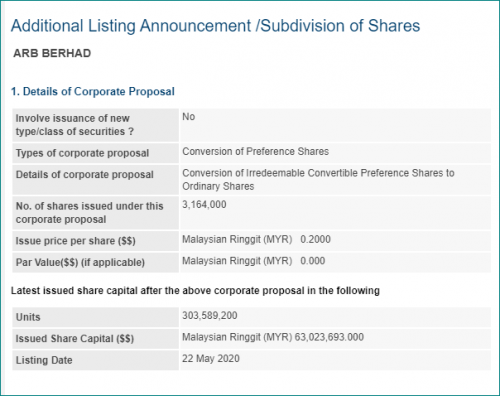

QUOTE(Boon3 @ May 13 2020, 09:09 AM) ... the above quotes are just for references .. posted on another thread. So an emerging fund bought.... the share rallies...  nice eh? now after a couple of months absence ... here comes the conversion of shares.... again..... https://malaysiastock.biz/Company-Announcem...aspx?id=1225848 same old same old ..... as the stock gathers some 'momentum'.... tons and tons of PA shares are converted ....  well? just keeping myself amused... ARBB earnings.. ok... I guess. the amusing thing is the conversion of the PA shares as usual. this was reported today... https://malaysiastock.biz/Company-Announcem...aspx?id=1228217 This time 3,140,000 shares were converted. Now comparing the other day conversion and today's conversion, this means that between then and now, ARBB has now 'grown' by another 7 million + shares.... |

|

|

|

|

|

Suicidal Guy

|

May 21 2020, 04:17 PM May 21 2020, 04:17 PM

|

|

I noticed this ARRB having such low PE and good profits last year. Until I checked how many PA shares are there. When valuing whether a stock is cheap or not, apart from considering PA and warrant shares, we also have to take into account the cash, debt, minority interest and other assets such as investment property the company has.

|

|

|

|

|

|

TSBoon3

|

May 21 2020, 05:20 PM May 21 2020, 05:20 PM

|

|

QUOTE(Suicidal Guy @ May 21 2020, 04:17 PM) I noticed this ARRB having such low PE and good profits last year. Until I checked how many PA shares are there. When valuing whether a stock is cheap or not, apart from considering PA and warrant shares, we also have to take into account the cash, debt, minority interest and other assets such as investment property the company has. Yup. It's dangerous to blindly use PE and stock like Arbb is a good example. |

|

|

|

|

|

hehe86

|

May 21 2020, 05:36 PM May 21 2020, 05:36 PM

|

|

QUOTE(Suicidal Guy @ May 21 2020, 04:17 PM) I noticed this ARRB having such low PE and good profits last year. Until I checked how many PA shares are there. When valuing whether a stock is cheap or not, apart from considering PA and warrant shares, we also have to take into account the cash, debt, minority interest and other assets such as investment property the company has. Ah i see. By converting those PA, the PE can be lowered. Quick check on its financial ratio, ROE also >10 and there's no debt if i read the QR correctly? One can also notice that the EPS lowered even though the NP simlar with its YoY. Hmm |

|

|

|

|

|

Suicidal Guy

|

May 22 2020, 12:42 AM May 22 2020, 12:42 AM

|

|

QUOTE(hehe86 @ May 21 2020, 05:36 PM) Ah i see. By converting those PA, the PE can be lowered. Quick check on its financial ratio, ROE also >10 and there's no debt if i read the QR correctly? One can also notice that the EPS lowered even though the NP simlar with its YoY. Hmm No. It increases the PE by converting the PA shares. If you add the value of the PA shares to it's market cap, it will show that the actual PE is much higher. The existence of the huge number of PA shares skewed all these ratios such as PE and ROE. |

|

|

|

|

|

hehe86

|

May 22 2020, 01:02 AM May 22 2020, 01:02 AM

|

|

QUOTE(Suicidal Guy @ May 22 2020, 12:42 AM) No. It increases the PE by converting the PA shares. If you add the value of the PA shares to it's market cap, it will show that the actual PE is much higher. The existence of the huge number of PA shares skewed all these ratios such as PE and ROE. Eh my bad. you're right. Shares increase, EPS lowered. EPS lower PE increase. What's the usual reason they convert these PA shares? To manipulate these ratios? This post has been edited by hehe86: May 22 2020, 01:03 AM |

|

|

|

|

|

TSBoon3

|

May 22 2020, 10:05 AM May 22 2020, 10:05 AM

|

|

QUOTE(Smurfs @ May 21 2020, 10:24 AM) At the end come back to the strategy part, we dont buy into REIT if the yield is very close to the FD rate.

remember this one ? » Click to show Spoiler - click again to hide... « QUOTE Sibuk on another Reit

Cmmt. Listed Jul 2010.Retail price 98 sen.

