QUOTE(contestchris @ Feb 19 2017, 01:09 PM)

What the hell man? Do you have trouble comprehending English? I am giving a damn example. Just because it is +10% for 1.5 months doesn't mean it will continue that way the rest of the year.

I feel sorry for certain participants in this thread who have a terrible grasp of the English language and are incapable of identifying nuance.

-------------

Seriously guys, what's the issue with this statement at all in a reply to the poster that posted the question?

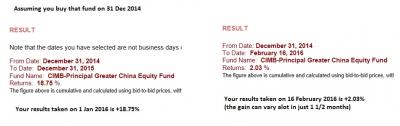

However, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE. Please keep that in mind. That fund could end the year at +40%, or -10%...but just cause it got 10% till Feb 16 doesn't mean it will get another 10% in 1.5 months time.Let me elaborate.

You said +40 or -10% flucuation. This means that is [ 40 - (-10) ]/2 = 25% VOLATILITY.

Now, the fund we were addressing is CIMB-Principle Greater China Equity fund. Let us take a look at its

Fund factsheet dated 31st Dec 2016, shall we?

Can you all see that the volatility is clearly shown to be on a three year average equal to 14.25%? Don't simply pluck some figure out of the sky and then defend it by hiding behind a vague concept called nuance.

You label it nuance, I call it ignorance. You categorically fall under the tok-kok, but don't know is talking cock category.

In the medica fraternity it is termed delusion.

Xuzen

P/s In the whole of FSM UTF universe, there are only two funds that have above 25% volatility, they are the two gold funds. Namely, they are RHB Gold & General Energy fund and AM Precious Metal fund. But both of them suxs big time as product for long term investment (but darn good for speculative purpose, especially if one is feelin' lucky, punk!)

This post has been edited by xuzen: Feb 19 2017, 01:47 PM

Feb 18 2017, 11:49 PM

Feb 18 2017, 11:49 PM

Quote

Quote

0.0174sec

0.0174sec

0.66

0.66

6 queries

6 queries

GZIP Disabled

GZIP Disabled