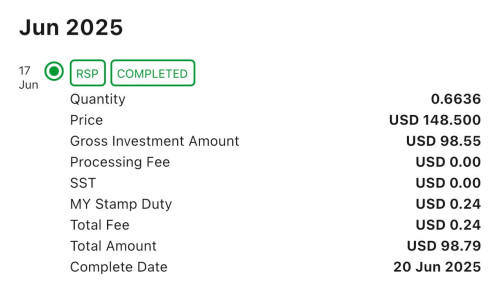

my first RSP through FSMONE. though the selling fee is ridiculously high but that should help me from selling it half way.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jun 18 2025, 09:08 AM Jun 18 2025, 09:08 AM

Return to original view | Post

#1

|

Junior Member

137 posts Joined: Apr 2009 |

|

|

|

|

|

|

Jun 18 2025, 10:07 AM Jun 18 2025, 10:07 AM

Return to original view | Post

#2

|

Junior Member

137 posts Joined: Apr 2009 |

|

|

|

Jul 1 2025, 03:09 PM Jul 1 2025, 03:09 PM

Return to original view | Post

#3

|

Junior Member

137 posts Joined: Apr 2009 |

QUOTE(lim47 @ Jun 30 2025, 06:51 PM) i am buying VWRA and deduct from USD auto sweep. and yes it will to be fractional as you are investing fixed amount of cash and the stock price will not be same. you can set to deduct from other cash account too, it will automatic convert to USD. what i did is i top up some amount into USD sweep and let it deduct every month This post has been edited by watermineral: Jul 1 2025, 03:12 PM |

|

|

Jul 2 2025, 04:17 PM Jul 2 2025, 04:17 PM

Return to original view | Post

#4

|

Junior Member

137 posts Joined: Apr 2009 |

QUOTE(tifosi @ Jul 1 2025, 03:16 PM) not sure about moomoo but last i compare with wise, seems quite closeThis post has been edited by watermineral: Jul 2 2025, 04:17 PM tifosi liked this post

|

|

|

Nov 27 2025, 01:23 PM Nov 27 2025, 01:23 PM

Return to original view | Post

#5

|

Junior Member

137 posts Joined: Apr 2009 |

QUOTE(jutamind @ Oct 24 2025, 09:40 AM) For those having RSP with FSMOne buying US or LSE ETFs, do you normally create your RSP and pay using MYR cash solution or USD auto sweep? I'm currently using MYR cash solution but wondering whether USD auto sweep is a better option since the idle USD will earn higher interests in USD auto sweep compared to MYR cash solution i am doing both. I make RSP contributions from my USD and MYR cash accounts. I convert currency when the rate is good, and I treat the RSP from my MYR account like dollar-cost averaging into USD.Regarding the double forex fee when doing RSP from different currency accounts, I checked one of my RSPs and compared it with the Google exchange rate, couldn’t find any problem For RSP, the fee is RM1 per RM1,000 invested, so it’s better to set your RSP in RM1,000 chunks. RM1 may not look much, but money is still money This post has been edited by watermineral: Nov 27 2025, 01:32 PM |

|

|

Nov 28 2025, 08:54 AM Nov 28 2025, 08:54 AM

Return to original view | Post

#6

|

Junior Member

137 posts Joined: Apr 2009 |

QUOTE(Medufsaid @ Nov 27 2025, 05:16 PM) kimi0148 yes but because USD will fluctuate, your intended investment of RM1,000 might suddenly become RM1,050 or in other words RM1.00 stamp duty becomes RM2.00 so you have to create a custom RSP order every time If you’re investing from your USD sweep account and the actual rate is around 1:4.13, you can just assume a higher rate, like anywhere from 4.2 to 4.5. Based on that, you can set your investment amount in the USD238 – USD222 range, depending on what you’re comfortable with. Just remember the closer your assumed rate is to the real rate, the more often you’ll need to adjust it to make sure you stay below your block size.This post has been edited by watermineral: Nov 28 2025, 09:28 AM kimi0148 liked this post

|

| Change to: |  0.0720sec 0.0720sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 07:25 PM |