The chart...

[attachmentid=10313751]

If bought during ipo retail price at 98 sen, price is now 1.04.

About making couple bottles of beer money I guess.

But the dividend is not bad. Since total collected is 69.46 sen.

[attachmentid=10313752]

But since the chart shows the stock is tanking since 2013, what would happen

if one chased and bought high at 1.90?

Would dividends save the day?

So if I minus out the dividends from fy2010 to fy2012..

The total dividends received would be only 49.75 sen.

So if buy at 1.90, total dividends received is only 49.75.

With share price at 1.04, mati lembu kuat kuat if chased this Reit.

Note the fy2014 dpu plunged... but recovered the next year.

Note the dpu has been declining since fy2015...

How smurf? QUOTE Aha! Thanks for the FY2013 DPU correction. Other figures looked correct. (this is what happens when you are free but just armed with a handphone. tongue.gif )

Right off the bat, I am now thinking, ok, what if one took the drastic correction towards the end part of 2013 as an OPPORTUNITY?

Ya? I mean, you be looking at some logical reasoning to buy, yes?

For example, the DPU/DY looked extremely attractive yes? And then will cheat a bit lor, assuming one used the help of the charts and use the breakout of the big correction trend, as an additional tool to help one's buy decision. So agak abit la. Use a price of 1.40 as an entry price? Date of entry around Feb 2014.

Same exercise, would the dividends help the reit investor.

This would see the investor collect the dividends of 8.91, 8.60, 8.43, 8.22, 7.90 and 3.22 which equals to total dividend of 45.28.

So current price is 1.05. Dividends received 45.28. Cost of investment 1.40.

So got untung quite a few bottles of beer la.

But then, this is almost close to a 5 year investment....

and if one had purchased higher than 1.50 (well I cheated and used back data to help me choose the 1.40 entry price tongue.gif ) during that fy2013 correction, one can lugi besar!

So far, based on the few examples I posted, it certainly looks like a high DY does not guarantee much when one is selecting a reit. If buy at wrong prices, one definitely lugi ringgit.

Like you said, declining DPU is one big flag to watch out for.

Do I pass my initial Reit workouts ah? post #4635CMMT price is now 81 sen vs those posting price of 1.04 (posting made Sep 2019!)  DPU for the period is 0.98 vs 1.71 a year ago.   Massive drop! |

|

|

|

|

|

Smurfs

|

May 22 2020, 01:58 PM May 22 2020, 01:58 PM

|

|

QUOTE(Boon3 @ May 22 2020, 10:05 AM) remember this one ? » Click to show Spoiler - click again to hide... « CMMT price is now 81 sen vs those posting price of 1.04 (posting made Sep 2019!)  DPU for the period is 0.98 vs 1.71 a year ago.   Massive drop! Imagine if you buy a condo for investment purpose, but the rental collected decreasing every year  1st year RM1.8k 2nd year RM1.4k 3rd year RM 1k Something wrong somewhere  |

|

|

|

|

|

TSBoon3

|

May 22 2020, 03:11 PM May 22 2020, 03:11 PM

|

|

QUOTE(Smurfs @ May 22 2020, 01:58 PM) Imagine if you buy a condo for investment purpose, but the rental collected decreasing every year  1st year RM1.8k 2nd year RM1.4k 3rd year RM 1k Something wrong somewhere  Cut loss right away!!! » Click to show Spoiler - click again to hide... «

Condo rentals as an investment.... so not easy. I am not touching!!

|

|

|

|

|

|

billy_overheat

|

May 23 2020, 10:30 AM May 23 2020, 10:30 AM

|

|

does anyone use put option to hedge against the risk over here in klse?

|

|

|

|

|

|

squarepilot

|

May 23 2020, 11:29 AM May 23 2020, 11:29 AM

|

|

QUOTE(billy_overheat @ May 23 2020, 10:30 AM) does anyone use put option to hedge against the risk over here in klse? yes. i do buy some FBMKLCI-H8Z warrant to hedge the risk. Market is kinda wild these days |

|

|

|

|

|

squarepilot

|

May 23 2020, 11:32 AM May 23 2020, 11:32 AM

|

|

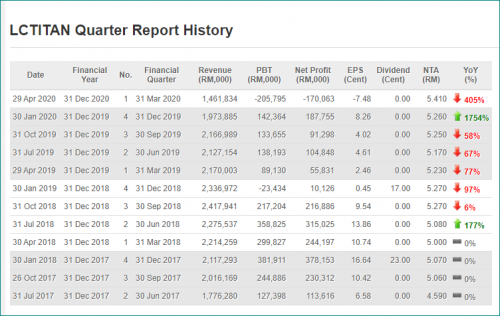

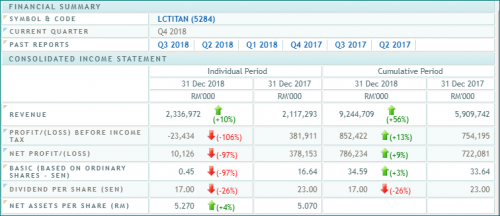

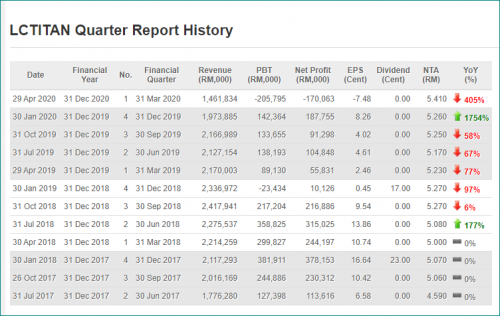

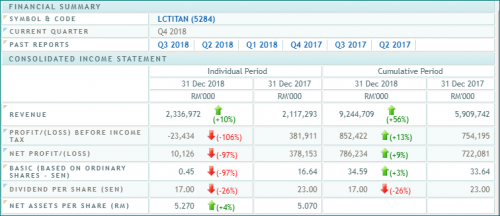

QUOTE(Boon3 @ Apr 29 2020, 04:10 PM) » Click to show Spoiler - click again to hide... « Here's one way to 'guess'/gauge if a company got substance or not. Watch what they say they earn b4 their IPO and then compare.... Ok, LC Titan was listed not so long ago... so what we do is search out article on them... this one will do .... https://www.thestar.com.my/business/busines...t-as-dividends/Second paragraph ... now let's compare ... using the msiastockbiz website ....  we want to look at the 2018 Q4 rpt. If we click on it......  So in 2017 they say they untung 722 million. In 2018 they say untung 786 million. But b4 their IPO they they untung 1.3 billion wo....  which was something exactly like Titan Chemicals the last time. B4 listing all big juicy numbers... then after listing, earnings less and less....   what this tells me... this is a stock that I do not want to waste my time on... who cares they big company or what not.... just check the ignore button .... and let's focus on the next better stock.  But But... the price went up instead of falling further  I'm surprised that PChem do actually do better than it's previous Qtr |

|

|

|

|

|

TSBoon3

|

May 23 2020, 12:48 PM May 23 2020, 12:48 PM

|

|

QUOTE(squarepilot @ May 23 2020, 11:32 AM) But But... the price went up instead of falling further   And yes it did. So? There are literally hundreds of stocks one could trade. If we do not weed out the literally garbage, all it means is that we are accepting all kind of possible shenanigans in the stocks that we trade. In the case of LKL. Did you see how much it flew? Was there any justification? Or how about the other garbage stocks that flew? Garbage stocks cannot fly?  Like it or not... my opinion remains firmly that LC Titan is a garbage stock that one needs to avoid like plague. And it remains garbage even if it moves higher.  |

|

|

|

|

May 21 2020, 10:14 AM

May 21 2020, 10:14 AM

Quote

Quote

0.0177sec

0.0177sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled